Factors, Outcome, and the Solutions of Supply Chain Finance: Review and the Future Directions

Abstract

:1. Introduction

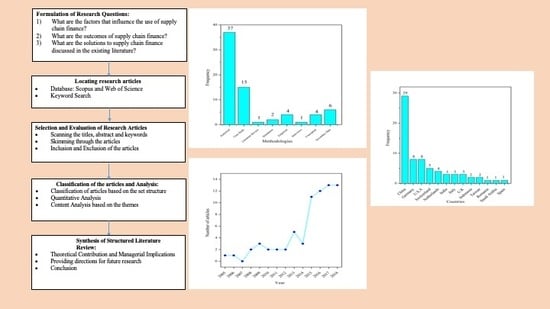

2. Methodology

3. Formulation of Research Questions

4. Locating the Research Articles

- Factors influencing supply chain finance

- The outcome of supply chain finance

- Solutions of supply chain

5. Classification of the Articles

6. Synthesis of Structure Literature Review

7. Results and Findings

7.1. Methodologies

7.2. Year of Publication

7.3. Source of Publication and Top Cited Papers

7.4. Country

7.5. Factors Influencing the Acceptance of Supply Chain Finance

7.6. The Outcome of Supply Chain Financing

7.7. Supply Chain Finance Solutions

8. Contribution to the Existing Literature

9. Managerial Implications

10. Conclusions, Future Directions, and Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Babich, Volodymyr, and Panos Kouvelis. 2018. Introduction to the special issue on research at the interface of finance, operations, and risk management (iFORM): Recent contributions and future directions. Manufacturing & Service Operations Management 20: 1–160. [Google Scholar]

- Bailey, Kate, and Mark Francis. 2008. Managing information flows for improved value chain performance. International Journal of Production Economics 111: 2–12. [Google Scholar] [CrossRef]

- Basu, Preetam, and Suresh K. Nair. 2012. Supply Chain Finance enabled early pay: Unlocking trapped value in B2B logistics. International Journal of Logistics Systems and Management 12: 334–53. [Google Scholar] [CrossRef]

- Bi, Gongbing, Yalei Fei, Xiaoyong Yuan, and Dong Wang. 2018a. Joint operational and financial collaboration in a capital-constrained supply chain under manufacturer collateral. Asia-Pacific Journal of Operational Research 35: 1850010. [Google Scholar] [CrossRef]

- Bi, Gongbing, Ping Chen, and Yalei Fei. 2018b. Optimal decisions and coordination strategy of a capital-constrained supply chain under customer return and supplier subsidy. Journal of Modelling in Management 13: 278–301. [Google Scholar] [CrossRef]

- Blackman, Ian D., and Christopher Holland. 2006. The management of financial supply chains: From adversarial to co-operative strategies. In Project E-Society: Building Bricks. Boston: Springer, pp. 82–95. [Google Scholar]

- Boissay, Frederic, and Reint Gropp. 2007. Trade credit defaults and liquidity provision by firms. ECB Working Paper No. 753, May 31. [Google Scholar]

- Budin, Morris, and A. T. Eapen. 1970. Cash Generation in Business Operations: Some Simulation Models. The Journal of Finance 25: 1091–107. [Google Scholar] [CrossRef]

- Camerinelli, Enrico. 2009. Supply chain finance. Journal of Payments Strategy & Systems 3: 114–28. [Google Scholar]

- Caniato, Federico, Luca Mattia Gelsomino, Alessandro Perego, and Stefano Ronchi. 2016. Does finance solve the supply chain financing problem? Supply Chain Management: An International Journal 21: 534–49. [Google Scholar] [CrossRef]

- Carnovale, Steven, and Sengun Yeniyurt. 2015. The impact of supply network structure on the financial performance of the firm. In Supply Chain Forum: An International Journal. Abingdon: Taylor & Francis, vol. 16, No. 3. pp. 18–28. [Google Scholar]

- Chen, Qianqian. 2016. A Supply Chain Financial Service Management Model of Chinese Logistics Enterprises. International Journal of Simulation Systems, Science & Technology 17. [Google Scholar] [CrossRef]

- Chen, Chongyang, and Robert Kieschnick. 2018. Bank credit and corporate working capital management. Journal of Corporate Finance 48: 579–96. [Google Scholar] [CrossRef]

- Chen, Hualiang, and Jianbo Wen. 2017. Financing Model Analysis and Risk Management of Supply Chain Finance Based on Gray Evaluation. Revista de la Facultad de Ingeniería 10: 95–105. [Google Scholar]

- Chen, Jianxin, Yong-Wu Zhou, and Yuanguang Zhong. 2017. A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. International Journal of Production Research 55: 5287–304. [Google Scholar] [CrossRef]

- Claassen, Marloes JT, Arjan J. Van Weele, and Erik M. Van Raaij. 2008. Performance outcomes and success factors of vendor managed inventory (VMI). Supply Chain Management: An International Journal 13: 406–14. [Google Scholar] [CrossRef]

- Coricelli, Fabrizio, and Igor Masten. 2004. Growth and volatility in transition countries: The role of credit. In Festschrift in Honor of Guillermo A. Calvo. Washington DC: International Monetary Fund, April. [Google Scholar]

- de Goeij, Christiaan A. J., Alexander T. C. Onstein, and Michiel A. Steeman. 2016. Impediments to the Adoption of Reverse Factoring for Logistics Service Providers. In Logistics and Supply Chain Innovation. Cham: Springer, pp. 261–77. [Google Scholar]

- Denyer, David, and David Tranfield. 2009. Producing a systematic review. In The SAGE Handbook of Organizational Research Methods. Edited by David A. Buchanan and Alan Bryman. London: Sage Publications, pp. 671–89. [Google Scholar]

- Ding, Zhaohan, Huidi Li, and Junqing Zhu. 2017. Research on the Framework of Supply Chain Finance Operation Model of E-commerce Enterprises by Taking JD as An Example. Boletín Técnico 55: 7–13. [Google Scholar]

- Fabbri, Daniela, and Leora F. Klapper. 2016. Bargaining power and trade credit. Journal of Corporate Finance 41: 66–80. [Google Scholar] [CrossRef] [Green Version]

- Fairchild, Alea. 2005. Intelligent matching: Integrating efficiencies in the financial supply chain. Supply Chain Management: An International Journal 10: 244–48. [Google Scholar] [CrossRef]

- Ferris, J. Stephen. 1981. A transactions theory of trade credit use. The Quarterly Journal of Economics 96: 243–70. [Google Scholar] [CrossRef]

- Gao, Guang-Xin, Zhi-Ping Fan, Xin Fang, and Yun Fong Lim. 2018. Optimal Stackelberg strategies for financing a supply chain through online peer-to-peer lending. European Journal of Operational Research 267: 585–97. [Google Scholar] [CrossRef]

- García-Teruel, Pedro Juan, and Pedro Martínez-Solano. 2010. Determinants of trade credit: A comparative study of European SMEs. International Small Business Journal 28: 215–33. [Google Scholar] [CrossRef]

- Gelsomino, Luca M., Riccardo Mangiaracina, Alessandro Perego, and Angela Tumino. 2016a. Supply Chain Finance: Modelling a Dynamic Discounting Programme. Journal of Advanced Management Science 4. [Google Scholar] [CrossRef]

- Gelsomino, Luca Mattia, Riccardo Mangiaracina, Alessandro Perego, and Angela Tumino. 2016b. Supply chain finance: A literature review. International Journal of Physical Distribution & Logistics Management 46: 348–66. [Google Scholar]

- Global Supply Chain Finance Forum. n.d. In Brief Standard Definition. Global Supply Chain Forum. Available online: http://supplychainfinanceforum.org/ (accessed on 18 September 2018).

- Gomm, Moritz Leon. 2010. Supply chain finance: Applying finance theory to supply chain management to enhance finance in supply chains. International Journal of Logistics: Research and Applications 13: 133–42. [Google Scholar] [CrossRef]

- Grüter, Robert, and David A. Wuttke. 2017. Option matters: Valuing reverse factoring. International Journal of Production Research 55: 6608–23. [Google Scholar] [CrossRef]

- Haley, W. Charles, and Robert C. Higgins. 1973. Inventory policy and trade credit financing. Management Science 20: 464–71. [Google Scholar] [CrossRef]

- Ho, Chia-Huei, Liang-Yuh Ouyang, and Chia-Hsien Su. 2008. Optimal pricing, shipment and payment policy for an integrated supplier–buyer inventory model with two-part trade credit. European Journal of Operational Research 187: 496–510. [Google Scholar] [CrossRef]

- Hofmann, Erik. 2005. Supply chain finance: Some conceptual insights. In Beiträge Zu Beschaffung Und Logistik. Wiesbaden: Springer Gabler, pp. 203–14. [Google Scholar]

- Hofmann, Erik, and Jan Bosshard. 2017. Supply chain management and activity-based costing: Current status and directions for the future. International Journal of Physical Distribution & Logistics Management 47: 712–35. [Google Scholar]

- Hofmann, Erik, and Herbert Kotzab. 2010. A supply chain-oriented approach of working capital management. Journal of business Logistics 31: 305–30. [Google Scholar] [CrossRef]

- Hofmann, Erik, and Stefan Zumsteg. 2015. Win-win and no-win situations in supply chain finance: The case of accounts receivable programs. In Supply Chain Forum: An International Journal. Abingdon: Taylor & Francis, vol. 16, No. 3. pp. 30–50. [Google Scholar]

- Huff, Jerry, and Dale S. Rogers. 2015. Funding the organization through supply chain finance: A longitudinal investigation. In Supply Chain Forum: An International Journal. Abingdon: Taylor & Francis, vol. 16, No. 3. pp. 4–17. [Google Scholar]

- Iacono, Dello Umberto, Matthew Reindorp, and Nico Dellaert. 2015. Market adoption of reverse factoring. International Journal of Physical Distribution & Logistics Management 45: 286–308. [Google Scholar]

- Jiang, Jia, Yibo Jin, and Chen Yang Dong. 2016. Research on the e-business logistics service mode based on branch storage and warehouse financing. International Journal of Services Technology and Management 22: 203–17. [Google Scholar] [CrossRef]

- Johnson, M. Eric. 2008. Information risk of inadvertent disclosure: An analysis of file-sharing risk in the financial supply chain. Journal of Management Information Systems 25: 97–124. [Google Scholar] [CrossRef]

- Karyani, Tuti, Eddy Renaldi, Agriani Hermita Sadeli, and Hesty Nurul Utami. 2015. Design of Supply Chain Financing Model of Red Chili Commodity with Structured Market Orientation. Abstrak 13: 6187–200. [Google Scholar]

- Karyani, Tuti, Hesty N. Utami, Agriani H. Sadeli, Elly Rasmikayati, Sulistyodewi, and Nur Syamsiyah. 2016. Mango Agricultural Supply Chain: Actors, Business Process and Financing Scheme. IJABER 14: 7751–64. [Google Scholar]

- Klapper, Leora. 2006. The role of factoring for financing small and medium enterprises. Journal of Banking and Finance 30: 3111–30. [Google Scholar] [CrossRef]

- Lamoureux, Jean-François, and Todd Evans. 2011. Supply chain finance: A new means to support the competitiveness and resilience of global value chains. Available online: https://ssrn.com/abstract=2179944 (accessed on 12 October 2011).

- Lekkakos, Spyridon Damianos, and Alejandro Serrano. 2016. Supply chain finance for small and medium sized enterprises: The case of reverse factoring. International Journal of Physical Distribution & Logistics Management 46: 367–92. [Google Scholar]

- Li, Guojuan. 2017. Research on Credit Ratings of Small and Medium-sized Enterprises Based on Supply-chain Finance. Agro Food Industry Hi-Tech 28: 2440–43. [Google Scholar]

- Li, Yixue, Shouyang Wang, Gengzhong Feng, and Kin Keung Lai. 2011. Comparative analysis of risk control in logistics and supply chain finance under different pledge fashions. International Journal of Revenue Management 5: 121–44. [Google Scholar] [CrossRef]

- Liebl, John, Evi Hartmann, and Edda Feisel. 2016. Reverse factoring in the supply chain: Objectives, antecedents and implementation barriers. International Journal of Physical Distribution & Logistics Management 46: 393–413. [Google Scholar]

- Liu, Qingtao, and Jianbo Wen. 2017. Supply Chain Financial Ecosystem Analysis Based on Cusp Catastrophe Model. Revisa de la Facultad de Ingeniería 32: 12–21. [Google Scholar]

- Luo, Yong, Zhiya Chen, and Changxin Chen. 2015. Robust optimization in warehouse space allocation of pledges in supply chain financing. Advances in Transportation Studies 1: 99–110. [Google Scholar]

- Maloni, Michael, and Wilhelm C. Benton. 2000. Power influences in the supply chain. Journal of Business Logistics 21: 49–74. [Google Scholar]

- Martin, Judith. 2017. Suppliers’ participation in supply chain finance practices: Predictors and outcomes. International Journal of Integrated Supply Management 11: 193–216. [Google Scholar] [CrossRef]

- Martin, Judith, and Erik Hofmann. 2017. Involving financial service providers in supply chain finance practices: Company needs and service requirements. Journal of Applied Accounting Research 18: 42–62. [Google Scholar] [CrossRef]

- More, Dileep, and Preetam Basu. 2013. Challenges of supply chain finance: A detailed study and a hierarchical model based on the experiences of an Indian firm. Business Process Management Journal 19: 624–47. [Google Scholar] [CrossRef]

- Pellegrino, Roberta, Nicola Costantino, and Danilo Tauro. 2018. Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. Journal of Purchasing and Supply Management. In press. [Google Scholar] [CrossRef]

- Pfohl, Hans-Christian, and Moritz Gomm. 2009. Supply chain finance: Optimizing financial flows in supply chains. Logistics Research 1: 149–61. [Google Scholar] [CrossRef]

- Popa, Virgil. 2013. The financial supply chain management: A new solution for supply chain resilience. Amfiteatru Economic Journal 15: 140–53. [Google Scholar]

- Protopappa-Sieke, Margarita, and Ralf W. Seifert. 2017. Benefits of working capital sharing in supply chains. Journal of the Operational Research Society 68: 521–32. [Google Scholar] [CrossRef]

- Raddatz, Claudio. 2010. Credit chains and sectoral comovement: Does the use of trade credit amplify sectoral shocks? The Review of Economics and Statistics 92: 985–1003. [Google Scholar] [CrossRef]

- Raghavan, NR Srinivasa, and Vinit Kumar Mishra. 2011. Short-term financing in a cash-constrained supply chain. International Journal of Production Economics 134: 407–12. [Google Scholar] [CrossRef]

- Ramezani, Majid, Ali Mohammad Kimiagari, and Behrooz Karimi. 2014. Closed-loop supply chain network design: A financial approach. Applied Mathematical Modelling 38: 4099–119. [Google Scholar] [CrossRef]

- Randall, Wesley S., and M. Theodore Farris. 2009. Supply chain financing: Using cash-to-cash variables to strengthen the supply chain. International Journal of Physical Distribution & Logistics Management 39: 669–89. [Google Scholar]

- Shang, Kevin H., Jing-Sheng Song, and Paul H. Zipkin. 2009. Coordination mechanisms in decentralized serial inventory systems with batch ordering. Management Science 55: 685–95. [Google Scholar] [CrossRef]

- Shi, Juan, and Qian Wang. 2015. Research on the Risk Analysis of Supply Chain Finance from the Perspective of Encoding Function Forecast. Metallurgical & Mining Industry 7: 525–30. [Google Scholar]

- Silvestro, Rhian, and Paola Lustrato. 2014. Integrating financial and physical supply chains: The role of banks in enabling supply chain integration. International Journal of Operations & Production Management 34: 298–324. [Google Scholar]

- Soenen, Luc A. 1993. Cash Conversion Cycle and Corporate Profitability. Journal of Cash Management 13: 53–58. [Google Scholar]

- Song, Zhilan, Huan Huang, Wenxue Ran, and Sen Liu. 2016. A Study on the Pricing Model for 3PL of Inventory Financing. Discrete Dynamics in Nature and Society 2016: 6489748. [Google Scholar] [CrossRef]

- Song, Hua, Kangkang Yu, and Qiang Lu. 2018. Financial service providers and banks’ role in helping SMEs to access finance. International Journal of Physical Distribution & Logistics Management 48: 69–92. [Google Scholar]

- Stemmler, Lars, and Stefan Seuring. 2003. Finanzwirtschaftliche Elemente in der Lieferkettensteuerung–Erste Überlegungen zu einem Konzept des Supply Chain Finance. Logistik Management 5: 27–37. [Google Scholar]

- Suayb Gundogdu, Ahmet. 2010. Islamic structured trade finance: A case of cotton production in West Africa. International Journal of Islamic and Middle Eastern Finance and Management 3: 20–35. [Google Scholar] [CrossRef]

- Ta, Ha, Terry L. Esper, Kenneth Ford, and Sebastian Garcia-Dastuge. 2018. Trustworthiness Change and Relationship Continuity after Contract Breach in Financial Supply Chains. Journal of Supply Chain Management 54: 42–61. [Google Scholar] [CrossRef]

- Tang, Christopher S., S. Alex Yang, and Jing Wu. 2018. Sourcing from suppliers with financial constraints and performance risk. Manufacturing & Service Operations Management 20: 70–84. [Google Scholar]

- Touboulic, Anne, and Helen Walker. 2015. Theories in sustainable supply chain management: A structured literature review. International Journal of Physical Distribution & Logistics Management 45: 16–42. [Google Scholar]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management 14: 207–22. [Google Scholar] [CrossRef]

- Tsai, Chang-Hsien, and Kuan-Jung Peng. 2017. The FinTech Revolution and Financial Regulation: The Case of Online Supply-Chain Financing. Asian Journal of Law and Society 4: 109–32. [Google Scholar] [CrossRef]

- Van der Vliet, Kasper, Matthew J. Reindorp, and Jan C. Fransoo. 2015. The price of reverse factoring: Financing rates vs. payment delays. European Journal of Operational Research 242: 842–53. [Google Scholar] [CrossRef]

- Waller, Matt, M. Eric Johnson, and Tom Davis. 1999. Vendor managed inventory in the retail supply chain. Journal of Business Logistics 20: 183–203. [Google Scholar]

- Wandfluh, Matthias, Erik Hofmann, and Paul Schoensleben. 2016. Financing buyer–supplier dyads: An empirical analysis on financial collaboration in the supply chain. International Journal of Logistics Research and Applications 19: 200–17. [Google Scholar] [CrossRef]

- Wang, Jing. 2017. Current Status and Risk Evaluation of Supply Chain Finance Business in Commercial Banks. Revista de la Facultad de Ingeniería 32: 106–15. [Google Scholar]

- Wang, Yang, Yunlu Ma, and Yuhe Zhan. 2012. Study on supplier-led supply chain finance. Research Journal of Applied Sciences, Engineering and Technology 4: 3375–80. [Google Scholar]

- Wuttke, David A., Constantin Blome, and Michael Henke. 2013a. Focusing the financial flow of supply chains: An empirical investigation of financial supply chain management. International Journal of Production Economics 145: 773–89. [Google Scholar] [CrossRef]

- Wuttke, David A., Constantin Blome, Kai Foerstl, and Michael Henke. 2013b. Managing the innovation adoption of supply chain finance—Empirical evidence from six European case studies. Journal of Business Logistics 34: 148–66. [Google Scholar] [CrossRef]

- Wuttke, David A., Constantin Blome, H. Sebastian Heese, and Margarita Protopappa-Sieke. 2016. Supply chain finance: Optimal introduction and adoption decisions. International Journal of Production Economics 178: 72–81. [Google Scholar] [CrossRef] [Green Version]

- Xiao, Yongbo, and Jihong Zhang. 2018. Preselling to a retailer with cash flow shortage on the manufacturer. Omega 80: 43–57. [Google Scholar] [CrossRef]

- Xu, Xinhan, Xiangfeng Chen, Fu Jia, Steve Brown, Yu Gong, and Yifan Xu. 2018. Supply chain finance: A systematic literature review and bibliometric analysis. International Journal of Production Economics 204: 160–73. [Google Scholar] [CrossRef]

- Yan, Nina, and Baowen Sun. 2013. Coordinating loan strategies for supply chain financing with limited credit. OR Spectrum 35: 1039–58. [Google Scholar] [CrossRef]

- Yan, Nina, and Baowen Sun. 2015. Comparative analysis of supply chain financing strategies between different financing modes. Journal of Industrial and Management Optimization 11: 1073–87. [Google Scholar] [CrossRef]

- Yan, Nina, Hongyan Dai, and Baowen Sun. 2014. Optimal bi-level Stackelberg strategies for supply chain financing with both capital-constrained buyers and sellers. Applied Stochastic Models in Business and Industry 30: 783–96. [Google Scholar] [CrossRef]

- Yan, Nina, Chongqing Liu, Ye Liu, and Baowen Sun. 2017. Effects of risk aversion and decision preference on equilibriums in supply chain finance incorporating bank credit with credit guarantee. Applied Stochastic Models in Business and Industry 33: 602–25. [Google Scholar] [CrossRef]

- Yang, Lei, Yufan Chen, and Jingna Ji. 2018. Cooperation Modes of Operations and Financing in a Low-Carbon Supply Chain. Sustainability 10: 821. [Google Scholar] [CrossRef]

- Yu, Hui, and Yun-lin Ma. 2015. The supply chain finance model-based on the order-to-factoring mode. Systems Engineering-Theory &: Practice 35: 1733–43. [Google Scholar]

- Yu, Jianjun, and Dan Zhu. 2018. Study on the Selection Strategy of Supply Chain Financing Modes Based on the Retailer’s Trade Grade. Sustainability 10: 3045. [Google Scholar] [CrossRef]

- Yuan, Soe-Tsyr. 2007. The TradeCard Financial Supply Chain Solution. International Journal of Cases on Electronic Commerce (IJCEC) 3: 48–70. [Google Scholar] [CrossRef]

- Zhang, Cheng. 2016. Small and medium-sized enterprises closed-loop supply chain finance risk based on evolutionary game theory and system dynamics. Journal of Shanghai Jiaotong University (Science) 21: 355–64. [Google Scholar] [CrossRef]

- Zheng, Jianguo, and Jing Zhang. 2017. Analysis on Coordination Mechanism of Supply Chain Finance for B2C Cross-border Ecommerce. Revista de la Facultad de Ingeniería 32: 103–9. [Google Scholar]

- Zhou, Yongwei, Dayong Wu, and Hehua Fan. 2016. Analysis on Coordination Mechanism of Supply Chain Finance for B2C Cross-border Ecommerce. 17. [Google Scholar] [CrossRef]

- Zhou, Qi, Xiangfeng Chen, and Shuting Li. 2018. Innovative Financial Approach for Agricultural Sustainability: A Case Study of Alibaba. Sustainability 10: 891. [Google Scholar] [CrossRef]

| Category | Information |

|---|---|

| Author(s) | Contributor(s) to the article |

| Source | Journal or book in which the considered article was published |

| Year | Year in which the article was published |

| Volume and issue | Volume and issue of the articles reviewed |

| Country | Country of the corresponding author’s affiliation |

| Keywords | Keywords stated by the articles to help with visibility |

| Objectives of the paper | Aims/objectives/research questions of the paper |

| Methodologies | Methodologies used in the study. If multiple methodologies were used, then all of the methodologies were recorded in the first round. Then, for the final categorisation, only the main methodology was considered. |

| Findings | Findings/results/outcomes of the paper |

| Factors | Forces or factors that are discussed explicitly or implicitly to influence supply chain finance |

| Outcome | The consequences or outcome of supply chain finance, whether positive or negative and discussed explicitly or implicitly in the literature |

| Solutions | Various instruments or initiatives or modes that help facilitate supply chain finance |

| Limitations and gaps | Limitations/gaps/future directions mentioned in the paper or that can be observed in the paper |

| Name of the Journal | No. of Articles |

|---|---|

| International Journal of Physical Distribution and Logistics Management | 6 |

| International Journal of Production Economics | 4 |

| Revista de la Facultad de Ingeniería | 3 |

| Supply Chain Forum | 3 |

| Sustainability | 3 |

| Applied Stochastic Models in Business and Industry | 2 |

| European Journal of Operational Research | 2 |

| International Journal of Applied Business and Economic Research | 2 |

| International Journal of Logistics Research and Applications | 2 |

| International Journal of Production Research | 2 |

| International Journal of Simulation: Systems, Science, and Technology | 2 |

| Manufacturing and Service Operations Management | 2 |

| Supply Chain Management | 2 |

| Advances in Transportation Studies | 1 |

| Agro Food Industry Hi-Tech | 1 |

| Amfiteatru Economic | 1 |

| Asian Journal of Law and Society | 1 |

| Asia-Pacific Journal of Operational Research | 1 |

| Boletin Tecnico/Technical Bulletin | 1 |

| Business Process Management Journal | 1 |

| International Federation for Information Processing (IFIP) | 1 |

| International Journal of Integrated Supply Management | 1 |

| International Journal of Islamic and Middle Eastern Finance and Management | 1 |

| International Journal of Logistics Systems and Management | 1 |

| International Journal of Operations and Production Management | 1 |

| International Journal of Revenue Management | 1 |

| International Journal of Services, Technology, and Management | 1 |

| Journal of Applied Accounting Research | 1 |

| Journal of Business Logistics | 1 |

| Journal of Corporate Finance | 1 |

| Journal of Cases on Information Technology | 1 |

| Journal of Industrial and Management Optimization | 1 |

| Journal of Management Information Systems | 1 |

| Journal of Purchasing and Supply Management | 1 |

| Journal of Modelling in Management | 1 |

| Journal of Supply Chain Management | 1 |

| Journal of the Operational Research Society | 1 |

| Journal of Shanghai Jiaotong University (Science) | 1 |

| Logistics and Supply Chain Innovation: Bridging the Gap between Theory and Practice | 1 |

| Logistics Research | 1 |

| Management Science | 1 |

| Omega | 1 |

| Metallurgical and Mining Industry | 1 |

| OR Spectrum | 1 |

| Research Journal of Applied Sciences, Engineering, and Technology | 1 |

| Research Journal of Applied Sciences, Engineering, and Technology | 1 |

| Shenzhen Daxue Xuebao (Ligong Ban)/Journal of Shenzhen University Science and Engineering | 1 |

| Xitong Gongcheng Lilun yu Shijian/System Engineering Theory and Practice | 1 |

| Scopus | Web of Science | ||

|---|---|---|---|

| Author(s) | Times Cited | Author(s) | Times Cited |

| Pfohl and Gomm (2009) | 63 | Raghavan and Mishra (2011) | 37 |

| Randall and Farris (2009) | 63 | Wuttke et al. (2013a) | 35 |

| Raghavan and Mishra (2011) | 58 | Shang et al. (2009) | 20 |

| Wuttke et al. (2013a) | 43 | Johnson (2008) | 20 |

| Wuttke et al. (2013b) | 34 | Yan and Sun (2013) | 17 |

| Gomm (2010) | 31 | Wuttke et al. (2016) | 8 |

| Johnson (2008) | 30 | Van der Vliet et al. (2015) | 7 |

| More and Basu (2013) | 29 | Yan et al. (2014) | 7 |

| Fairchild (2005) | 26 | Yan and Sun (2015) | 6 |

| Shang et al. (2009) | 25 | Chen et al (2017) | 5 |

| Operational Factors | Financial Factors | Relationship Factors | Technological Factors | Informational Factors |

|---|---|---|---|---|

| Coordination | Financial attractiveness | Collaboration | Automation of trade process/level of digitalisation | Information sharing |

| Frequency and volume of transactions | Financing cost | Trust | Information visibility | |

| Objectives | Availability of external financing | Bargaining power | Reputation/image | |

| Workforce | Credit rating | Cooperation | ||

| Appropriate financing scheme/solutions | Dependence | |||

| Joint decision making | ||||

| Shared risk and reward | ||||

| Supply chain network |

| Solutions | Definition | Source | Frequency in the Sample |

|---|---|---|---|

| Reverse Factoring | In reverse factoring, the buyer sells the accounts payables and works together with the supplier and the banks to optimise the flow of funds. | Liebl et al. (2016) | 7 |

| Accounts Receivables Financing | Accounts receivable financing refers to the act of borrowing from a commercial bank with the accounts receivable that have not yet been received. | Ramezani et al. (2014); Wang (2017) | 5 |

| Purchase Order Financing | “Purchase order financing allows banks to offer loans to suppliers by considering the value of purchase orders issued by reputable buyers, and assessing the risk of the supplier delivering the order successfully.” | Babich and Kouvelis (2018) | 5 |

| Agricultural Supply Chain Finance | A supply chain financing generally of pre-harvest, trade services financing, and post-harvest, which is applied in the agriculture sector. | Suayb Gundogdu (2010); Li et al. (2011); Karyani et al. (2015); | 5 |

| Factoring | “Factoring is a type of supplier financing in which firms sell their creditworthy accounts receivable at a discount (generally equal to interest plus service fees), and receive immediate cash.” | Klapper (2006) | 4 |

| Online SCF Platform | An online platform that facilitates in networking the parties involved in supply chain finance (SCF). | Hofmann and Zumsteg (2015); Martin and Hofmann (2017); Gao et al. (2018) | 5 |

| Inventory Financing | A short-term loan from a financial institution to finance inventories. | Caniato et al. (2016) | 4 |

| Warehousing Financing | Warehouse financing means that co-operators mortgage their goods in warehouses for pledge loans. | Jiang et al. (2016) | 4 |

| Buyer Direct Financing | In buyer direct financing, the buyer (manufacturer) issues both sourcing contracts and loans directly to the suppliers. | Babich and Kouvelis (2018) | 4 |

| Vendor-Managed Inventory | “The supplier is given the freedom to plan its own production and decide upon the replenishment schedule as long as the agreed customer service levels are met. This enables suppliers to stabilise their production and to optimise the transportation cost” | Waller et al. (1999); Claassen et al. (2008) | 3 |

| Raw Material Financing | It is a part of inventory financing whereby the funds are given to finance raw materials. | Basu and Nair (2012); More and Basu (2013) | 2 |

| Third Party Logistics Financing | A logistics service provider buys goods from a manufacturer and obtains an interim legal ownership before selling them to the manufacturers’ customers after a certain time. | Caniato et al. (2016); Song et al. (2016) | 2 |

| Dynamic Discounting | “Dynamic Discounting (DD) utilises trade process visibility granted by an information and communication technology (ICT) platform to allow the dynamic settlement of invoices in a buyer–supplier relationship.” | Gelsomino et al. (2016a) | 2 |

| Early Payment Discount Program | A programme in which the supplier offers a cash discount to encourage the buyer to pay quickly. | Ho et al. (2008) | 2 |

| Buy Back Guarantee | “It refers to a kind of supply chain financing [in which] the bank helps the capital-constrained retailer settle the payment, based on the core supplier’s buyback guarantee.” | Chen et al. (2017) | 2 |

| Credit Guarantee | “A credit guarantee where the deep-pocket manufacturer represents a promise of timely payment for the retailer with high default risks in the supply chain.” | Yan et al. (2014, 2017) | 2 |

| Bank Guarantee | A bank guarantee is a promise from the debtor’s bank that the liabilities of the debtor will be met in the event of failure to repay. | Martin and Hofmann (2017) | 1 |

| Manufacturer Collateral | “The manufacturer assumed to be the core enterprise of a chain, provides her retailer with collateral to help him borrow from the bank at a low-interest rate.” | Bi et al. (2018a) | 1 |

| Supplier’s Subsidy | The supplier allows the retailer a delay in payment, and provides a subsidy contract to alleviate its problems if it is profitable. | Bi et al. (2018a) | 1 |

| Pre-selling | In a preselling program, firms offer to sell their products, possibly at a discounted wholesale price, long before the selling season. | Xiao and Zhang (2018) | 1 |

| Trade Credit | Trade credit is a short-term loan between firms that are tied in both timing and value to the exchange of goods between them. It occurs when there is a delay between the delivery of goods or the provision of services by a supplier and their payment. | Ferris (1981); and García-Teruel and Martínez-Solano (2010) | 1 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marak, Z.R.; Pillai, D. Factors, Outcome, and the Solutions of Supply Chain Finance: Review and the Future Directions. J. Risk Financial Manag. 2019, 12, 3. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm12010003

Marak ZR, Pillai D. Factors, Outcome, and the Solutions of Supply Chain Finance: Review and the Future Directions. Journal of Risk and Financial Management. 2019; 12(1):3. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm12010003

Chicago/Turabian StyleMarak, Zericho R, and Deepa Pillai. 2019. "Factors, Outcome, and the Solutions of Supply Chain Finance: Review and the Future Directions" Journal of Risk and Financial Management 12, no. 1: 3. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm12010003