Structural Break and Causal Analyses of U.S. Corn Use for Ethanol and Other Corn Market Variables

Abstract

:1. Introduction

2. Materials and Methods

2.1. Overview of Corn Market and Other Data

- Production: Figure 1 shows that reported USDA corn production in the U.S. is the annual fall harvest and occurs almost entirely in MY Q1 (September–November). The harvesting season for a few U.S. states begins in late July or August but these states are not major corn producers.

- Total Supply: Total corn supply is the sum of production, imports and beginning stocks. The pattern of total supply in Figure 1 shows that corn stocks are replenished in Q1 and used over all four quarters of the MY. Since U.S. corn imports are small, total supply and beginning stocks are nearly the same in Q2 to Q4 of the MY.

- Price: Figure 1 shows quarterly prices reported by USDA for No 2 Yellow Corn which is used in this paper to represent the pattern of global corn prices. The corn price tends to be stable over each MY and was largely stable across years between 1988 and 2005, after which there were significant fluctuations.

- Domestic Corn Uses: Domestic uses of corn are divided into fuel and non-fuel categories in this paper. Fuel use is reported as a separate variable in the Feed Grains Database and is the gross input of corn for ethanol production in the U.S.—about one-third of this corn input into biofuel production are returned as Distiller’s Dry Grains (DDGS), a high-protein livestock feed. Non-fuel corn use, which includes uses for feed, seed, other industrial purposes and residuals, is calculated as the difference between total domestic corn use and corn use for ethanol fuel. Figure 1 shows that the pattern of total domestic corn use is similar to that of total supply. Corn use for ethanol grew very slowly until the late 1990s when a gradual period of growth started, followed by rapid increases between 2003 and 2010. There was a sizable decline in other domestic corn use in MY 2003:Q4 and more persistent declines between MY 2005 and 2012, corresponding to the period of acceleration in corn use for ethanol production in the U.S.

- Trade: Since U.S. corn imports are small relative to exports, Figure 1 shows U.S. net exports of corn (quarterly U.S. corn imports are generally below 0.3 million tons whereas quarterly exports are more than 12 million tons), showing substantial variations across quarters and years. The large dip in net U.S. corn exports in MY 2012 corresponds to the severe drought period from 2011 to 2013.

2.2. Methodology

2.2.1. Unit Root and Structural Break Tests

2.2.2. Causal Analysis Tests

3. Results

3.1. Unit Root and Structural Break Test Results

3.2. Causality Test Results

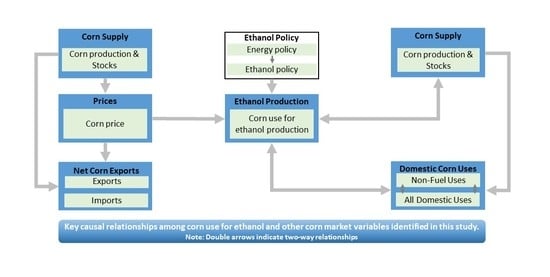

4. Discussion

4.1. Structural Breaks

4.2. Causality

4.3. Summary

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Copyright Notice

References

- Searchinger, T.; Heimlich, R.; Houghton, R.A.; Dong, F.; Elobeid, A.; Fabiosa, J.; Tokgoz, S.; Hayes, D.; Yu, T.H. Use of US Croplands for Biofuels Increases Greenhouse Gases through Emissions from Land-Use Change. Science 2008, 319, 1238–1240. [Google Scholar] [CrossRef] [PubMed]

- Condon, N.; Klemick, H.; Wolverton, A. Impacts of Ethanol Policy on Corn Prices: A Review and Meta-Analysis of Recent Evidence. Food Policy 2015, 51, 63–73. [Google Scholar] [CrossRef]

- Kline, K.L.; Msangi, S.; Dale, V.H.; Woods, J.; Souza, G.M.; Osseweijer, P.; Clancy, J.S.; Hilbert, J.A.; Johnson, F.X.; McDonnell, P.C.; et al. Reconciling Food Security and Bioenergy: Priorities for Action. Gcb Bioenergy 2017, 9, 557–576. [Google Scholar] [CrossRef] [Green Version]

- Oladosu, G.; Msangi, S. Biofuel-Food Market Interactions: A Review of Modeling Approaches and Findings. Agriculture 2013, 3, 53–71. [Google Scholar] [CrossRef] [Green Version]

- Persson, U.M. The Impact of Biofuel Demand on Agricultural Commodity Prices: A Systematic Review. Wiley Interdiscip. Rev. Energy Environ. 2015, 4, 410–428. [Google Scholar] [CrossRef]

- Wicke, B.; Verweij, P.; Meijl, H.; Vuuren, D.P.; Faaij, A.P. Indirect Land Use Change: Review of Existing Models and Strategies for Mitigation. Biofuels 2012, 3, 87–100. [Google Scholar] [CrossRef]

- Dunn, J.B.; Merz, D.; Copenhaver, K.L.; Mueller, S. Measured Extent of Agricultural Expansion Depends on Analysis Technique. Biofuels Bioprod. Biorefining 2017, 11, 247–257. [Google Scholar] [CrossRef] [Green Version]

- Malins, C.; Plevin, R.; Edwards, R. How Robust Are Reductions in Modeled Estimates from GTAP-BIO of the Indirect Land Use Change Induced by Conventional Biofuels? J. Clean. Prod. 2020, 258, 120716. [Google Scholar] [CrossRef]

- Efroymson, R.A.; Kline, K.L.; Angelsen, A.; Verburg, P.H.; Dale, V.H.; Langeveld, J.W.; McBride, A. A Causal Analysis Framework for Land-Use Change and the Potential Role of Bioenergy Policy. Land Use Policy 2016, 59, 516–527. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Z.; Luanne, L.; Escalante, C.; Wetzstein, M. Food versus Fuel: What Do Prices Tell Us? Energy Policy 2008, 38, 445–451. [Google Scholar] [CrossRef]

- Cha, K.S.; Bae, J.H. Dynamic Impacts of High Oil Prices on the Bioethanol and Feedstock Markets. Energy Policy 2011, 39, 753–760. [Google Scholar] [CrossRef]

- Qui, C.; Colson, G.; Escalante, C.; Wetztein, M. Considering Macroeconomic Indicators in the Food before Fuel Nexus. Energy Econ. 2012, 34, 2021–2028. [Google Scholar]

- Nazlioglu, S.; Soytas, U. Oil Price, Agricultural Commodity Prices, and the Dollar: A Panel Cointegration and Causality Analysis. Energy Econ. 2012, 34, 1098–1104. [Google Scholar] [CrossRef]

- Natanelov, V.; Alam, M.J.; McKenzie, A.M.; Huylenbroeck, G.V. Is There Co-Movement of Agricultural Commodities Futures Prices and Crude Oil? Energy Policy 2011, 39, 4971–4984. [Google Scholar] [CrossRef] [Green Version]

- Ciaian, P. Interdependencies in the Energy–Bioenergy–Food Price Systems: A Cointegration Analysis. Resour. Energy Econ. 2011, 33, 326–348. [Google Scholar] [CrossRef]

- Nazlioglu, S. World Oil and Agricultural Commodity Prices: Evidence from Nonlinear Causality. Energy Policy 2011, 39, 2935–2943. [Google Scholar] [CrossRef]

- Harri, A.; Nally, L.; Hudson, D. The Relationship between Oil, Exchange Rates, and Commodity Prices. J Agric. Appl. Econ. 2009, 41, 501–510. [Google Scholar] [CrossRef] [Green Version]

- Katrakilidis, C.; Sidiropoulos, M.; Tabakis, N. An Empirical Investigation of the Price Linkages between Oil, Biofuels and Selected Agricultural Commodities. Procedia Econ. Financ. 2015, 33, 313–320. [Google Scholar] [CrossRef] [Green Version]

- Papiez, M. A dynamic analysis of causality between prices of corn, crude oil and ethanol. In Proceedings of the 32nd International Conference on Mathematical Methods in Economics, Olomouc, Czech Republic, 10–12 September 2014. [Google Scholar]

- Rezitis, A.N. The Relationship between Agricultural Commodity Prices, Crude Oil Prices and US Dollar Exchange Rates: A Panel VAR Approach and Causality Analysis. Int. Rev. Appl. Econ. 2015, 29, 403–434. [Google Scholar] [CrossRef]

- Filip, O.; Janda, K.; Kristoufek, L.; Zilberman, D. Food versus Fuel: An Updated and Expanded Evidence. Energy Econ. 2017, 82, 152–166. [Google Scholar] [CrossRef] [Green Version]

- Chen, B.; Saghaian, S. Market Integration and Price Transmission in the World Rice Export Markets. J. Agric. Resour. Econ. 2016, 41, 444–457. [Google Scholar]

- Taghizadeh-Hesary, F.; Rasoulinezhad, E.; Yoshino, N. Trade Linkages and Transmission of Oil Price Fluctuations in a Model Incorporating Monetary Variables. Energy Policy. 2019, 133, 110872. [Google Scholar] [CrossRef]

- Roman, M.; Górecka, A.; Domagała, J. The Linkages between Crude Oil and Food Prices. Energies 2020, 13, 6545. [Google Scholar] [CrossRef]

- Vo, D.H.; Vu, T.N.; McAleer, M. Modeling the Relationship between Crude Oil and Agricultural Commodity Prices. Energies 2019, 12, 1344. [Google Scholar] [CrossRef] [Green Version]

- Eigenbrod, F.; Beckmann, M.; Dunnett, S.; Graham, L.; Holland, R.A.; Meyfroidt, P.; Seppelt, R.; Song, X.-P.; Spake, R.; Václavík, T.; et al. Identifying Agricultural Frontiers for Modeling Global Cropland Expansion. One Earth 2020, 3, 504–514. [Google Scholar] [CrossRef]

- Granger, C.W. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econom. J. Econom. Soc. 1969, 1, 424–438. [Google Scholar] [CrossRef]

- Seth, A.K.; Barrett, A.B.; Barnett, L. Granger Causality Analysis in Neuroscience and Neuroimaging. J. Neurosci. 2015, 35, 3293–3297. [Google Scholar] [CrossRef] [PubMed]

- ERS. Feed Grains Database; Economic Research Service, US Department of Agriculture: Washington, DC, USA, 2018. Available online: https://www.ers.usda.gov/data-products/feed-grains-database/ (accessed on 24 February 2021).

- EIA. Cushing, OK WTI Spot Price FOB; Energy Information Administration, US Department of Energy: Washington, DC, USA, 2018. Available online: https://www.eia.gov/dnav/pet/hist/RWTCD.htm (accessed on 24 February 2021).

- Bastianin, A.; Galeotti, M.; Manera, M. Causality and Predictability in Distribution: The Ethanol–Food Price Relation Revisited. Energy Econ. 2014, 42, 152–160. [Google Scholar] [CrossRef]

- Gilbert, C.L. How to Understand High Food Prices. J. Agric. Econ. 2010, 61, 398–425. [Google Scholar] [CrossRef]

- Saghaian, S.H. The Impact of the Oil Sector on Commodity Prices: Correlation or Causation? J. Agric. Appl. Econ. 2010, 42, 477–485. [Google Scholar] [CrossRef] [Green Version]

- Tiwari, A.K.; Ludwig, A. Short-and Long-Run Rolling Causality Techniques and Optimal Window-Wise Lag Selection: An Application to the Export-Led Growth Hypothesis. J. Appl. Stat. 2015, 42, 662–675. [Google Scholar] [CrossRef]

- Nyakabawo, W.; Miller, S.M.; Balcilar, M.; Das, S.; Gupta, R. Temporal Causality between House Prices and Output in the US: A Bootstrap Rolling-Window Approach. N. Am. J. Econ. Financ. 2015, 33, 55–73. [Google Scholar] [CrossRef] [Green Version]

- Balcilar, M.; Ozdemir, Z.A.; Arslanturk, Y. Economic Growth and Energy Consumption Causal Nexus Viewed through a Bootstrap Rolling Window. Energy Econ. 2010, 32, 1398–1410. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Lütkepohl, H. New Introduction to Multiple Time Series Analysis; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2005. [Google Scholar]

- Hansen, B.E. The New Econometrics of Structural Change: Dating Breaks in US Labour Productivity. J. Econ. Perspect. 2001, 15, 117–128. [Google Scholar] [CrossRef] [Green Version]

- Glynn, J.; Perera, N. Unit Root Tests and Structural Breaks: A Survey with Applications Contrastes de raíces unitarias y cambios estructurales: Un estudio con aplicaciones. Rev. Métod. Cuantitativos Para Econ. Empresa J. Quant. Methods Econ. Bus. Adm. 2007, 3, 63–79. [Google Scholar]

- Kwiatkowski, D.; Phillips, P.C.; Schmidt, P.; Shin, Y. Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root: How Sure Are We That Economic Time Series Have a Unit Root? J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Computation and Analysis of Multiple Structural Change Models. J. Appl. Econom. 2003, 18, 1–22. [Google Scholar] [CrossRef] [Green Version]

- Hafner, C.M.; Herwartz, H. Testing for Linear Vector Autoregressive Dynamics under Multivariate Generalized Autoregressive Heteroskedasticity. Stat. Neerl. 2009, 63, 294–323. [Google Scholar] [CrossRef]

- Enders, W.; Jones, P. Grain Prices, Oil Prices, and Multiple Smooth Breaks in a VAR. Stud. Nonlinear Dyn. Econom. 2016, 20, 399–419. [Google Scholar] [CrossRef]

- McCarthy, J.E.; Tiemann, M. Tiemann MTBE in Gasoline: Clean Air and Drinking Water Issues. In Congressional Research Service Reports; Congressional Research Service, The Library of Congress: Washington, DC, USA, 2006; p. 26, 98-290 ENR. [Google Scholar]

- Anderson, S.T.; Elzinga, A. A Ban on One Is a Boon for the Other: Strict Gasoline Content Rules and Implicit Ethanol Blending Mandates. J. Environ. Econ. Manag. 2014, 67, 258–273. [Google Scholar] [CrossRef]

- US Senate. S.265 - MTBE Elimination Act—107th Congress (2001-2002); Government Printing Office: Washington, DC, USA, 2001. Available online: https://www.congress.gov/107/bills/s265/BILLS-107s265is.pdf (accessed on 24 February 2021).

- Rippey, B.R. The US Drought of 2012. Weather Clim. Extrem. 2015, 10, 57–64. [Google Scholar] [CrossRef] [Green Version]

- RFA. Monthly Ethanol Supply and Demand Data; Renewable Fuel Association: Ellisville, MI, USA, 2020; Available online: https://ethanolrfa.org/statistics/weekly-monthly-ethanol-supply-demand/ (accessed on 24 February 2021).

- Oladosu, G.; Kline, K.; Uria-Martinez, R.; Eaton, L. Sources of Corn for Ethanol Production in the United States: A Decomposition Analysis of the Empirical Data. Biofuels Bioprod. Biorefining 2011, 5, 640–653. [Google Scholar] [CrossRef]

- Hoffman, L.A.; Baker, A.J. Estimating the Substitution of Distillers’ Grains for Corn and Soybean Meal in the US Feed Complex; US Department of Agriculture: Washington, DC, USA, 2011. [Google Scholar]

- Hanrahan, C.E.; Becker, G.S. Mad Cow Disease and US Beef Trade; Congressional Research Service, Library of Congress: Washington, DC, USA, 2006. [Google Scholar]

- USDA. Cattle & Beef Statistics; US Department of Agriculture: Washington, DC, USA, 2020. Available online: https://www.ers.usda.gov/topics/animal-products/cattle-beef/statistics-information.aspx (accessed on 24 February 2021).

| ADF Test | KPSS Test | Zivot-Andrew Test | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | None | Drift | Trend | Drift | Trend | Drift | Trend | Both | |

| Beginning Stocks | Level | −3.36 | −12.36 | −12.86 | 0.34 | 0.13 | −15.64 | −15.89 | −15.81 |

| 1st Diff. | −15.11 | −15.04 | −14.98 | 0.01 | 0.01 | −15.27 | −15.27 | −15.38 | |

| Total Supply | Level | −2.35 | −10.89 | −13.28 | 1.11 * | 0.14 | −15.47 | −15.75 | −15.68 |

| 1st Diff. | −14.97 | −14.91 | −14.86 | 0.03 | 0.01 | −14.88 | −14.88 | −14.97 | |

| Price (No2 Y Gulf) | Level | −0.66 * | −2.29 * | −2.94 * | 3.35 * | 0.50 * | −4.32 * | −3.29 * | −5.93 |

| 1st Diff. | −11.55 | −11.51 | −11.47 | 0.04 | 0.04 | −12.29 | −11.81 | −12.28 | |

| Net Corn Exports | Level | −0.98 * | −5.41 | −5.40 | 0.11 | 0.10 | −5.78 | −5.46 | −6.49 |

| 1st Diff. | −10.65 | −10.60 | −10.56 | 0.03 | 0.01 | −10.77 | −10.67 | −11.24 | |

| Corn for Ethanol Fuel | Level | 2.71 * | 1.04 * | −1.55 * | 5.50 * | 1.35 * | −4.62 * | −2.23 * | −2.75 * |

| 1st Diff. | −4.63 | −5.23 | −5.50 | 0.81 * | 0.21 * | −6.73 | −6.08 | −6.68 | |

| Other Domestic Uses | Level | −1.58 * | −12.49 | −13.17 | 0.47 * | 0.19 * | −16.19 | −15.42 | −16.27 |

| 1st Diff. | −14.55 | −14.49 | −14.43 | 0.01 | 0.01 | −14.43 | −14.43 | −14.50 | |

| Total Domestic Use | Level | −0.86 * | −4.72 | −14.27 | 4.72 * | 0.13 | −15.99 | −15.61 | −15.96 |

| 1st Diff. | −14.54 | −14.50 | −14.44 | 0.02 | 0.01 | −14.44 | −14.44 | −14.50 | |

| WTI Crude Price | Level | −0.89 * | −2.05 * | −3.22 * | 4.58 * | 0.51 * | −4.98 | −4.21 * | −4.68 * |

| 1st Diff. | −11.44 | −11.41 | −11.38 | 0.04 | 0.04 | −12.03 | −11.66 | −13.09 | |

| Critical Values | 1% | −2.58 | −3.46 | −3.99 | 0.74 | 0.22 | −5.34 | −4.93 | −5.57 |

| 5% | −1.95 | −2.88 | −3.43 | 0.46 | 0.15 | −4.80 | −4.42 | −5.08 | |

| 10% | −1.62 | −2.57 | −3.13 | 0.35 | 0.12 | −4.58 | −4.11 | −4.82 | |

| Impact | Driver | Granger | Instantaneous |

|---|---|---|---|

| Corn for Ethanol | Net Exports | −0.02 | 0.04 |

| No2Y Corn Gulf Price | −0.05 * | −0.01 | |

| Other Dom. Uses | −0.24 * | 0.28 ** | |

| Total Dom. Uses | −0.02 | 0.41 *** | |

| Total Supply | 0.04 | 0.23 * | |

| Net Exports | Corn for Ethanol | 0.11 | 0.04 |

| No2Y Corn Gulf Price | −0.12 | −0.35 *** | |

| Other Dom. Uses | 0.47 ** | 0.34 *** | |

| Total Dom. Uses | −1.09 ** | 0.37 *** | |

| Total Supply | 0.09 | 0.22 ** | |

| No2Y Corn Gulf Price | Corn for Ethanol | −0.08 | −0.01 |

| Net Exports | 0.03 | −0.35 *** | |

| Other Dom. Uses | 0.22 | −0.25 *** | |

| Total Dom. Uses | 0.13 | −0.37 *** | |

| Total Supply | −0.24 * | −0.17 * | |

| Other Dom. Uses | Corn for Ethanol | −0.04 ** | 0.28 ** |

| Net Exports | 0.00 | 0.34 *** | |

| No2Y Corn Gulf Price | 0.02 * | −0.25 *** | |

| Total Dom. Uses | 0.08 | 0.91 *** | |

| Total Supply | 0.28 ** | 0.49 *** | |

| Total Dom. Uses | Corn for Ethanol | −0.03 ** | 0.41 *** |

| Net Exports | 0.00 | 0.37 *** | |

| No2Y Corn Gulf Price | 0.00 | −0.37 *** | |

| Other Dom. Uses | −0.39 ** | 0.91 *** | |

| Total Supply | 0.21 * | 0.60 *** | |

| Total Supply | Corn for Ethanol | 0.02 *** | 0.23 * |

| Net Exports | −0.01 ** | 0.22 ** | |

| No2Y Corn Gulf Price | 0.03 | −0.17 * | |

| Other Dom. Uses | −0.38 * | 0.49 *** | |

| Total Dom. Uses | −0.06 *** | 0.60 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oladosu, G.A.; Kline, K.L.; Langeveld, J.W.A. Structural Break and Causal Analyses of U.S. Corn Use for Ethanol and Other Corn Market Variables. Agriculture 2021, 11, 267. https://0-doi-org.brum.beds.ac.uk/10.3390/agriculture11030267

Oladosu GA, Kline KL, Langeveld JWA. Structural Break and Causal Analyses of U.S. Corn Use for Ethanol and Other Corn Market Variables. Agriculture. 2021; 11(3):267. https://0-doi-org.brum.beds.ac.uk/10.3390/agriculture11030267

Chicago/Turabian StyleOladosu, Gbadebo A., Keith L. Kline, and Johannes W. A. Langeveld. 2021. "Structural Break and Causal Analyses of U.S. Corn Use for Ethanol and Other Corn Market Variables" Agriculture 11, no. 3: 267. https://0-doi-org.brum.beds.ac.uk/10.3390/agriculture11030267