Design and Implementation of a Blockchain-Based Energy Trading Platform for Electric Vehicles in Smart Campus Parking Lots

Abstract

:1. Introduction

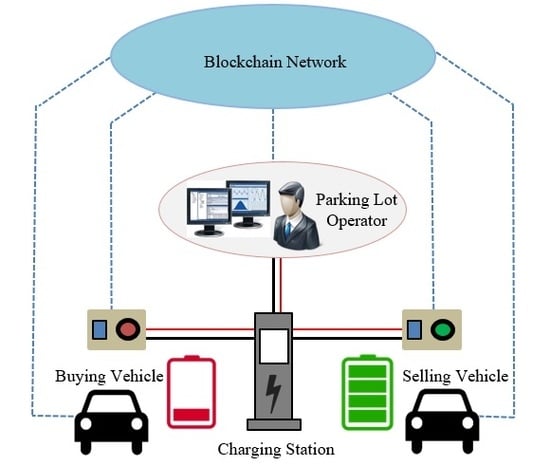

- A system architecture for energy trading in a smart campus parking lot is proposed. It consists of two layers: the physical infrastructure layer and the cyber infrastructure layer.

- A local energy trading blockchain-based platform is designed for selling and buying energy among electric vehicles in university campus parking lots. The system reduces dependence on the main grid and reduces the peak demand of university buildings.

- A case study scenario concerning smart parking lots located at the Chonbuk National University of South Korea is evaluated for three different market mechanisms, where approved transactions are recorded and shared on the platform.

2. Proposed System Architecture for an Energy Trading Platform in Smart Campus Parking Lots

2.1. Physical Infrastructure Layer

2.2. Cyber Infrastructure Layer

3. Blockchain-Based Energy Trading Platform

- Peer is a network entity that commits transactions and maintains a ledger in conjunction with the support of the ordering service. Smart contracts run on this ledger and let assets move and transactions occur according to the business logic defined by the participants of the network.

- Ordering service (OS) establishes the ordering of the blocks in the ledger in a decentralized fashion. In addition, this component allows for events to be broadcasted among all the participants.

- Certificate authority (CA) is an entity that issues enrollment for participants.

3.1. Participants

- SEVs (owners) are willing to sell part of their energy.

- BEVs (owners) are willing to buy energy.

- PLLC is willing to sell/buy based on grid condition.

3.2. Assets

- Energy: It represents the main asset in the system, and it can be traded among all participants.

- kWhlisting: This asset is generated automatically by the system. It includes the following information, such as available energy “kWhavailable”, required kWh “kWhrequired”, selling offer “SellOffer”, and buying offer “BuyOffer”.

3.3. Transactions

- Sell energy: This transaction enables the participant to sell any amount of his available energy to the PLLC.

- Buy energy: This transaction enables the participant to buy energy from the PLLC.

- Notifications from the PLLC about status of the bidding process.

| Algorithm 1 BUYOffer Transaction |

| Input: KWHlisting (Blockchain Asset), BuyOffer(Object that contains information of the submitted offer: EV, Qty, Price), EVState (State of the EV, available status are SEV, BEV), KWHlistingState )represents the state of the listing, available status are ‘Accepting Offers’ and ‘Closed Offers’) Output: listingBuyOffers (Array of all the buying offers) 1. if KWHlisting.state is equal to “ACCEPTING OFFERS” then 2: if EVState is equal to BEV then 3: listingBuyOffer.push(buyOffer); 4: KWHlisting.update(listingBuyOffers); 5: else 6: This EV is not allowed to BUY. 7: end 8: else 9: The listing is not accepting offers. 10: end |

| Algorithm 2 SELLOffer Transaction |

| Input: KWHlisting (Blockchain Asset), SellOffer (Object that contains information of the submitted offer: EV, Qty, Price), EVState (State of the EV, available status are SEV, BEV), KWHlistingState (represents the state of the listing, available status are ‘Accepting Offers’ and ‘Closed Offers’) Output: listingSellOffers (Array of all the selling offers) 1. if KWHlisting.state is equal to “ACCEPTING OFFERS” then 2: if EVState is equal to SEV then 3: listingSellOffer.push(sellOffer); 4: KWHlisting.update(listingSellOffers); 5: else 6: This EV is not allowed to SELL. 7: end 8: else 9: The listing is not accepting offers. 10: end |

3.4. Parking Lot Energy Trading Mechanism

- Power bought from the grid in kW

- Electricity buying price in money unit per kWh

- Length of scheduling time interval

- Selling amount of energy by SEVi at time t

- Selling price by SEVi at time t

- Buying amount of energy by BEVj at time t

- Buying price by BEVj at time t

- N Number of SEVs

- K Number of BVs

- t Time interval

- Discharge power from SEVi in kW

- Electricity price in money unit per kWh

- N Number of SEVs

- Length of scheduling time interval

- Power sold to charge BEVj in kW

- Electricity price in money unit per kWh

- K Number of BEVs

- Length of scheduling time interval

4. Implementation of Energy Trading Platform

4.1. User Interface

- User registration: This view allows the registration of a user into the platform.

- Log in: This view allows the user to access to the platform.

- Electric vehicle registration: Once a user is logged in, the user can register the electric vehicle for later interaction in the platform.

- Selling energy: In this view, the user can offer any amount of his available energy for selling.

- Buying energy: This view allows a user to bid for energy.

4.2. REST API

- Receives incoming requests from users.

- Connects to a MongoDB to store reference information related to electric vehicle owners and electric vehicles.

- When a user requests a transaction, the API collects the information regarding the transaction, and sends a request to the Hyperledger Composer REST API, so that it can be incorporated in the blockchain.

- When an event is received from Hyperledger Composer API, the API sends a notification to the user.

4.3. MongoDB

4.4. Hyperledger Composer

- The model file defines the structure and relationships between business network elements, including assets, participants, and transactions.

- The script file contains the transaction processor functions and the smart contract definition.

- The access control file contains a set of access control rules that define the rights of the different participants in the business network.

4.5. Hyperledger Fabric

5. Performance Evaluation

5.1. Simulation Results

5.1.1. Grid-to-Vehicle Charging

5.1.2. Mid-Market Price Scenario

5.1.3. Auction-Based Price Scenario

5.2. Implementation Results

5.2.1. Electric Vehicle Registration

5.2.2. Selection of the Operation Mode

5.2.3. Review of the Registration Process

5.2.4. Trading Notification from the PLLC

5.2.5. Buying/Selling Transaction

5.2.6. The PLLC Dashboard

5.2.7. Update Balance Information

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Bayram, I.S.; Shakir, M.Z.; Abdallah, M.; Qaraqe, K. A survey on energy trading in smart grid. In Proceedings of the 2014 IEEE Global Conference on Signal and Information Processing (GlobalSIP), Atlanta, GA, USA, 3–5 December 2014; pp. 258–262. [Google Scholar]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Liu, C.; Chau, K.T.; Wu, D.; Gao, S. Opportunities and Challenges of Vehicle-to-Home, Vehicle-to-Vehicle, and Vehicle-to-Grid Technologies. Proc. IEEE 2013, 101, 2409–2427. [Google Scholar] [CrossRef] [Green Version]

- Sousa, T.J.C.; Monteiro, V.; Fernandes, J.C.A.; Couto, C.; Meléndez, A.A.N.; Afonso, J.L. New Perspectives for Vehicle-to-Vehicle (V2V) Power Transfer. In Proceedings of the IECON 2018 - 44th Annual Conference of the IEEE Industrial Electronics Society, Washington, DC, USA, 21–23 October 2018; pp. 5183–5188. [Google Scholar]

- Mao, T.; Zhang, X.; Zhou, B. Modeling and Solving Method for Supporting ‘Vehicle-to-Anything’ EV Charging Mode. Appl. Sci. 2018, 8, 1048. [Google Scholar] [CrossRef] [Green Version]

- Li, G.; Boukhatem, L.; Zhao, L.; Wu, J. Direct Vehicle-to-Vehicle Charging Strategy in Vehicular Ad-Hoc Networks. In Proceedings of the 2018 9th IFIP International Conference on New Technologies, Mobility and Security (NTMS), Paris, France, 26–28 February 2018; pp. 1–5. [Google Scholar]

- Gerla, M.; Lee, E.; Pau, G.; Lee, U. Internet of vehicles: From intelligent grid to autonomous cars and vehicular clouds. In Proceedings of the 2014 IEEE World Forum on Internet of Things (WF-IoT), Seoul, Korea, 6–8 March 2014; pp. 241–246. [Google Scholar]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Kang, J.; Yu, R.; Huang, X.; Maharjan, S.; Zhang, Y.; Hossain, E. Enabling Localized Peer-to-Peer Electricity Trading Among Plug-in Hybrid Electric Vehicles Using Consortium Blockchains. IEEE Trans. Ind. Informatics 2017, 13, 3154–3164. [Google Scholar] [CrossRef]

- Alvaro-Hermana, R.; Fraile-Ardanuy, J.; Zufiria, P.J.; Knapen, L.; Janssens, D. Peer to Peer Energy Trading with Electric Vehicles. IEEE Intell. Transp. Syst. Mag. 2016, 8, 33–44. [Google Scholar] [CrossRef] [Green Version]

- Abdella, J.; Shuaib, K. Peer to Peer Distributed Energy Trading in Smart Grids: A Survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- Pipattanasomporn, M.; Kuzlu, M.; Rahman, S. A Blockchain-based Platform for Exchange of Solar Energy: Laboratory-scale Implementation. In Proceedings of the 2018 International Conference and Utility Exhibition on Green Energy for Sustainable Development (ICUE), Phuket, Thailand, 24–26 October 2018; pp. 1–9. [Google Scholar]

- Yuan, P.; Xiong, X.; Lei, L.; Zheng, K. Design and Implementation on Hyperledger-Based Emission Trading System. IEEE Access 2019, 7, 6109–6116. [Google Scholar] [CrossRef]

- Jogunola, O.; Hammoudeh, M.; Adebisi, B.; Anoh, K. Demonstrating Blockchain-Enabled Peer-to-Peer Energy Trading and Sharing. In Proceedings of the 2019 IEEE Canadian Conference of Electrical and Computer Engineering (CCECE), Edmonton, AB, Canada, 5–8 May 2019; pp. 1–4. [Google Scholar]

- Ahmed, M.; Kim, Y.-C. Energy Trading with Electric Vehicles in Smart Campus Parking Lots. Appl. Sci. 2018, 8, 1749. [Google Scholar] [CrossRef] [Green Version]

- Shamsi, P.; Xie, H.; Longe, A.; Joo, J.-Y. Economic Dispatch for an Agent-Based Community Microgrid. IEEE Trans. Smart Grid 2016, 7, 2317–2324. [Google Scholar] [CrossRef]

- Jing, Z.; Pipattanasomporn, M.; Rahman, S. Blockchain-based Negawatt Trading Platform: Conceptual Architecture and Case Studies. In Proceedings of the 2019 IEEE PES GTD Grand International Conference and Exposition Asia (GTD Asia), Bangkok, Thailand, 20–23 March 2019; pp. 68–73. [Google Scholar]

- Liu, Y.; Wu, L.; Li, J. Peer-to-peer (P2P) electricity trading in distribution systems of the future. Electr. J. 2019, 32, 2–6. [Google Scholar] [CrossRef]

- Shuai, W.; Maille, P.; Pelov, A. Charging Electric Vehicles in the Smart City: A Survey of Economy-Driven Approaches. IEEE Trans. Intell. Transp. Syst. 2016, 17, 2089–2106. [Google Scholar] [CrossRef] [Green Version]

- Ubuntu. Available online: https://ubuntu.com/ (accessed on 1 April 2019).

- Hyperledger Composer. Available online: https://hyperledger.github.io/composer/latest/ (accessed on 1 April 2019).

- Hyperledger Fabric. Available online: https://www.hyperledger.org/projects/fabric (accessed on 1 April 2019).

- Vue. Available online: https://vuejs.org/ (accessed on 1 April 2019).

- Restify. Available online: http://restify.com/ (accessed on 1 April 2019).

- JSON Web Token. Available online: https://jwt.io/ (accessed on 1 April 2019).

- MongDB. Available online: https://www.mongodb.com/ (accessed on 1 April 2019).

- Vehicle Fuel Economy and CO2 Emissions: Data and Analyses. Available online: www.energy.or.kr (accessed on 1 August 2018).

- Electric Vehicle Charging Tariff. Available online: http.www.kepco.co.kr (accessed on 17 December 2019).

| Title | Description |

|---|---|

| Participants | Electric vehicle owner (ID, Balance), parking lot local controller (ID, Balance) |

| Assets | Electric vehicle (EViD, State, Total Capacity, ActualSoC, OwnerID), kWhlisting (listinPL, kWhavailable, kWhrequired, State, SellOffer, BuyOffer) |

| Transactions | AcceptOfferBroadcast (listinPL), SellOffer (EViD, kWhavailable, SellPrice), BuyOffer (EViD, kWhavailable, BuyPrice), CloseBiddig (listinPL) |

| Vehicle Model | Battery Capacity | Fuel Economy (km/kWh) | Release Year |

|---|---|---|---|

| SOUL | 27 kWh | 5.0 | 2014 |

| LEAF | 24 kWh | 5.2 | 2014 |

| SM3 Z.E. | 22 kWh | 4.4 | 2013 |

| BMW i3 | 18 kWh | 5.9 | 2014 |

| RAY | 16 kWh | 5.0 | 2012 |

| Time | Classification | Energy Charge (KRW/kWh) | ||

|---|---|---|---|---|

| Summer | Spring/Fall | Winter | ||

| Off-Peak | Low-voltage | 57.6 | 58.7 | 80.7 |

| Mid-Peak | 145.3 | 70.5 | 128.2 | |

| On-Peak | 232.5 | 75.4 | 190.8 | |

| Day | Power Consumption (kW) | |

|---|---|---|

| Min | Max | |

| Tuesday | 75 | 152 |

| Wednesday | 77.8 | 144.6 |

| Thursday | 79.7 | 243 |

| Friday | 72.6 | 131.1 |

| Saturday | 78 | 102.5 |

| Sunday | 74.7 | 101.8 |

| Monday | 77.8 | 150.5 |

| Vehicle | Energy Amount | Grid Price | Amount | Price | Revenue | OPEX | Profit |

|---|---|---|---|---|---|---|---|

| (kWh) | (KRW/kWh) | (kWh) | (KRW/kWh) | (KRW) | (KRW/kWh) | (KRW) | |

| BEV1 | 8 | 232 | 8 | 232 | 1856 | 344 | 1512 |

| BEV2 | 13.5 | 232 | 13.5 | 232 | 3132 | 580.5 | 2551.5 |

| BEV3 | 11 | 232 | 11 | 232 | 2552 | 473 | 2079 |

| BEV4 | 11 | 232 | 11 | 232 | 2552 | 473 | 2079 |

| BEV5 | 11 | 232 | 6.5 | 232 | 1508 | 279.5 | 1228.5 |

| BEV6 | 9 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV7 | 13.5 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV8 | 11 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV10 | 12 | 232 | 0 | 0 | 0 | 0 | 0 |

| Total | 108 | 50 | 11,600 | 2150 | 9450 |

| Vehicle | Energy Amount (kWh) | Grid Price (KRW/kWh) | Amount (kWh) | Price (KRW/kWh) | Revenue (KRW) | OPEX (KRW/kWh) | Profit (KRW) |

|---|---|---|---|---|---|---|---|

| BEV2 | 13.5 | 232 | 13.5 | 232 | 3132 | 580.5 | 2551.5 |

| BEV7 | 13.5 | 232 | 13.5 | 232 | 3132 | 580.5 | 2551.5 |

| BEV10 | 12 | 232 | 12 | 232 | 2784 | 516 | 2268 |

| BEV3 | 11 | 232 | 11 | 232 | 2552 | 473 | 2079 |

| BEV4 | 11 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV5 | 11 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV8 | 11 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV6 | 9 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV1 | 8 | 232 | 0 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 232 | 0 | 0 | 0 | 0 | 0 |

| Total | 108 | 50 | 11,600 | 2150 | 9450 |

| Vehicle | Energy Amount (kWh) | Energy Price (KRW/kWh) | Price MMP (KRW/kWh) | Amount (kWh) | Revenue (KRW) | OPEX (KRW/kWh) | Profit (KRW) |

|---|---|---|---|---|---|---|---|

| BEV1 | 12 | 94 | 0 | 0 | 0 | 0 | 0 |

| BEV2 | 12 | 69 | 0 | 0 | 0 | 0 | 0 |

| BEV3 | 9 | 198 | 158.68 | 9 | 1428.12 | 387 | 1041.12 |

| BEV4 | 8 | 169 | 158.68 | 8 | 1269.44 | 344 | 925.44 |

| BEV5 | 11 | 219 | 158.68 | 11 | 1745.48 | 473 | 1272.48 |

| BEV6 | 9 | 69 | 0 | 0 | 0 | 0 | 0 |

| BEV7 | 12 | 193 | 158.68 | 12 | 1904.16 | 516 | 1388.16 |

| BEV8 | 13.5 | 221 | 158.68 | 10 | 1586.80 | 430 | 1156.80 |

| BEV9 | 8 | 99 | 0 | 0 | 0 | 0 | 0 |

| BEV10 | 12 | 224 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 158.68 | 50 | 7934 | 2150 | 5784 |

| Vehicle | Energy Amount (kWh) | Energy Price (KRW/kWh) | Price MMP (kWh) | Amount (kWh) | Revenue (KRW) | OPEX (KRW/kWh) | Profit (KRW) |

|---|---|---|---|---|---|---|---|

| BEV8 | 13.5 | 221 | 158.68 | 13.5 | 2142.19 | 580.5 | 1561.69 |

| BEV1 | 12 | 94 | 0 | 0 | 0 | 0 | 0 |

| BEV2 | 12 | 69 | 0 | 0 | 0 | 0 | 0 |

| BEV7 | 12 | 193 | 158.68 | 12 | 1904.16 | 516 | 1388.16 |

| BEV10 | 12 | 224 | 158.68 | 12 | 1904.16 | 516 | 1388.16 |

| BEV5 | 11 | 219 | 158.68 | 11 | 1745.48 | 473 | 1272.48 |

| BEV3 | 9 | 198 | 158.68 | 1.5 | 238.02 | 64.5 | 173.52 |

| BEV6 | 9 | 69 | 0 | 0 | 0 | 0 | 0 |

| BEV4 | 8 | 169 | 158.68 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 99 | 158.68 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 158.68 | 50 | 7934 | 2150 | 5784 |

| Vehicle | Energy Amount (kWh) | Energy Price (KRW/kWh) | Amount (kWh) | Price (KRW/kWh) | Revenue (KRW) | OPEX (KRW/kWh) | Profit (KRW) |

|---|---|---|---|---|---|---|---|

| BEV1 | 12 | 94 | 12 | 94 | 1128 | 516 | 612 |

| BEV2 | 12 | 69 | 12 | 69 | 828 | 516 | 312 |

| BEV3 | 9 | 198 | 9 | 198 | 1782 | 387 | 1395 |

| BEV4 | 8 | 169 | 8 | 169 | 1352 | 344 | 1008 |

| BEV5 | 11 | 219 | 9 | 219 | 1971 | 387 | 1584 |

| BEV6 | 9 | 69 | 0 | 0 | 0 | 0 | 0 |

| BEV7 | 12 | 193 | 0 | 0 | 0 | 0 | 0 |

| BEV8 | 13.5 | 221 | 0 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 99 | 0 | 0 | 0 | 0 | 0 |

| BEV10 | 12 | 224 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 7061 | 2150 | 4911 |

| Vehicle | Energy Amount (kWh) | Energy Price (KRW/kWh) | Amount (kWh) | Price (KRW/kWh) | Revenue (KRW) | OPEX (KRW/kWh) | Profit (KRW) |

|---|---|---|---|---|---|---|---|

| BEV8 | 13.5 | 221 | 13.5 | 221 | 2983.5 | 580.5 | 2403 |

| BEV10 | 12 | 224 | 12 | 224 | 2688 | 516 | 2172 |

| BEV5 | 11 | 219 | 11 | 219 | 2409 | 473 | 1936 |

| BEV7 | 12 | 193 | 12 | 193 | 2316 | 516 | 1800 |

| BEV3 | 9 | 198 | 1.5 | 198 | 297 | 64.5 | 232.5 |

| BEV4 | 8 | 169 | 0 | 0 | 0 | 0 | 0 |

| BEV1 | 12 | 94 | 0 | 0 | 0 | 0 | 0 |

| BEV6 | 9 | 69 | 0 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 99 | 0 | 0 | 0 | 0 | 0 |

| BEV2 | 12 | 69 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 10,693.5 | 2150 | 8543.5 |

| Vehicle | Energy Amount (kWh) | Energy Price (KRW/kWh) | Amount (kWh) | Price (KRW/kWh) | SEV Revenue (KRW) | OPEX (KRW/kWh) | Seller Profit (KRW) |

|---|---|---|---|---|---|---|---|

| SEV1 | 12 | 94 | 12 | 94 | 1128 | 516 | 612 |

| SEV2 | 12 | 69 | 12 | 69 | 828 | 516 | 312 |

| SEV3 | 9 | 198 | 9 | 198 | 1782 | 387 | 1395 |

| SEV4 | 8 | 169 | 8 | 169 | 1352 | 344 | 1008 |

| SEV5 | 11 | 219 | 9 | 219 | 1971 | 387 | 1584 |

| SEV6 | 9 | 69 | 0 | 0 | 0 | 0 | 0 |

| SEV7 | 12 | 193 | 0 | 0 | 0 | 0 | 0 |

| SEV8 | 13.5 | 221 | 0 | 0 | 0 | 0 | 0 |

| SEV9 | 8 | 99 | 0 | 0 | 0 | 0 | 0 |

| SEV10 | 12 | 224 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 7061 | 2150 | 4911 |

| Vehicle | Energy Amount (kWh) | Energy Price (KRW/kWh) | Amount (kWh) | Price (KRW/kWh) | SEV Revenue (KRW) | OPEX (KRW/kWh) | Seller Profit (KRW) |

|---|---|---|---|---|---|---|---|

| SEV6 | 9 | 69 | 9 | 69 | 621 | 387 | 234 |

| SEV9 | 8 | 99 | 8 | 99 | 792 | 344 | 448 |

| SEV2 | 12 | 69 | 12 | 69 | 828 | 516 | 312 |

| SEV1 | 12 | 94 | 12 | 94 | 1128 | 516 | 612 |

| SEV4 | 8 | 169 | 8 | 169 | 1352 | 344 | 1008 |

| SEV3 | 9 | 198 | 1 | 198 | 198 | 43 | 155 |

| SEV7 | 12 | 193 | 0 | 0 | 0 | 0 | 0 |

| SEV5 | 11 | 219 | 0 | 0 | 0 | 0 | 0 |

| SEV10 | 12 | 224 | 0 | 0 | 0 | 0 | 0 |

| SEV8 | 13.5 | 221 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 4919 | 2150 | 2769 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Silva, F.C.; A. Ahmed, M.; Martínez, J.M.; Kim, Y.-C. Design and Implementation of a Blockchain-Based Energy Trading Platform for Electric Vehicles in Smart Campus Parking Lots. Energies 2019, 12, 4814. https://0-doi-org.brum.beds.ac.uk/10.3390/en12244814

Silva FC, A. Ahmed M, Martínez JM, Kim Y-C. Design and Implementation of a Blockchain-Based Energy Trading Platform for Electric Vehicles in Smart Campus Parking Lots. Energies. 2019; 12(24):4814. https://0-doi-org.brum.beds.ac.uk/10.3390/en12244814

Chicago/Turabian StyleSilva, Felipe Condon, Mohamed A. Ahmed, José Manuel Martínez, and Young-Chon Kim. 2019. "Design and Implementation of a Blockchain-Based Energy Trading Platform for Electric Vehicles in Smart Campus Parking Lots" Energies 12, no. 24: 4814. https://0-doi-org.brum.beds.ac.uk/10.3390/en12244814