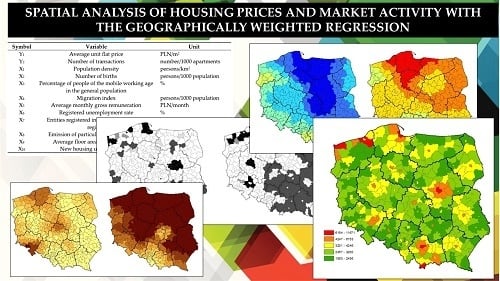

Spatial Analysis of Housing Prices and Market Activity with the Geographically Weighted Regression

Abstract

:1. Introduction

2. Literature Review

3. Methods of Research

3.1. Geographically Weighted Regression (GWR)

3.2. Mixed Geographically Weighted Regression (MGWR)

- Step 1. Supply an initial value for , say , using OLS (ordinary least squares)

- Step 2. Set i = 1

- Step 3. Set

- Step 4. Set

- Step 5. Set i = i + 1

- Step 6. Return to Step 3, unless converges to

4. General Data Characteristics

5. Results and Discussion

6. Summary and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Adams, Z.; Füss, R. Macroeconomic Determinants of International Housing Markets. J. Hous. Econ. 2010, 19, 38–50. [Google Scholar] [CrossRef]

- Hott, C.; Monnin, P. Fundamental Real Estate Prices: An Empirical Estimation with International Data. J. Real Estate Financ. Econ. 2008, 36, 427–450. [Google Scholar] [CrossRef]

- Gasparėnienė, L.; Remeikienė, R.; Skuka, A. Assessment of the Impact of Macroeconomic Factors on Housing Price Level: Lithuanian Case. Intellect. Econ. 2016, 10, 122–127. [Google Scholar] [CrossRef]

- Lee, C.L. Housing Price Volatility and Its Determinants. Int. J. Hous. Mark. Anal. 2009, 2, 293–308. [Google Scholar] [CrossRef] [Green Version]

- Anas, A.; Eum, S.J. Hedonic Analysis of a Housing Market in Disequilibrium. J. Urban Econ. 1984, 15, 87–106. [Google Scholar] [CrossRef]

- DeSilva, S.; Elmelech, Y. Housing Inequality in the United States: Explaining the White-Minority Disparities in Homeownership. Hous. Stud. 2012, 27, 1–26. [Google Scholar] [CrossRef]

- Engelhardt, G.V.; Poterba, J.M. House Prices and Demographic Change: Canadian Evidence. Reg. Sci. Urban Econ. 1991, 21, 539–546. [Google Scholar] [CrossRef]

- Essafi, Y.; Simon, A. Housing Market and Demography, Evidence from French Panel Data. Eur. Real Estate Soc. 2015, 2015, 107–133. [Google Scholar] [CrossRef]

- Lin, W.-S.; Tou, J.-C.; Lin, S.-Y.; Yeh, M.-Y. Effects of Socioeconomic Factors on Regional Housing Prices in the USA. Int. J. Hous. Mark. Anal. 2014, 7, 30–41. [Google Scholar] [CrossRef]

- Magnusson, L.; Turner, B. Countryside Abandoned? Suburbanization and Mobility in Sweden. Eur. J. Hous. Policy 2003, 3, 35–60. [Google Scholar] [CrossRef]

- Gallin, J. The Long-run Relationship between House Prices and Income: Evidence from Local Housing Markets. Real Estate Econ. 2006, 34, 417–438. [Google Scholar] [CrossRef] [Green Version]

- Jud, G.D.; Winkler, D.T. The Dynamics of Metropolitan Housing Prices. J. Real Estate Res. 2002, 23, 29–46. [Google Scholar]

- Reichert, A.K. The Impact of Interest Rates, Income, and Employment upon Regional Housing Prices. J. Real Estate Financ. Econ. 1990, 3, 373–391. [Google Scholar] [CrossRef]

- Berg, L. Prices on the Second-Hand Market for Swedish Family Houses: Correlation, Causation and Determinants. Eur. J. Hous. Policy 2002, 2, 1–24. [Google Scholar] [CrossRef] [Green Version]

- De Bruyne, K.; Van Hove, J. Explaining the Spatial Variation in Housing Prices: An Economic Geography Approach. Appl. Econ. 2013, 45, 1673–1689. [Google Scholar] [CrossRef]

- Allen, J.; Amano, R.; Byrne, D.P.; Gregory, A.W. Canadian City Housing Prices and Urban Market Segmentation. Can. J. Econ. Can. Déconomique 2009, 42, 1132–1149. Available online: https://0-www-jstor-org.brum.beds.ac.uk/stable/40389501 (accessed on 20 March 2020). [CrossRef]

- Ridker, R.G.; Henning, J.A. The Determinants of Residential Property Values with Special Reference to Air Pollution. Rev. Econ. Stat. 1967, 49, 246–257. [Google Scholar] [CrossRef]

- Kim, C.W.; Phipps, T.T.; Anselin, L. Measuring the Benefits of Air Quality Improvement: A Spatial Hedonic Approach. J. Environ. Econ. Manag. 2003, 45, 24–39. [Google Scholar] [CrossRef] [Green Version]

- Saphores, J.-D.; Aguilar-Benitez, I. Smelly Local Polluters and Residential Property Values: A Hedonic Analysis of Four Orange County (California) Cities. Estud. Econ. 2005, 20, 197–218. Available online: https://0-www-jstor-org.brum.beds.ac.uk/stable/40311503 (accessed on 25 March 2020).

- Orenstein, D.E.; Hamburg, S.P. Population and Pavement: Population Growth and Land Development in Israel. Popul. Environ. 2010, 31, 223–254. [Google Scholar] [CrossRef]

- Broitman, D.; Koomen, E. Regional Diversity in Residential Development: A Decade of Urban and Peri-Urban Housing Dynamics in The Netherlands. Lett. Spat. Resour. Sci. 2015, 8, 201–217. [Google Scholar] [CrossRef]

- Belke, A.; Keil, J. Fundamental Determinants of Real Estate Prices: A Panel Study of German Regions. Int. Adv. Econ. Res. 2018, 24, 25–45. [Google Scholar] [CrossRef] [Green Version]

- Grum, B.; Govekar, D.K. Influence of Macroeconomic Factors on Prices of Real Estate in Various Cultural Environments: Case of Slovenia, Greece, France, Poland and Norway. Procedia Econ. Financ. 2016, 39, 597–604. [Google Scholar] [CrossRef] [Green Version]

- Fujita, M.; Krugman, P.R.; Venables, A. The Spatial Economy: Cities, Regions, and International Trade; MIT press: Cambridge, MA, USA, 1999. [Google Scholar]

- Gaspareniene, L.; Venclauskiene, D.; Remeikiene, R. Critical Review of Selected Housing Market Models Concerning the Factors That Make Influence on Housing Price Level Formation in the Countries with Transition Economy. Procedia-Soc. Behav. Sci. 2014, 110, 419–427. [Google Scholar] [CrossRef] [Green Version]

- Holly, S.; Pesaran, M.H.; Yamagata, T. A Spatio-Temporal Model of House Prices in the USA. J. Econ. 2010, 158, 160–173. [Google Scholar] [CrossRef]

- Lee, L.; Yu, J. Some Recent Developments in Spatial Panel Data Models. Reg. Sci. Urban Econ. 2010, 40, 255–271. [Google Scholar] [CrossRef]

- Otto, P.; Schmid, W. Spatiotemporal Analysis of German Real-Estate Prices. Ann. Reg. Sci. 2018, 60, 41–72. [Google Scholar] [CrossRef]

- Griffith, D.A. Modeling Spatial Autocorrelation in Spatial Interaction Data: Empirical Evidence from 2002 Germany Journey-to-Work Flows. J. Geogr. Syst. 2009, 11, 117–140. [Google Scholar] [CrossRef]

- Griffith, D.A. Spatial Filtering. In Handbook of Applied Spatial Analysis; Fisher, M.M., Getis, A., Eds.; Springer: Berlin, Germany, 2010. [Google Scholar]

- Tiefelsdorf, M.; Griffith, D.A. Semiparametric Filtering of Spatial Autocorrelation: The Eigenvector Approach. Environ. Plan. Econ. Space 2007, 39, 1193–1221. [Google Scholar] [CrossRef]

- Thayn, J.B.; Simanis, J.M. Accounting for Spatial Autocorrelation in Linear Regression Models Using Spatial Filtering with Eigenvectors. Ann. Assoc. Am. Geogr. 2013, 103, 47–66. [Google Scholar] [CrossRef]

- Griffith, D.A. Spatial-Filtering-Based Contributions to a Critique of Geographically Weighted Regression (GWR). Environ. Plan. A 2008, 40. [Google Scholar] [CrossRef]

- Huang, B.; Wu, B.; Barry, M. Geographically and Temporally Weighted Regression for Modeling Spatio-Temporal Variation in House Prices. Int. J. Geogr. Inf. Sci. 2010, 24, 383–401. [Google Scholar] [CrossRef]

- Lu, B.; Charlton, M.; Fotheringhama, A.S. Geographically Weighted Regression Using a Non-Euclidean Distance Metric with a Study on London House Price Data. Procedia Environ. Sci. 2011, 7, 92–97. [Google Scholar] [CrossRef] [Green Version]

- Kestens, Y.; Thériault, M.; Des Rosiers, F. Heterogeneity in Hedonic Modelling of House Prices: Looking at Buyers’ Household Profiles. J. Geogr. Syst. 2006, 8, 61–96. [Google Scholar] [CrossRef]

- Yu, D. Modeling Owner-Occupied Single-Family House Values in the City of Milwaukee: A Geographically Weighted Regression Approach. GIScience Remote Sens. 2007, 44, 267–282. [Google Scholar] [CrossRef]

- McCord, M.; Davis, P.T.; Haran, M.; McGreal, S.; McIlhatton, D. Spatial Variation as a Determinant of House Price. J. Financ. Manag. Prop. Constr. 2012, 17, 49–72. [Google Scholar] [CrossRef]

- Yang, J.; Bao, Y.; Zhang, Y.; Li, X.; Ge, Q. Impact of Accessibility on Housing Prices in Dalian City of China Based on a Geographically Weighted Regression Model. Chin. Geogr. Sci. 2018, 28, 505–515. [Google Scholar] [CrossRef] [Green Version]

- Helbich, M.; Brunauer, W.; Vaz, E.; Nijkamp, P. Spatial Heterogeneity in Hedonic House Price Models: The Case of Austria. Urban Stud. 2014, 51, 390–411. [Google Scholar] [CrossRef] [Green Version]

- Mondal, B.; Das, D.N.; Dolui, G. Modeling Spatial Variation of Explanatory Factors of Urban Expansion of Kolkata: A Geographically Weighted Regression Approach. Model. Earth Syst. Environ. 2015, 1, 29. [Google Scholar] [CrossRef]

- Sholihin, M.; Soleh, A.M.; Djuraidah, A. Geographically and Temporally Weighted Regression (GTWR) for Modeling Economic Growth Using R. Int. J. Comput. Sci. Netw. 2017, 6, 800–805. [Google Scholar]

- Wu, C.; Ren, F.; Hu, W.; Du, Q. Multiscale Geographically and Temporally Weighted Regression: Exploring the Spatiotemporal Determinants of Housing Prices. Int. J. Geogr. Inf. Sci. 2019, 33, 489–511. [Google Scholar] [CrossRef]

- Purhadi, P.; Yasin, H. Mixed Geographically Weighted Regression Model (Case Study: The Percentage of Poor Households in Mojokerto 2008. Eur. J. Sci. Res. 2012, 69, 188–196. [Google Scholar]

- Rencher, A.C.; Schaalje, G.B. Linear Models in Statistics; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Fotheringham, A.S.; Brunsdon, C.; Charlton, M. Geographically Weighted Regression: The Analysis of Spatially Varying Relationships; John Wiley & Sons: Hoboken, NJ, USA, 2003. [Google Scholar]

- Mei, C.-L.; Wang, N.; Zhang, W.-X. Testing the Importance of the Explanatory Variables in a Mixed Geographically Weighted Regression Model. Environ. Plan. A 2006, 38, 587–598. [Google Scholar] [CrossRef]

- Brunsdon, C.; Fotheringham, S.; Charlton, M. Geographically Weighted Regression as a Statistical Model; Working paper, Spatial Analysis Research Group; Department of Geography, University of Newcastle-upon-Tyne: Newcastle, UK, 2000. [Google Scholar]

- Akaike, H. Information Theory and an Extension of the Maximum Likelihood Principle. In Selected Papers of Hirotugu Akaike; Springer: Berlin/Heidelberg, Germany, 1998; pp. 199–213. [Google Scholar]

- Hurvich, C.M.; Simonoff, J.S.; Tsai, C.-L. Smoothing Parameter Selection in Nonparametric Regression Using an Improved Akaike Information Criterion. J. R. Stat. Soc. Ser. B Stat. Methodol. 1998, 60, 271–293. [Google Scholar] [CrossRef]

- Leung, Y.; Mei, C.-L.; Zhang, W.-X. Statistical Tests for Spatial Nonstationarity Based on the Geographically Weighted Regression Model. Environ. Plan. A 2000, 32, 9–32. [Google Scholar] [CrossRef]

- LeSage, J.P. A Family of Geographically Weighted Regression Models. In Advances in Spatial Econometrics; Springer: Berlin, Germany, 2004; pp. 241–264. [Google Scholar]

- Wheeler, D.C.; Páez, A. Geographically Weighted Regression. In Advances in Spatial Econometrics; Anselin, L.R., Florax, J.G.M., Rey, S.J., Eds.; Springer: Heidelberg, Germany, 2010. [Google Scholar]

- Lu, B.; Harris, P.; Charlton, M.; Brunsdon, C. The GWmodel R Package: Further Topics for Exploring Spatial Heterogeneity Using Geographically Weighted Models. Geo-Spat. Inf. Sci. 2014, 17, 85–101. [Google Scholar] [CrossRef]

- Ispriyanti, D.; Yasin, H.; Warsito, B.; Hoyyi, A.; Winarso, K. Mixed Geographically Weighted Regression Using Adaptive Bandwidth to Modeling of Air Polluter Standard Index. ARPN J. Eng. Appl. Sci. 2017, 12, 4477–4482. [Google Scholar] [CrossRef]

- Speckman, P. Kernel Smoothing in Partial Linear Models. J. R. Stat. Soc. Ser. B Methodol. 1988, 50, 413–436. [Google Scholar] [CrossRef]

- Wei, C.-H.; Qi, F. On the Estimation and Testing of Mixed Geographically Weighted Regression Models. Econ. Model. 2012, 29, 2615–2620. [Google Scholar] [CrossRef]

- Lewandowska-Gwarda, K. Geographically Weighted Regression in the Analysis of Unemployment in Poland. ISPRS Int. J. Geo-Inf. 2018, 7, 17. [Google Scholar] [CrossRef] [Green Version]

- Foryś, I. Społeczno-Gospodarcze Determinanty Rozwoju Rynku Mieszkaniowego w Polsce: Ujęcie Ilościowe. Wydawnictwo Naukowe Uniwersytetu Szczecińskiego 2011, 793, 398. [Google Scholar]

- Rącka, I.; Rehman, S.K. Housing Market in Capital Cities–the Case of Poland and Portugal. Geomat. Environ. Eng. 2018, 12, 75–87. [Google Scholar] [CrossRef]

- Sitek, M. Situation in the Polish Housing Market Compared to Other EU Countries. J. Int. Stud. 2014, 7, 57–69. [Google Scholar] [CrossRef]

- Tomal, M. The Impact of Macro Factors on Apartment Prices in Polish Counties: A Two-Stage Quantile Spatial Regression Approach. Real Estate Manag. Valuat. 2019, 27, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Cliff, A.D. Spatial Autocorrelation; Pion.: London, UK, 1973. [Google Scholar]

- Goodchild, M.F.; Janelle, D.G. Spatially Integrated Social Science; Oxford University Press: Oxford, UK, 2004. [Google Scholar]

| Symbol | Variable | Unit |

|---|---|---|

| Y1 | Average unit flat price | PLN/m2 (New Polish Zloty/m2) |

| Y2 | Number of transactions | number/1000 apartments |

| X1 | Population density | persons/km2 |

| X2 | Number of births | persons/1000 population |

| X3 | Percentage of people of the mobile working age in the general population | % |

| X4 | Migration index | persons/1000 population |

| X5 | Average monthly gross remuneration | PLN/month |

| X6 | Registered unemployment rate | % |

| X7 | Entities registered in the business entities register | number/1000 population |

| X8 | Emission of particulate pollutants PM10 (a mixture of airborne particles with a diameter of not more than 10 μm) | t/km2 |

| X9 | Average floor area of a housing unit | m2 |

| X10 | New housing units completed | units/1000 population |

| Variable | Minimum | Average | Median | Maximum | SD | Coef. of Variation |

|---|---|---|---|---|---|---|

| Y1 | 1063.000 | 3120.587 | 2887.750 | 11,671.250 | 1099.301 | 0.352 |

| Y2 | 0.070 | 9.332 | 7.711 | 42.286 | 7.461 | 0.799 |

| X1 | 19.000 | 369.463 | 90.500 | 3757.000 | 655.136 | 1.773 |

| X2 | −10.570 | −1.122 | −1.245 | 9.420 | 2.616 | −2.332 |

| X3 | 55.800 | 61.053 | 61.200 | 64.400 | 1.333 | 0.022 |

| X4 | −79.956 | −12.407 | −19.726 | 269.204 | 40.243 | −3.243 |

| X5 | 3183.340 | 4142.138 | 4017.170 | 8121.080 | 561.983 | 0.136 |

| X6 | 1.200 | 7.796 | 6.950 | 24.300 | 4.059 | 0.521 |

| X7 | 4.473 | 8.893 | 8.408 | 21.006 | 2.305 | 0.259 |

| X8 | 0.000 | 0.409 | 0.030 | 19.470 | 1.374 | 3.358 |

| X9 | 22.233 | 27.695 | 27.307 | 43.100 | 3.126 | 0.113 |

| X10 | 0.599 | 3.548 | 2.948 | 16.938 | 2.520 | 0.710 |

| Model OLS1: Explained Variable Y1 | Model OLS2: Explained Variable Y2 | |||||

|---|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | p-Value | Estimate | Standard Error | p-Value |

| Intercept | 5274.500 | 2412.281 | 0.029 | 9.538 | 16.158 | 0.555 |

| X1 | 0.170 | 0.074 | <0.001 | 0.003 | <0.001 | <0.001 |

| X2 | 62.591 | 18.842 | 0.002 | −0.553 | 0.126 | <0.001 |

| X3 | −113.473 | 36.894 | <0.001 | 0.072 | 0.247 | 0.770 |

| X4 | −5.148 | 1.431 | <0.001 | <0.001 | 0.009 | 0.973 |

| X5 | 0.252 | 0.073 | <0.001 | 0.001 | <0.001 | 0.001 |

| X6 | −16.627 | 11.420 | 0.146 | −0.092 | 0.076 | 0.228 |

| X7 | 201.589 | 21.534 | <0.001 | 0.862 | 0.144 | <0.001 |

| X8 | −26.221 | 28.738 | 0.362 | −0.040 | 0.192 | 0.840 |

| X9 | 61.126 | 15.960 | <0.001 | −0.936 | 0.107 | <0.001 |

| X10 | 92.568 | 24.343 | <0.001 | 1.730 | 0.163 | <0.001 |

| R2 = 0.627, adjusted R2 = 0.615, F = 61.95, p-value < 0.001 | R2 = 0.636, adjusted R2 = 0.626, F = 64.58, p-value < 0.001 | |||||

| Model GWR1: Explained Variable Y1 | Model GWR2: Explained Variable Y2 | |||||

|---|---|---|---|---|---|---|

| Variable | Min | Mean | Max | Min | Mean | Max |

| Intercept | −29,273.640 | 5791.513 | 19,715.073 | −32.147 | 22.050 | 94.227 |

| X1 | −0.457 | 0.179 | 1.857 | 0.001 | 0.003 | 0.009 |

| X2 | −106.880 | 27.134 | 260.713 | −1.098 | −0.268 | 1.207 |

| X3 | −392.461 | 100.259 | 337.890 | −1.292 | −0.134 | 1.796 |

| X4 | −11.007 | −2.264 | 10.934 | −0.011 | 0.004 | 0.073 |

| X5 | 0.063 | 0.309 | 0.881 | −0.002 | 0.001 | 0.006 |

| X6 | −95.599 | −39.944 | 40.515 | −0.355 | −0.030 | 0.636 |

| X7 | −45.708 | 154.211 | 416.206 | −0.731 | 0.332 | 2.068 |

| X8 | −514.866 | −30.609 | 1491.609 | −3.661 | −0.067 | 5.925 |

| X9 | −62.211 | 29.364 | 306.800 | −1.666 | −0.606 | 1.763 |

| X10 | −152.259 | 91.005 | 250.984 | 0.625 | 1.367 | 1.580 |

| Local R2 | 0.673 | 0.824 | 0.929 | 0.678 | 0.765 | 0.873 |

| Bandwidth | 208.177 km | 264.770 km | ||||

| Variable | Model GWR1 | Model GWR2 |

|---|---|---|

| Difference (AICc) | Difference (AICc) | |

| Intercept | −1343.857 | −2140.382 |

| X1 | 4.226 | 6.769 |

| X2 | −7.746 | 3.604 |

| X3 | −971.042 | −1654.359 |

| X4 | 1.791 | 2.849 |

| X5 | −73.429 | −143.213 |

| X6 | 2.628 | −3.382 |

| X7 | −19.018 | −85.209 |

| X8 | −5.470 | −1.719 |

| X9 | −190.189 | −848.640 |

| X10 | −9.038 | −20.806 |

| Global Variables (Fixed). | Local Variables | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | p-Value | Variable | Min | Mean | Max |

| X1 | 0.058 | 0.071 | 0.413 | Intercept | −3554.828 | 8723.078 | 21,493.044 |

| X4 | −1.670 | 1.317 | 0.223 | X2 | −102.219 | 30.120 | 235.182 |

| X6 | −27.038 | 11.897 | <0.001 | X3 | −367.237 | −149.301 | 32.045 |

| R2 = 0.825, Adjusted R2 = 0.872 Loglik = 5737.308 (likehood function logarithm) AIC = 5858.230, AICc = 5881.561 (Akaike criterion) BIC = 6096.457 (Bayesian information criterion) | X5 | 0.047 | 0.324 | 0.936 | |||

| X7 | 32.429 | 168.906 | 405.211 | ||||

| X8 | −256.046 | −31.748 | 308.190 | ||||

| X9 | −54.450 | 21.286 | 156.876 | ||||

| X10 | −50.590 | 92.550 | 189.093 | ||||

| Global Variables (Fixed) | Local Variables | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | p-Value | Variable | Min | Mean | Max |

| X1 | 2.823 | 0.309 | <0.001 | Intercept | 5.328 | 8.690 | 12.058 |

| X2 | −0.697 | 0.294 | 0.018 | X3 | −1.593 | −0.299 | 1.071 |

| X4 | 0.596 | 0.356 | 0.094 | X5 | −0.541 | 0.894 | 2.121 |

| X6 | −0.209 | 0.011 | 0.476 | ||||

| R2 = 0.805, Adjusted R2 = 0.767 Loglik = 1982.374 (likehood function logarithm) AIC = 2083.313, AICc = 2099.127 (Akaike criterion) BIC = 2282.172 (Bayesian information criterion) | X7 | −0.410 | 0.343 | 1.080 | |||

| X8 | −1.269 | −0.010 | 0.897 | ||||

| X9 | −1.235 | −0.606 | 0.012 | ||||

| X10 | 0.607 | 1.421 | 2.100 | ||||

| OLS1 | GWR1 | MGWR1 | OLS2 | GWR2 | MGWR2 | |

|---|---|---|---|---|---|---|

| Standard Error | 670.776 | 463.981 | 459.505 | 4.496 | 3.213 | 3.252 |

| R2 | 0.627 | 0.821 | 0.825 | 0.633 | 0.814 | 0.809 |

| Adjusted R2 | 0.615 | 0.775 | 0.782 | 0.622 | 0.766 | 0.769 |

| logLik | 6024.804 | 5744.674 | 5737.308 | 2220.888 | 1965.611 | 1974.595 |

| AIC | 6048.804 | 5868.691 | 5858.230 | 2244.888 | 2089.627 | 2083.103 |

| AICc | 6049.654 | 5893.342 | 5881.561 | 2245.738 | 2114.278 | 2101.565 |

| BIC | 6096.086 | 6113.015 | 6069.457 | 2292.170 | 2333.951 | 2296.873 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cellmer, R.; Cichulska, A.; Bełej, M. Spatial Analysis of Housing Prices and Market Activity with the Geographically Weighted Regression. ISPRS Int. J. Geo-Inf. 2020, 9, 380. https://0-doi-org.brum.beds.ac.uk/10.3390/ijgi9060380

Cellmer R, Cichulska A, Bełej M. Spatial Analysis of Housing Prices and Market Activity with the Geographically Weighted Regression. ISPRS International Journal of Geo-Information. 2020; 9(6):380. https://0-doi-org.brum.beds.ac.uk/10.3390/ijgi9060380

Chicago/Turabian StyleCellmer, Radosław, Aneta Cichulska, and Mirosław Bełej. 2020. "Spatial Analysis of Housing Prices and Market Activity with the Geographically Weighted Regression" ISPRS International Journal of Geo-Information 9, no. 6: 380. https://0-doi-org.brum.beds.ac.uk/10.3390/ijgi9060380