Off-Patent Biologicals and Biosimilars Tendering in Europe—A Proposal towards More Sustainable Practices

Abstract

:1. Introduction

2. Results

2.1. Survey Results—Organization and Design of Tenders for Off-Patent Biologicals and Biosimilars

2.1.1. Perceptions about the Tender Organization

2.1.2. The Tender Design

2.1.3. Application of Selection and Award Criteria

2.1.4. Interchangeability and Switching Considerations in the Context of Tenders

2.2. Interview Results—Considerations Regarding the Design and Organisation of Tender Procedures

2.2.1. Considerations Regarding Tender Design Elements

Dividing Product Volume among Suppliers—Ensuring Market Plurality

Tender Award Criteria—Ensuring a Fair Design and Application

Tender Frequency and (Re-)Opening of Contracts—Ensuring Timely Competition

Supply Conditions—Increasing Volume and Predictability to Ensure Continuity of Supply

2.2.2. Considerations Regarding the Organization of Tenders

Considerations Regarding Transparency about the Tender Procedure and Price

Switching Considerations in the Context of Tenders—Clinical Data, Cost, Physician Freedom and Guidance

Collaboration and Communication in the Context of Tenders

Healthcare Professional Involvement and Motivation

2.2.3. Considerations Regarding the Sustainability of Tender Procedures and Their Impact on Market Dynamics

2.2.4. Considerations Regarding Competition Dynamics—Ensuring a Level Playing Field

2.2.5. Future Outlook of Interviewees: Possible Evolutions in Tender Organization

3. Discussion

3.1. Challenges in the Organization of Tenders for Off-Patent Biologics and Biosimilars

3.2. Five Main Avenues for Optimization

3.3. Strengths and Limitations

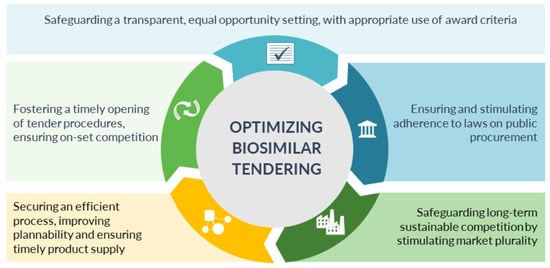

Tender practices should abide with the European Union and Member State rules on tendering. The involved actors, suppliers, purchaser bodies, payers, government and competition authorities, have a role to fulfil to ensure efficient, fair and transparent tender procedures for off-patent biologics and biosimilars.

|

| 1. Safeguarding a transparent, equal opportunity setting for all suppliers, with an appropriate use of award criteria |

The tender procedure needs to be transparent and non-discriminatory with predefined rules and pathway, which are adhered to throughout the process

|

| 2. Fostering a timely opening of tender procedures, ensuring on-set competition |

Tender procedures should be opened as soon as possible, to avoid delays in competition and market opportunity for biosimilar competitors:

|

| 3. Ensuring and stimulating adherence to laws on public procurement |

The rules on public procurement should be correctly applied:

|

| 4. Securing an efficient process, improving plannability and ensuring timely product supply |

The tender procedure needs to be efficiently managed, optimizing and reducing the administrative and time burden for both suppliers and purchasers, as well as increasing predictability and plannability for the supplier—supporting timely product supply.

|

| 5. Safeguarding long-term sustainable competition by stimulating market plurality |

The tender procedures and overall procurement strategy need to take a long-term view into account, tailored to supporting long-term sustainability, providing commercial opportunity for multiple suppliers

|

3.4. Balancing Short and Long Term Benefits

4. Materials and Methods

4.1. Quantitative Web-Survey

4.1.1. Recruitment

4.1.2. Survey Development

4.1.3. Analysis

4.2. Qualitative Semi-Structured Interviews

4.2.1. Recruitment

4.2.2. Interview Guide and Interviews

4.2.3. Analysis

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IMS Institute for Healthcare Informatics. Delivering on the Potential of Biosimilar Medicines: The Role of Functioning Competitive Markets Introduction; IMS Institute for Healthcare Informatics: Parsippany, NJ, USA, 2016. [Google Scholar]

- IQVIA. The Impact of Biosimilar Competition in Europe; IQVIA: Durham, NC, USA, 2019. [Google Scholar]

- IQVIA. Advancing Biosimilar Sustainability in Europe—A Multi-Stakeholder Assessment; IQVIA: Durham, NC, USA, 2018. [Google Scholar]

- European Medicines Agency. Guideline on Similar Biological Medicinal Products; European Medicines Agency: Amsterdam, The Netherlands, 2014. [Google Scholar]

- European Medicines Agency. Biosimilar Medicines. Available online: https://www.ema.europa.eu/en/medicines/field_ema_web_categories%253Aname_field/Human/ema_group_types/ema_medicine/field_ema_med_status/authorised-6/ema_medicine_types/field_ema_med_biosimilar/search_api_aggregation_ema_medicine_types/field_ema_med_biosim (accessed on 23 January 2021).

- European Medicines Agency. Applications for New Human Medicines under Evaluation by the Committee for Medicinal Products for Human Use; European Medicines Agency: Amsterdam, The Netherlands, 2020. [Google Scholar]

- IQVIA. The Impact of Biosimilar Competition in Europe; IQVIA: Durham, NC, USA, 2018. [Google Scholar]

- IQVIA. The Impact of Biosimilar Competition in Europe; IQVIA: Durham, NC, USA, 2020. [Google Scholar]

- Rémuzat, C.; Kapuśniak, A.; Caban, A.; Ionescu, D.; Mendoza, C.; Toumi, M. Supply-side and demand-side policies for biosimilars: An overview in 10 European member states. J. Mark. Access Health Policy 2017, 5, 1307315. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Vogler, S.; Gombocz, M.; Zimmermann, N. Tendering for off-patent outpatient medicines: Lessons learned from experiences in Belgium, Denmark and the Netherlands. J. Pharm. Health Serv. Res. 2017, 8, 147–158. [Google Scholar] [CrossRef]

- Simoens, S.; Cheung, R. Tendering and biosimilars: What role for value-added services? J. Mark. Access. Health Policy 2020, 8, 1705120. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Dranitsaris, G.; Jacobs, I.; Kirchhoff, C.; Popovian, R.; Shane, L.G. Drug tendering: Drug supply and shortage implications for the uptake of biosimilars. Clin. Outcomes Res. 2017, 9, 573–584. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- European Union. Directive 2014/24/EU of The European Parliament and of The Council of 26 February 2014 on Public Procurement and Repealing Directive 2004/18/EC; Off. J. Eur. Union: Luxembourg, 2014. [Google Scholar]

- European Commission. Public Procurement. Available online: https://ec.europa.eu/growth/single-market/public-procurement_en (accessed on 24 February 2021).

- European Commission. Public Procurement: Legal Rules and Implementation. Available online: https://ec.europa.eu/growth/single-market/public-procurement/rules-implementation_en (accessed on 24 February 2021).

- Simon-Kucher & Partners. Payers’ Price & Market Access Policies Supporting a Sustainable Biosimilar Medicines Market; Simon-Kucher & Partners: Bonn, Germany, 2016. [Google Scholar]

- Reiland, J.-B.; Freischem, B.; Roediger, A. What pricing and reimbursement policies to use for off-patent biologicals in Europe?—Results from the second EBE biological medicines policy survey. Gabi. J. Generics Biosimilars Initiat. J. 2017, 6, 61–78. [Google Scholar] [CrossRef]

- Medicines for Europe. Market Review—European Biosimilar Medicines Markets; Medicines for Europe: Brussels, Belgium, 2017. [Google Scholar]

- Bird&Bird. Public Procurement of Medicinal Products White Paper—Common Legislation But Diverging Implementation Approaches Throughout the EU; Bird&Bird: London, UK, 2014. [Google Scholar]

- Medicines for Europe. Position Paper on Best Procurement Practices; Medicines for Europe: Brussels, Belgium, 2018. [Google Scholar]

- European Association of Hospital Pharmacists. EAHP Position Paper on Procurement; EAHP: Brussels, Belgium, 2018. [Google Scholar]

- Sammarco, C. Competition in Public Bidding Exercises for Pharmaceutical Products. Opinio Juris Compratione 2010, 2, 4. [Google Scholar]

- Schoonveld, E. The Price of Global Health: Drug Pricing Strategies to Balance Patient Access and the Funding of Innovation; Taylor and Francis: London, UK, 2020. [Google Scholar]

- European Commission. EU Public Procurement Reform: Less Bureaucracy, Higher Efficiency; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- O’Mahony, B. Guide to National Tenders for the Purchase of Clotting Factor Concentrates; World Federation of Hemophilia: Montréal, QC, Canada, 2015. [Google Scholar]

- European Biopharmaceutical Enterprises. EBE Position Paper on Tendering of Biosimilars/Biologicals; EBE: Brussels, Belgium, 2011. [Google Scholar]

- EuropaBio. Public Procurement of Biological Medicines; EuropaBio: Brussels, Belgium, 2015. [Google Scholar]

- EuropaBio. “Buying Innovative” in the Healthcare Biotech Market in Europe; EuropaBio: Brussels, Belgium, 2017. [Google Scholar]

- Vulto, A.; Cheesman, S.; Stuart, P. Tender-criteria biosimilars ‘beyond price’. In Proceedings of the Amgen BEAM Workshop, Zurich, Switzerland, 5–6 September 2019. [Google Scholar]

- Alhola, K. Environmental Criteria in Public Procurement Focus on Tender Documents; Finnish Environment Institute: Helsinki, Finland, 2012. [Google Scholar]

- Raffaelli, E.A.; Massimino, F. Biosimilars: Considerations in light of the Italian legal framework. Generics Biosimilars Initiat. J. 2019, 8, 5–23. [Google Scholar] [CrossRef]

- NHS. An Overview of NHS Procurement of Medicines and Pharmaceutical Products and Services for Acute Care in the United Kingdom Executive Summary; NHS: London, UK, 2018. [Google Scholar]

- Minister of Social Affairs and Health. Omzendbrief Actieplan Biosimilars; Minister of Social Affairs and Health: Brussels, Belgium, 2016. [Google Scholar]

- Vandenplas, Y.; Huys, I.; Van Wilder, P.; Vulto, A.G.; Simoens, S. Probleemstelling en Voorstellen tot Maatregelen Voor Af-Patent Biologische en Biosimilaire Geneesmiddelen in België; KU Leuven: Leuven, Belgium, 2020. [Google Scholar]

- RIZIV/INAMI. Terugbetaling van Geneesmiddelen: Wat Is Gewijzigd Sinds 1 April 2019—RIZIV. Available online: https://www.inami.fgov.be/nl/professionals/andere-professionals/farmaceutische-industrie/Paginas/terugbetaling-geneesmiddelen-01042019.aspx#Daling_tot_85%25_voor_de_facturatie_van_bepaalde_geneesmiddelen_in_het_ziekenhuis (accessed on 13 October 2020).

- Akker, I.; Sauter, W.A. Cure for All Ills? The Effectiveness of Therapeutic and Biosimilar Pharmaceutical Competition in the Netherlands. Eur. Pharm. Law. Rev. 2020, 4, 57–66. [Google Scholar] [CrossRef]

- KMPG. Improving Healthcare Delivery in Hospitals by Optimized Utilization of Medicines: A Study into 8 European Countries; KMPG: Amstelveen, The Netherlands, 2019. [Google Scholar]

- Amgros. All the Agreements in the First Joint Nordic Tendering Procedure Are in Place. Available online: https://amgros.dk/en/knowledge-and-analyses/articles/all-the-agreements-in-the-first-joint-nordic-tendering-procedure-are-in-place/ (accessed on 11 June 2020).

- European Commission. Expert Panel on Effective Ways of Investing in Health—European Commission. Opinion on Public Procurement in Healthcare Systems; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Madsen, S. Regulation of Biosimilars and Success Factors for Uptake in Clinical Practice. In Proceedings of the ‘Biological Medicines in Belgium’ Symposium of the Belgian Federal Agency of Medicinal Products and Health, FAMHP, Brussels, Belgium, 8 February 2018. [Google Scholar]

- Medicines for Europe. Positioning Statements on Physician-Led Switching for Biosimilar Medicines; Medicines for Europe: Brussels, Belgium, 2019. [Google Scholar]

- The Cancer Vanguard. Project Evaluation Report: Biosimilars Getting It Right 1st Time; NHS: London, UK, 2018. [Google Scholar]

- The Cancer Vanguard. Biosimilars—Getting It Right First Time. Available online: https://cancervanguard.nhs.uk/biosimilars-getting-it-right-first-time/ (accessed on 9 November 2020).

- OECD. Tackling Wasteful Spending on Health; OECD: Paris, France, 2017. [Google Scholar]

- Razanskaite, V.; Bettey, M.; Downey, L.; Wright, J.; Callaghan, J.; Rush, M.; Cummings, F. Biosimilar Infliximab in Inflammatory Bowel Disease: Outcomes of a Managed Switching Programme. J. Crohns. Colitis. 2017, 11, 690–696. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Welch, A.R. Biosimilars: Regulatory, Clinical, and Biopharmaceutical Development—Chapter: Biosimilars 101: An Introduction to Biosimilars; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Autoriteit Consument & Markt. Sectoronderzoek Concurrentie voor en na Toetreding van Biosimilars; Autoriteit Consument & Markt: Den Haag, The Netherlands, 2019. [Google Scholar]

- European Commission. Limiting the Temptation for Corruption in Public Procurement. Available online: https://ec.europa.eu/growth/content/limiting-temptation-corruption-public-procurement_en (accessed on 24 February 2021).

- Kanavos, P.; Ferrario, A.; Nicod, E.; Sandberg, D. Tender Systems for Outpatient Pharmaceuticals in the European Union: Evidence from the Netherlands and Germany; London School of Economics: London, UK, 2012. [Google Scholar]

- Bax, H. Value-Based Procurement: The Unexpected Driver of Patient- Centric and Sustainable Healthcare; VBP CoP: Brussels, Belgium, 2020. [Google Scholar]

- Plackett, B. No money for new drugs. Nature 2020, 586, S50–S52. [Google Scholar] [CrossRef]

- Cherla, A.; Howard, N.; Mossialos, E. The ‘Netflix plus model’: Can subscription financing improve access to medicines in low- and middle-income countries? Health Econ. Policy Law 2020, 16, 113–123. [Google Scholar] [CrossRef] [Green Version]

- Macaulay, R.; Miller, P.; Turkstra, E. Subscription model for reimbursement: A fad or the future? In Proceedings of the ISPOR Europe 2019, Copenhagen, Denmark, 2–6 November 2019. [Google Scholar]

- NHS. Regional Medicines Optimisation Committee Briefing Best Value Biologicals: Adalimumab Update 6; NHS: London, UK, 2019. [Google Scholar]

- NHS England. Commissioning Framework for Biological Medicines (Including Biosimilar Medicines); NHS England: Leeds, UK, 2017. [Google Scholar]

- Verboven, Y. MedTech Europe View—Value Based Procurement & Most Economic Advantageous Tendering (MEAT); MedTech Europe: Brussels, Belgium, 2018. [Google Scholar]

- Gerecke, G.; Clawson, J.; Verboven, Y. Procurement: The Unexpected Driver of Value-Based Health Care; MedTech Europe: Brussels, Belgium, 2015. [Google Scholar]

- Barbier, L.; Simoens, S.; Vulto, A.G.; Huys, I. European Stakeholder Learnings Regarding Biosimilars: Part I—Improving Biosimilar Understanding and Adoption. BioDrugs 2020, 34, 783–796. [Google Scholar] [CrossRef] [PubMed]

- Barbier, L.; Simoens, S.; Vulto, A.G.; Huys, I. European Stakeholder Learnings Regarding Biosimilars: Part II—Improving Biosimilar Use in Clinical Practice. BioDrugs 2020, 34, 797–808. [Google Scholar] [CrossRef] [PubMed]

- Duggan, B.; Smith, A.; Barry, M. Uptake of biosimilars for TNF-α inhibitors adalimumab and etanercept following the best-value biological medicine initiative in Ireland. Int. J. Clin. Pharm. 2021. [Google Scholar] [CrossRef] [PubMed]

- Amgros. New International Record for Switch to Biosimilar. Available online: https://amgros.dk/en/knowledge-and-analyses/articles/new-international-record-for-switch-to-biosimilar/ (accessed on 11 June 2020).

- Moorkens, E.; Godman, B.; Huys, I.; Hoxha, I.; Malaj, A.; Keuerleber, S.; Vulto, A.G. The expiry of Humira® market exclusivity and the entry of adalimumab biosimilars in Europe: An overview of pricing and national policy measures. Front Pharm. 2021, 11. [Google Scholar] [CrossRef] [PubMed]

- Gabriel, M. Public Procurement Laws and Tendering of Biological Pharmaceuticals and Biosimilars in the EU. In Proceedings of the EU Commission Stakeholder Event on Biosimilar Medicinal Products, Brussels, Belgium, 14 September 2018. [Google Scholar]

- OECD. Recommendation of the OECD Council on Fighting Bid Rigging in Public Procurement; OECD: Paris, France, 2012. [Google Scholar]

- Palinkas, L.A.; Horwits, S.M.; Green, C.A.; Wisdom, J.P.; Duan, N.; Hoagwood, K. Purposeful sampling for qualitative data collection and analysis in mixed method implementation research. Adm. Policy Ment. Health 2015, 42, 533–544. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lacey, A.; Luff, D. Qualitative Data Analysis; The NIHR RDS: Nottingham/Sheffield, UK, 2007. [Google Scholar]

| What is already known about the topic? |

|

| What does the paper add to existing knowledge? |

|

| What insights does the paper provide for informing health care-related decision-making |

|

| Advantages | Conditions |

|---|---|

|

|

|

|

|

|

| |

| |

|

| A Selection of Possible Criteria to Consider beyond Price |

1. Quality and technical related criteria

|

2. Service-related criteria

|

3. Patient related criteria

|

| A Selection of Less Desirable Criteria to Consider |

| Only criteria that drive actual benefits (meaningful product differentiation, advantage for purchaser and/or patient) and are related to the subject matter should be included. The below criteria may be considered to impact the level playing field between products, to be misaligned with the biosimilarity principle and/or to be of limited value. |

| 1. Criteria that require the product to be already on the market for a certain period of time, as these would naturally advantage products with longer market presence, i.e., the originator product, and disadvantage recently launched biosimilars |

|

3. Award criteria related to the efficacy, safety or quality profile of the biosimilar product

|

4. Request for clinical switch data or financial support to conduct a switch study

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barbier, L.; Simoens, S.; Soontjens, C.; Claus, B.; Vulto, A.G.; Huys, I. Off-Patent Biologicals and Biosimilars Tendering in Europe—A Proposal towards More Sustainable Practices. Pharmaceuticals 2021, 14, 499. https://0-doi-org.brum.beds.ac.uk/10.3390/ph14060499

Barbier L, Simoens S, Soontjens C, Claus B, Vulto AG, Huys I. Off-Patent Biologicals and Biosimilars Tendering in Europe—A Proposal towards More Sustainable Practices. Pharmaceuticals. 2021; 14(6):499. https://0-doi-org.brum.beds.ac.uk/10.3390/ph14060499

Chicago/Turabian StyleBarbier, Liese, Steven Simoens, Caroline Soontjens, Barbara Claus, Arnold G. Vulto, and Isabelle Huys. 2021. "Off-Patent Biologicals and Biosimilars Tendering in Europe—A Proposal towards More Sustainable Practices" Pharmaceuticals 14, no. 6: 499. https://0-doi-org.brum.beds.ac.uk/10.3390/ph14060499