1. Introduction

Variable renewable energies (VREs) have come a long way from exotic newcomers to essential building blocks of the energy systems of today. Currently, large industrialized countries in the EU, e.g., Germany and Denmark, have VRE-shares of more than 40% [

1,

2,

3]. In addition, it has been convincingly demonstrated that energy systems with VRE shares of 80–100% are feasible [

4,

5,

6].

Many support and deployment policies have been in place for decades in many countries in order to facilitate this transition to cleaner energy. The central goal of these policies is usually to ensure refinancing of power plants generating electricity from renewable energy sources. Often, in their introductory phase, fixed feed-in tariffs have been successfully promoting renewables by significantly reducing investment risks. With fixed feed-in tariffs, renewable energy plant owners receive a fixed remuneration for each kWh of electricity fed into the grid. They have a proven track record enabling new renewable technologies to enter the market [

7].

However, since the beginning of integrating renewables into energy systems, a major transition has taken place, since the goal now is to move towards a new market design by creating liberalized and competitive electricity markets in the EU. Accordingly, a large number of various support schemes has been introduced to support this transition [

8]. Our article is concerned about a potential design flaw of variable market premia. This flaw could affect electricity prices and market premia even before expansion targets are reached.

In order to place our analysis in context it is helpful to take a look at the different support schemes that exist. For supply-oriented support schemes a general distinction can be made between price-based and volume-based support instruments [

9]. Schemes are often characterized by effectiveness, efficiency, impact and feasibility [

10]. Each scheme is designed to achieve specific subgoals [

7] and comes with its own advantages and disadvantages. Price-based schemes set financial incentives. The resulting volume is not determined and may vary. In contrast, volume-based schemes require a fixed volume resulting in variable prices. For price-based schemes, costs cannot be predicted beforehand [

9]. Volume-driven schemes, in contrast, are quite inflexible. If, for example, the targeted volume is exhausted quickly, further expansion is difficult and requires setting up a new scheme. Typical instruments of price-based schemes include feed-in tariffs, market premia, contracts for difference (CFD, also referred to as symmetrical market premium or double-sided sliding premium) or investment support, low interest loans and tax exemptions. Volume-based schemes include instruments like quota obligations, tender or auction-schemes [

9].

In the last few years, market premia were introduced as a widespread approach to align supply and demand, since fixed feed-in tariffs are very well suited to ensure refinancing but do not set any incentives for demand orientation. Policy instruments with market premia are one of the major pillars of European VRE market integration legislation: According to RES LEGAL, at least the 12 European countries currently employ some form of variable market premium scheme (Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Italy, Lithuania, Luxemburg, the Netherlands and the United Kingdom; see [

11]). Moreover, some current VRE auction designs rely on a variable market premium, for example in Denmark, Germany, Italy and the Netherlands. Additionally, more than a dozen of countries world-wide also employ feed-in tariffs with premium payments [

12].

In particular, market premia are designed to eliminate the risks of renewable power plant operators [

13,

14]. They come in two flavors: either as fixed or as variable (sliding or floating) premium. Both variants are designed to increase demand-oriented feed-in and decentralized direct marketing [

9]. By dynamically adjusting the variable premium to a target strike price, the total gain for the plant operator remains constant even for low electricity market prices to ensure refinancing. Another design option is the symmetrical market premium, also referred to as double-sided sliding premium or contracts for difference. In this case the technologies receive a contract, which tops up the income per MWh from the average market price to a target strike price stated in the contract. If market prices exceed the target price the contract decreases the electricity market revenues to the strike price level [

15,

16].

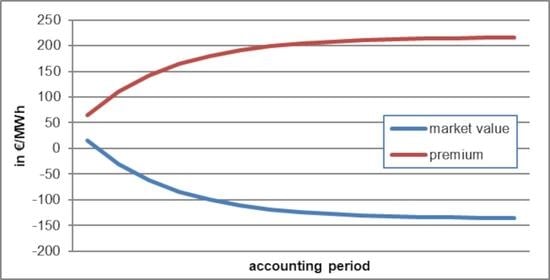

In this study, we focus on the design of the variable premium as computed as the ex-post difference between the energy-source-specific market value (usually averaged over an accounting period of e.g., 1 month) and a predefined energy-source-specific reference tariff level. Latter is usually calculated in accordance with the energy- source-specific levelized cost of electricity (LCOE) [

17] to ensure refinancing.

However, this type of premium has been introduced for markets with low shares of VRE [

18]. Given that current transition goals involve very high shares of VRE, this article analyzes a design problem with both a variable market premium and high shares of VRE leading to self-reinforcing downward electricity price dynamics and increasing premia. High premia may jeopardize political acceptance of VRE and highly negative prices indicate an overproduction, which actually does not happen. These effects might counteract an effective and efficient further integration of renewables. We also list solutions in the discussion.

The rest of the article is structured as follows. We first present a mathematical model that is reduced to the mathematical bare-bones of the flaw and which shows that the problem of falling market prices and increasing premia is inherent to its structure. In the Results, we substantiate our claims with model results from an agent-based simulation, to demonstrate that this effect also arises under more complex and realistic conditions. Finally, in the Discussion, we raise possible objections concerning simulation assumptions, technological influences and current regulations. Possible solutions are also discussed.

4. Discussion

Now that self-reinforcing deflationary price dynamics under the variable market premium scheme have been mathematically described and shown to be persistent in more realistic market simulations, one question emerges—is this effect of practical relevance? We identify three categories of objections: deflationary price dynamics will not occur in this form, since the effect…

… is an artefact of the simulation itself (Objection A);

… is attenuated by other influences (Objection B);

… is already addressed by current regulations (Objection C).

4.1. Objection A—Is the Effect a Model Artefact?

Both the mathematical model and the simulations are simplified examples—hence the effect observed could be due to model artefacts. One assumption is that remunerated plant operators are willing to offer energy at negative prices. Furthermore, to determine their (negative) bidding prices, a simplistic forecast of the expected market premium has been used. Although doubts regarding these two aspects of the modelling are legitimate, we will show that these are, in fact, sound assumptions.

The basis for the assumption of plant operators bidding at negative prices is the guaranteed income via the market premium. The premium fills the gap between a plant operator’s income from the electricity market and its LCOE, provided the plant operator’s feed-in pattern matches the average feed-in pattern of the corresponding technology. Since the subsequent balancing of market revenues to the LCOE is guaranteed, negative bidding is virtually risk-free: If the plant operator is price-setting, any occurring losses due to negatives bids are compensated for by the market premium. At the same time, this strategy increases the probability of being awarded in the spot market and thus increases the amount of claimable premia.

Therefore, market participants who offer energy at variable marginal costs without considering markdowns have a higher volume risk and their bidding strategy should be evolutionarily unstable [

34]. In theory, bids can be as negative as permitted by the lower price limit of the energy exchange. However, if a significant share of plant operators places substantially lower bids than their competitors, the income of the latter may be increased beyond their corresponding LCOE. This is caused by a disproportionate increase of the market premium rewarded to the competitors compared to their reduced market share. Consequently, a bidding strategy that employs the expected market premium as bidding price offers a reasonable compromise between these two risks.

Hence, the fundamental problem described exists independently of our simplifying assumptions. Decreasing prices are offset by the premium and using the expected premium as bidding price is a reasonable strategy [

35].

This leads to a second possible objection: The forecast of the expected market premium shows a significant impact on the models’ convergence behavior. Nevertheless, the simplified estimate of the market premium equaling that of the previous accounting period is used. It is likely that real-world actors would make more of an effort to obtain more precise estimates for the expected market premium. Possible methods could include adjustments of the expected value during the accounting periods or to use information from previous years to better reflect the premium’s dynamics during a year.

However, more sophisticated forecasts do not have any impact on the general dynamics of the market premium that we report. Equations (3) and (4) offer but one point of stability, i.e., where the expected market premium equals the actual one. Thus, on the contrary, if prediction methods for the expected market premium are enhanced, this will only lead to a faster convergence of the system.

In summary, both objections do not hold. Either they do not concern the general dynamics or they would even aggravate the problem.

4.2. Objection B—Is the Effect Attenuated by Other Influences?

Yet, both the plain mathematical model and the AMIRIS simulation are stylized and simplified. Therefore, they possibly abstract away important features of the real world that may counteract the strong decline in market prices and market values of VRE described above. In the following, it is discussed which factors might counteract this effect of declining prices.

For example, the chosen scenario, due to its relatively strong PV deployment, may overestimate the self-reinforcing effect. Especially in summer, synchronous production profiles enhance the share of hours where PV is price setting. This decreases prices and thus market values even stronger. We can confirm the strong influence of PV on the results in our simulations.

However, we observe the deflationary price dynamics in scenarios with large wind capacities as well. This result is robust against different proportions of technologies, since we conducted several sensitivity checks regarding the influence of the composition of the power plant park (for a scenario with high wind capacities see

Appendix A.2).

Scenarios with large wind capacities reveal cross effects like in the extended scenario above—just with wind as price-dominating technology. Hours with alternative price-setting technologies with negative bids and differing feed-in profiles further reduce the market values of the technologies considered. Hence, the deflationary effects of the different technologies reinforce each other.

A further argument could be that these effects are attenuated by expanding storage capacities. We examined this sensitivity, too. Storage capacities are included in the expanded scenario with 20 GW capacity at an energy to power-ratio of 7. In an alternative scenario, the capacity was increased to 40 GW. As expected, increasing storage capacities reduces the number of hours in which renewables bidding with negative prices are price-setting. Accordingly, monthly averages of electricity prices and thus market values of PV and wind are higher; this, in turn, results in lower market premia. However, the deflationary dynamics occur even with these highly ambitious assumptions in place (for a scenario with high storage capacities see

Appendix A.3).

It could further be argued that future energy systems with high shares of VRE very likely face higher demand as a result of increased sector coupling. For instance, a new demand may arise from P2X technologies like power-to-heat, power-to-gas and power-to-vehicle technologies. These technologies transfer electrical energy into other energy sectors. Consequently, PtX technologies have the potential to significantly reduce the amount of hours with negative or zero prices assuming a certain “willingness-to-pay” for these applications [

36]. For the price-declining effect to occur, however, a correspondingly high proportion of VRE is essential. Accordingly, growing demand will only delay the effect, but not cancel it.

Finally, import and export of electric power is not considered in the simulation. In case of a meteorological condition that leads to a high VRE electricity production in one country and a small VRE electricity production in a neighboring country and resulting price differences, electricity would be traded across borders. This leads to lower prices in the importing country and to higher prices in the exporting country, thus reducing the probability of negative prices in the market.

Cross-border trade adds flexibility to a country’s market and could therefore mitigate the discussed market price declining effect if weather patterns are sufficiently decorrelated. Even today there are situations when residual loads are low in much of continental Europe, as for example on the 5th of July 2020. On that date, day-ahead prices in all Central Western Europe were negative during the whole day.

We therefore believe that it is unlikely that these, or the other influences discussed can cancel the effect completely.

4.3. Objection C—Is the Effect Addressed by Current Regulations?

Finally, market price decline might be limited by instruments and regulatory design itself. For instance, the so called 6-hour-negative pricing rule has been implemented in the renewable energy source act 2014 in Germany [

37]. Its aim is to incite curtailment in hours of overproduction. Therefore, this regulation ensures that the market premium is set to zero if prices at the day-ahead auction are below zero in 6 and more consecutive hours.

Obviously, this regulation prevents the observed effect. At the same time, it significantly reduces potential full-load hours of renewables with corresponding substantial risks for their refinancing. In fact, this negative impact can already be observed at present. For instance, an estimated €50 million in losses for offshore wind projects in February 2020 alone have been attributed to this regulation [

38]. While the declining price effect is thus prevented at present, this adjustment would significantly impact in a negative way on the refinancing for an electricity system with a high proportion of VRE in the long term.

Another regulative solution would be to cap premia at a maximum value, for example at the LCOE in order to still be able to ensure refinancing. This approach has at least two disadvantages: (a) it will hardly be possible to calculate the LCOE correctly if the foreseeable changes in full-load hours are considered, and (b) relatively expensive technologies are placed to the left of the cheaper technologies in the merit order. Both problems mean that a new market distortion emerges. This would significantly weaken the function of the market to ensure an efficient allocation of resources.

Yet another regulation that would prevent the declining price effect is the introduction of a fixed market premium, which has been used, e.g., in Germany for the so-called innovation tenders [

39]. With this design, the premium is independent of the market price. The premium is a constant payment in addition to the market price which is effected at the market. Hence, the variation in returns depends strongly on market price variations. However, this has the drawback that the refinancing of plant owners is exposed to a significantly higher risk [

40].

Finally, an alternative design of the market premium, which is, for example, in place in Great Britain and France for offshore wind, are so-called contracts for difference (CFD, also referred to as symmetrical market premium or double-sided sliding premium) [

15,

16]. If the average market value is below the CFD value, the plant operator receives this difference as a premium. If the market value is above the CFD value, the plant operator pays the difference to the counterparty. While this mechanism prevents excessive profits to power plant operators, the declining price effect remains the same as for the variable market premium, since the contract covers the price risks.

We conclude that the regulations discussed above would indeed prevent the self-reinforcing downward electricity price dynamics. However, they all have undesired side effects.

5. Conclusions

Both a plain mathematical model and two scenarios with the agent-based simulation model AMIRIS show that high shares of fluctuating renewables in combination with variable market premia may lead to a downward spiral of electricity prices and increasing costs for their support.

We are convinced that there is a basic problem: Market premia play an essential role in the market integration of renewables by guaranteeing investment security and aligning production with demand. However, at very high shares of fluctuating renewables they distort the market price formation, which results, in the worst case, in a self-reinforcing loop of declining prices. If technologies that receive an ex-post market premium cover 100% of consumption and thus become price-setting, they counteract an effective and efficient further integration of renewables. Price-setting power plants may demand any negative price and are remunerated with a market premium in any case, since this instrument has been designed to guarantee refinancing in accordance with the value to be invested. Hence, the main driver for the discussed downward loop consists in premia filling in even for negative prices. Since premium recipients are by design retroactively remunerated with a reference value and can thus call up virtually any prices, the mechanism can be exploited under certain circumstances.

High negative prices could be one result of this negative feedback loop. These would have unfavorable effects on the electricity market and the electricity system as a whole. First, they would distort the level of market prices and thus offer false incentives for the operation and investment of generation technologies as well as demand. Second, acceptance of technologies receiving premia could be reduced by a strong price influence; electricity prices would certainly fall, but the remuneration costs paid by electricity customers would skyrocket at the same time. Distribution effects also have to be considered—e.g., in Germany, not all electricity consumers are equally involved in the payment of remunerations.

The described dilemma is not trivial to avert in the current market setting, as voluntary change in bidding behavior is not to be expected. The problem is also not easy to circumvent given the current remuneration system. However, a direct intervention in the market (e.g., prohibiting negative bids) would indeed avoid the self-reinforcing pattern described above. Yet, it is to be expected that refinancing of premium recipients would then be in jeopardy. Yet, refinancing is one of the main reasons for market premia to exist in the first place. Fixed market premia would also entail immense investment risks for the state given very high levels of VRE. In addition, this would jeopardize refinancing of newcomer plants, as do upper and lower limits for the variable market premium.

Since many countries employ feed-in premia (see above), and VRE are increasing their share, such potential downward price spirals might become problematic on a larger scale. Hence, we conclude that this problem needs further investigation and encourage the research community to reproduce our findings. We need solutions for both how the refinancing of new technologies and efficient allocation of electricity generation at the wholesale market can work at high shares of renewable energy. One interesting aspect to study is to calculate the point—both from a national or European point of view and of the individual actors involved—when it would be optimal to stop giving market premia to renewables and switch to other support instruments like capacity mechanisms or quota systems for VRE.