Influence of Ownership Structure on the Determinants of Effective Tax Rates of Spanish Companies

Abstract

:1. Introduction

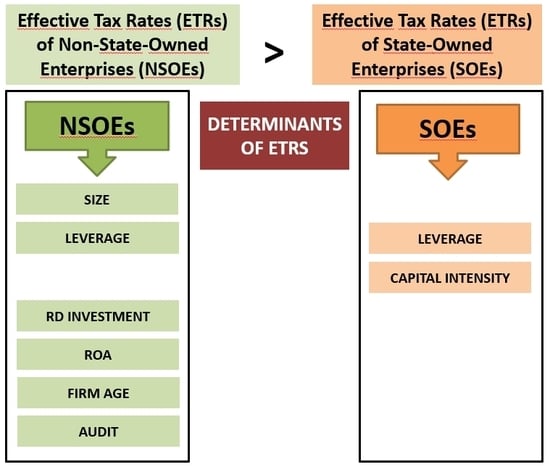

- Does ownership structure influence the ETRs of Spanish firms?

- Does ownership structure affect the determinants of the ETRs of Spanish firms?

2. Study Design

2.1. Ownership Structure

2.2. Control Variables

2.3. Econometric Specification and Description of Variables

- GAAPETR1: The tax expense is divided by the pretax income of entity i in year t. For this first measure of tax burden, all the observations with a negative tax expense and/or negative pretax income were eliminated. Observations with values greater than one were also eliminated to limit the variable between zero and one, as is customary in the prior literature.

- GAAPETR2: The tax expense is divided by the pretax income of firm i in year t. For this second measure, all the observations for the dependent variable -ETR- were used, following the methodology of Monterrey-Mayoral and Sánchez-Segura [21]. According to these authors, the use of all the observations allows for greater generality and richer empirical results.

- GAAPETR3: This is a measure of long-term tax burden, based on the methodology developed by Dyreng et al. [52]. It is defined as the three-year sum (from year t − 2 to year t) of the tax expense divided by the three-year sum of pretax income.

- CASHETR1: This is the cash tax paid by the pretax income of entity i in year t. As with the first measure based on income tax expense, all the observations with negative cash taxes paid and/or negative pretax income were eliminated. In addition, the variable is limited between zero and one, following the usual procedure from previous investigations.

- CASHETR2: This is the cash tax paid by the pretax income of company i in year t, using all the observations, again following the criteria of Monterrey-Mayoral and Sánchez-Segura [21].

- CASHETR3: This is the second measure of the long-term tax burden, defined as the three-year sum (from year t − 2 to year t) of the cash tax paid divided by the three-year sum of pretax income [52].

3. Sample and Results

3.1. Sample

3.2. Descriptive Statistics and Mean Difference

3.3. Determinants of Effective Tax Rates in Spanish State-Owned and Privately Owned Companies

3.4. Effects of Ownership Structure on the Effective Tax Rates of Spanish Companies

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Dependent Variables | |

| GAAPETR1 | Total tax expense divided by pretax income. Firms are required to have both a positive denominator and numerator. The variable is winsorized at 0 and 1. |

| GAAPETR2 | Total tax expense divided by pretax income. The variable is winsorized at 1% and 99% of the distribution. |

| GAAPETR3 | The three-year sum (from year t − 2 to year t) of total tax expense divided by the three-year sum of pretax income. The variable is winsorized at 1% and 99% of the distribution. Based on the measure developed by Dyreng et al. [52]. |

| CASHETR1 | Total cash taxes paid divided by pretax income. Firms are required to have both a positive denominator and numerator. The variable is winsorized at 0 and 1. |

| CASHETR2 | Total cash taxes paid divided by pretax income. The variable is winsorized at 1% and 99% of the distribution. |

| CASHETR3 | The three-year sum (from year t − 2 to year t) of total cash taxes paid divided by the three-year sum of pretax income. The variable is winsorized at 1% and 99% of the distribution. Based on the measure developed by Dyreng et al. [52]. |

| Variable of Interest | |

| GOVOWN | A dummy that equals 1 if the majority of the firm is owned by the government (more than 50%), and 0 otherwise. |

| Control Variables | |

| SIZE | Natural logarithm of total assets. |

| LEV | Total leverage scaled by total assets. |

| CAPINT | The book value of the property, plant, and equipment scaled by total assets. |

| RD | Research and development investment scaled by total assets. |

| INVINT | Total inventories scaled by total assets. |

| ROA | Pretax income scaled by total assets. |

| FIRMAGE | Natural logarithm of the firm’s age since the date of it was established to the closing date of each financial year, rounded up. |

| FOREIGN | A dummy that equals 1 if the firm undertakes foreign operations and 0 otherwise. |

| SME | Equals 1 if the firm is a small- or medium-sized enterprise (SME) and 0 otherwise. SMEs between 2008 and 2010: Sales <8,000,000 euros. SMEs since 2011: Sales <10,000,000 euros. |

| AUDIT | A dummy that equals 1 if the firm is audited and 0 otherwise. |

| SECTOR | A dummy variable for each SIC sector. |

| YEAR | A dummy variable for each year (2008–2014). |

| All continuous control variables are winsorized at 1% and 99% of the distribution. | |

References

- Shackelford, D.A.; Shevlin, T. Empirical tax research in accounting. J. Account. Econ. 2001, 31, 321–387. [Google Scholar] [CrossRef] [Green Version]

- Hanlon, M.; Heitzman, S. A review of tax research. J. Account. Econ. 2010, 50, 127–178. [Google Scholar] [CrossRef] [Green Version]

- Graham, J.R.; Raedy, J.S.; Shackelford, D.A. Research in accounting for income taxes. J. Account. Econ. 2012, 53, 412–434. [Google Scholar] [CrossRef]

- Stickney, C.P.; McGee, V.E. Effective corporate tax rates the effect of size, capital intensity, leverage, and other factors. J. Account. Public Policy 1982, 1, 125–152. [Google Scholar] [CrossRef]

- Zimmerman, J.L. Taxes and firm size. J. Account. Econ. 1983, 5, 119–149. [Google Scholar] [CrossRef]

- Gupta, S.; Newberry, K. Determinants of the variability in corporate effective tax rates: Evidence from longitudinal data. J. Account. Public Policy 1997, 16, 1–34. [Google Scholar] [CrossRef]

- Mills, L.; Erickson, M.M.; Maydew, E.L. Investments in tax planning. J. Am. Tax. Assoc. 1998, 20, 1–20. [Google Scholar]

- Manzon, G.B.; Plesko, G.A. The relation between financial and tax reporting measures of income. Tax Law Rev. 2002, 55, 175–214. [Google Scholar]

- Rego, S.O. Tax-Avoidance Activities of U.S. Multinational Corporations. Contemp. Account. Res. 2003, 20, 805–833. [Google Scholar] [CrossRef] [Green Version]

- Wilde, J.H.; Wilson, R.J. Perspectives on Corporate Tax Planning: Observations from the Past Decade. J. Am. Tax. Assoc. 2018, 40, 63–81. [Google Scholar] [CrossRef]

- Phillips, J.D. Corporate tax-planning effectiveness: The role of compensation-based incentives. Account. Rev. 2003, 78, 847–874. [Google Scholar] [CrossRef]

- Armstrong, C.S.; Blouin, J.L.; Larcker, D.F. The incentives for tax planning. J. Account. Econ. 2012, 53, 391–411. [Google Scholar] [CrossRef]

- Rego, S.O.; Wilson, R. Equity Risk Incentives and Corporate Tax Aggressiveness. J. Account. Res. 2012, 50, 775–810. [Google Scholar] [CrossRef]

- Gaertner, F.B. CEO After-Tax Compensation Incentives and Corporate Tax Avoidance. Contemp. Account. Res. 2014, 31, 1077–1102. [Google Scholar] [CrossRef] [Green Version]

- Powers, K.; Robinson, J.R.; Stomberg, B. How do CEO incentives affect corporate tax planning and financial reporting of income taxes? Rev. Account. Stud. 2016, 21, 672–710. [Google Scholar] [CrossRef]

- Chi, S.; Huang, S.X.; Sanchez, J.M. CEO Inside Debt Incentives and Corporate Tax Sheltering. J. Account. Res. 2017, 55, 837–876. [Google Scholar] [CrossRef] [Green Version]

- Desai, M.A.; Dharmapala, D. Corporate tax avoidance and high-powered incentives. J. Financ. Econ. 2006, 79, 145–179. [Google Scholar] [CrossRef] [Green Version]

- Minnick, K.; Noga, T. Do corporate governance characteristics influence tax management? J. Corp. Financ. 2010, 16, 703–718. [Google Scholar] [CrossRef]

- Armstrong, C.S.; Blouin, J.L.; Jagolinzer, A.D.; Larcker, D.F. Corporate governance, incentives, and tax avoidance. J. Account. Econ. 2015, 60, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Richardson, G.; Taylor, G.; Lanis, R. The impact of board of director oversight characteristics on corporate tax aggressiveness: An empirical analysis. J. Account. Public Policy 2013, 32, 68–88. [Google Scholar] [CrossRef]

- Monterrey-Mayoral, J.; Sánchez-Segura, A. Planificación fiscal y gobierno corporativo en las empresas cotizadas españolas. Hacienda Publica Espanola 2015, 214, 55–89. [Google Scholar] [CrossRef]

- Bird, A.; Karolyi, S.A. Governance and taxes: Evidence from regression discontinuity. Account. Rev. 2017, 92, 29–50. [Google Scholar] [CrossRef]

- Kim, J.; Im, C. Study on Corporate Social Responsibility (CSR): Focus on Tax Avoidance and Financial Ratio Analysis. Sustainability 2017, 9, 1710. [Google Scholar] [CrossRef]

- Young, A. How does governance affect tax avoidance? Evidence from shareholder proposals. Appl. Econ. Lett. 2017, 24, 1208–1213. [Google Scholar] [CrossRef]

- Gulzar, M.A.; Cherian, J.; Sial, M.; Badulescu, A.; Thu, P.; Badulescu, D.; Khuong, N. Does Corporate Social Responsibility Influence Corporate Tax Avoidance of Chinese Listed Companies? Sustainability 2018, 10, 4549. [Google Scholar] [CrossRef]

- Chen, S.; Chen, X.; Cheng, Q.; Shevlin, T. Are family firms more tax aggressive than non-family firms? J. Financ. Econ. 2010, 95, 41–61. [Google Scholar] [CrossRef] [Green Version]

- Monterrey-Mayoral, J.; Sánchez-Segura, A. Diferencias en agresividad fiscal entre empresas familiares y no familiares. Span. J. Financ. Account. 2010, 39, 65–97. [Google Scholar]

- Zeng, T. Institutional environment, inside ownership and effective tax rate. Nankai Bus. Rev. Int. 2011, 2, 348–357. [Google Scholar] [CrossRef]

- Wu, L.; Wang, Y.; Luo, W.; Gillis, P. State ownership, tax status and size effect of effective tax rate in China. Account. Bus. Res. 2012, 42, 97–114. [Google Scholar] [CrossRef] [Green Version]

- Badertscher, B.A.; Katz, S.P.; Rego, S.O. The separation of ownership and control and corporate tax avoidance. J. Account. Econ. 2013, 56, 228–250. [Google Scholar] [CrossRef]

- McGuire, S.T.; Wang, D.; Wilson, R.J. Dual class ownership and tax avoidance. Account. Rev. 2014, 89, 1487–1516. [Google Scholar] [CrossRef]

- Chan, K.H.; Mo, P.L.L.; Zhou, A.Y. Government ownership, corporate governance and tax aggressiveness: Evidence from China. Account. Financ. 2013, 53, 1029–1051. [Google Scholar] [CrossRef]

- Wu, W.; Rui, O.M.; Wu, C. Institutional environment, ownership and firm taxation. Econ. Transit. 2013, 21, 17–51. [Google Scholar] [CrossRef]

- Derashid, C.; Zhang, H. Effective tax rates and the “industrial policy” hypothesis: Evidence from Malaysia. J. Int. Account. Audit. Tax. 2003, 12, 45–62. [Google Scholar] [CrossRef]

- Adhikari, A.; Derashid, C.; Zhang, H. Public policy, political connections, and effective tax rates: Longitudinal evidence from Malaysia. J. Account. Public Policy 2006, 25, 574–595. [Google Scholar] [CrossRef]

- Mahenthiran, S.; Kasipillai, J. Influence of ownership structure and corporate governance on effective tax rates and tax planning: Malaysian evidence. Aust. Tax Forum 2012, 27, 941–969. [Google Scholar] [CrossRef]

- Khan, M.; Srinivasan, S.; Tan, L. Institutional ownership and corporate tax avoidance: New evidence. Account. Rev. 2017, 92, 101–122. [Google Scholar] [CrossRef]

- Tang, T.; Mo, P.L.L.; Chan, K.H. Tax collector or tax avoider? An investigation of intergovernmental agency conflicts. Account. Rev. 2017, 92, 247–270. [Google Scholar] [CrossRef]

- Fernández-Rodríguez, E. The determining factors of the Spanish business tax burden through the accounting information. The case of financing decissions. Span. J. Financ. Account. 2004, 33, 125–159. [Google Scholar]

- Park, S. Related Party Transactions and Tax Avoidance of Business Groups. Sustainability 2018, 10, 3571. [Google Scholar] [CrossRef]

- Fonseca-Díaz, A.R.; Fernández-Rodríguez, E.; Martínez-Arias, A. Factores empresariales e institucionales condicionantes de la presión fiscal a nivel internacional. Span. J. Financ. Account. 2018. [Google Scholar] [CrossRef]

- Delgado, F.J.; Fernandez-Rodriguez, E.; Martinez-Arias, A. Effective tax rates in corporate taxation: A quantile regression for the EU. Eng. Econ. 2014, 25, 487–496. [Google Scholar] [CrossRef]

- Frank, M.M.; Lynch, L.J.; Rego, S.O. Tax Reporting Aggressiveness and Its Relation to Aggressive Financial Reporting. Account. Rev. 2009, 84, 467–496. [Google Scholar] [CrossRef]

- Wilson, R.J. An Examination of Corporate Tax Shelter Participants. Account. Rev. 2009, 84, 969–999. [Google Scholar] [CrossRef]

- Hope, O.-K.; Ma, M.; Thomas, W.B. Tax avoidance and geographic earnings disclosure. J. Account. Econ. 2013, 56, 170–189. [Google Scholar] [CrossRef]

- Dyreng, S.D.; Hanlon, M.; Maydew, E.L.; Thornock, J.R. Changes in corporate effective tax rates over the past 25 years. J. Financ. Econ. 2017, 124, 441–463. [Google Scholar] [CrossRef]

- Lisowsky, P. Seeking Shelter: Empirically modeling tax shelters using financial statement information. Account. Rev. 2010, 85, 1693–1720. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Hsiao, C. Panel Data Analysis-Advantages and Challenges 2013; Wang Yanan Institute for Studies in Economics (WISE), Xiamen University: Xiamen, China, 2013. [Google Scholar]

- Baltagi, B.H. Econometric Analysis of Panel Data, 4th ed.; John Wiley & Sons: Chichester, UK; Hoboken, NJ, USA, 2008; ISBN 978-0-470-51886-1. [Google Scholar]

- Martínez Vargas, J. From accrued to paid income tax: A review of effective tax rate calculation. Span. Account. Rev. 2015, 18, 68–77. [Google Scholar]

- Dyreng, S.D.; Hanlon, M.; Maydew, E.L. Long-run corporate tax avoidance. Account. Rev. 2008, 83, 61–82. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, H.; Tsai, S.-B.; Jiang, J.; Sun, Y.; Wang, J. An Empirical Study on Effective Tax Rate and CEO Promotion: Evidence from Local SOEs in China. Sustainability 2018, 10, 2007. [Google Scholar] [CrossRef]

| Non-Financial Companies with Data Available for 2008–2014 | 6772 |

|---|---|

| minus “Mining”, because SOEs represent 1.96% | (51) |

| minus “Manufacturing”, because SOEs account for 0.26% | (1904) |

| minus “Wholesale trade”, because SOEs account for 0.24% | (1235) |

| minus “Retail trade”, because there are no SOEs in this sector | (381) |

| minus entities with particular characteristics or subject to special regulations | (32) |

| Total companies | 3169 |

| Majority stake in capital held by the state—SOEs | 208 |

| Majority stake in capital held by private investors—NSOEs | 2961 |

| Panel A. Descriptive Statistics and Means Test | |||||||||||||||||

| Sample | SOEs | NSOEs | Means Test | ||||||||||||||

| P 25 | P 50 (Median) | P 75 | Mean | Minimum | Maximum | Mean | Mean | Difference | T Value | ||||||||

| GAAPETR1 | 0.2157 | 0.2951 | 0.3007 | 0.2585 | 0.0000 | 1.0000 | 0.1448 | 0.2648 | −0.1200 | −15.823 *** | |||||||

| GAAPETR2 | 0.0828 | 0.2831 | 0.3001 | 0.2040 | −2.4148 | 1.6667 | 0.0757 | 0.2130 | −0.1373 | −17.519 *** | |||||||

| GAAPETR3 | 0.0935 | 0.2754 | 0.3002 | 0.2016 | −2.1151 | 1.5963 | 0.0684 | 0.2108 | −0.1424 | −17.930 *** | |||||||

| CASHETR1 | 0.0000 | 0.1084 | 0.2968 | 0.1650 | 0.0000 | 1.0000 | 0.1024 | 0.1683 | −0.0659 | −9.575 *** | |||||||

| CASHETR2 | 0.0000 | 0.0000 | 0.2511 | 0.1193 | −1.5663 | 2.7471 | 0.0568 | 0.1236 | −0.0667 | −8.911 *** | |||||||

| CASHETR3 | 0.0000 | 0.0417 | 0.2475 | 0.1185 | −1.3268 | 1.8831 | 0.0542 | 0.1229 | −0.0688 | −9.004 *** | |||||||

| SIZE | 15.9475 | 16.8718 | 18.0488 | 17.0805 | 13.5860 | 21.8344 | 17.3391 | 17.0620 | 0.2771 | 6.643 *** | |||||||

| LEV | 0.4350 | 0.6614 | 0.8387 | 0.6325 | 0.0345 | 1.5211 | 0.5733 | 0.6367 | −0.0634 | −8.643 *** | |||||||

| CAPINT | 0.0163 | 0.1168 | 0.4430 | 0.2544 | 0.0000 | 0.9514 | 0.3347 | 0.2488 | 0.0859 | 10.394 *** | |||||||

| RD | 0.0000 | 0.0000 | 0.0000 | 0.0007 | 0.0000 | 0.0727 | 0.0004 | 0.0007 | −0.0003 | −3.540 *** | |||||||

| INVINT | 0.0000 | 0.0017 | 0.0185 | 0.0424 | 0.0000 | 0.7994 | 0.0833 | 0.0395 | 0.0438 | 9.622 *** | |||||||

| ROA | −0.0037 | 0.0260 | 0.0849 | 0.0403 | −0.5053 | 0.5152 | −0.0052 | 0.0434 | −0.0486 | −19.979 *** | |||||||

| FIRMAGE | 2.3323 | 2.8733 | 3.2997 | 2.7853 | −5.8999 | 4.8547 | 2.9468 | 2.7739 | 0.1729 | 9.151 *** | |||||||

| FOREIGN | 0.0000 | 0.0000 | 0.0000 | 0.2490 | 0.0000 | 1.0000 | 0.0625 | 0.2621 | −0.1996 | −28.337 *** | |||||||

| SME | 0.0000 | 0.0000 | 1.0000 | 0.3374 | 0.0000 | 1.0000 | 0.4707 | 0.3280 | 0.1427 | 10.376 *** | |||||||

| AUDIT | 1.0000 | 1.0000 | 1.0000 | 0.8816 | 0.0000 | 1.0000 | 0.9114 | 0.8795 | 0.0319 | 4.100 *** | |||||||

| Panel B. Correlation matrix | |||||||||||||||||

| GAAPETR1 | CASHETR1 | GAAPETR2 | CASHETR2 | GAAPETR3 | CASHETR3 | GOVOWN | SIZE | LEV | CAPINT | RD | INVINT | ROA | FIRMAGE | FOREIGN | SME | AUDIT | |

| GAAPETR1 | 1 | ||||||||||||||||

| CASHETR1 | 0.247 *** | 1 | |||||||||||||||

| GAAPETR2 | 1.000 *** | 0.195 *** | 1 | ||||||||||||||

| CASHETR2 | 0.198 *** | 1.000 *** | 0.168 *** | 1 | |||||||||||||

| GAAPETR3 | 0.411 *** | 0.188 *** | 0.352 *** | 0.121 *** | 1 | ||||||||||||

| CASHETR3 | 0.179 *** | 0.532 *** | 0.145 *** | 0.347 *** | 0.252 *** | 1 | |||||||||||

| GOVOWN | −0.200 *** | −0.076 *** | −0.119 *** | −0.056 *** | −0.131 *** | −0.070 *** | 1 | ||||||||||

| SIZE | −0.037 *** | 0.022 ** | −0.038 *** | −0.022 *** | −0.045 *** | −0.027 *** | 0.045 *** | 1 | |||||||||

| LEV | 0.123 *** | −0.044 *** | 0.025 *** | −0.046 *** | 0.036 *** | −0.067 *** | −0.059 *** | 0.118 *** | 1 | ||||||||

| CAPINT | −0.024 *** | 0.025 *** | −0.005 | −0.023 *** | −0.014 | −0.035 *** | 0.074 *** | 0.071 *** | −0.017 ** | 1 | |||||||

| RD | −0.026 *** | −0.020 ** | −0.025 *** | −0.019 *** | −0.020 ** | −0.012 | −0.018 *** | 0.006 | 0.019 *** | −0.055 *** | 1 | ||||||

| INVINT | −0.036 *** | −0.036 *** | −0.032 *** | −0.023 *** | −0.034 *** | −0.034 *** | 0.093 *** | 0.075 *** | 0.041 *** | −0.149 *** | 0.032 *** | 1 | |||||

| ROA | −0.010 | 0.062 *** | 0.091 *** | 0.134 *** | 0.091 *** | 0.143 *** | −0.106 *** | −0.089 *** | −0.279 *** | −0.104 *** | −0.025 *** | −0.097 *** | 1 | ||||

| FIRMAGE | −0.027 *** | 0.088 *** | −0.023 *** | 0.047 *** | −0.024 *** | 0.049 *** | 0.054 *** | 0.046 *** | −0.196 *** | −0.073 *** | 0.014 ** | 0.068 *** | 0.040 *** | 1 | |||

| FOREIGN | 0.004 | 0.011 | 0.000 | 0.010 | 0.007 | 0.028 *** | −0.114 *** | 0.115 *** | 0.028 *** | −0.177 *** | 0.129 *** | 0.041 *** | 0.026 *** | 0.080 *** | 1 | ||

| SME | −0.073 *** | −0.115 *** | −0.049 *** | −0.074 *** | −0.065 *** | −0.080 *** | 0.075 *** | −0.405 *** | −0.121 *** | 0.108 *** | −0.040 *** | −0.006 | −0.129 *** | −0.106 *** | −0.170 *** | 1 | |

| AUDIT | 0.054 *** | 0.175 *** | 0.020 *** | 0.087 *** | 0.007 | 0.074 *** | 0.024 *** | 0.140 *** | −0.026 *** | −0.036 *** | 0.036 *** | 0.009 | 0.032 *** | 0.263 *** | 0.061 *** | −0.226 *** | 1 |

| (I) | (II) | (III) | (IV) | (V) | (VI) | |

| GAAPETR1 | GAAPETR2 | GAAPETR3 | CASHETR1 | CASHETR2 | CASHETR3 | |

| GOVOWN | −0.1108 *** (−21.25) | −0.1110 *** (−12.97) | −0.1152 *** (−12.10) | −0.0604 *** (−7.67) | −0.0490 *** (−5.36) | −0.0495 *** (−5.64) |

| SIZE | −0.0073 *** (−8.28) | −0.0120 *** (−7.86) | −0.0149 *** (−8.78) | −0.0056 *** (−4.32) | −0.0092 *** (−5.64) | −0.0087 *** (−5.60) |

| LEV | 0.0562 *** (11.52) | 0.0444 *** (5.28) | 0.0513 *** (5.57) | −0.0292 *** (−4.07) | −0.0160 * (−1.80) | −0.0373 *** (−4.44) |

| CAPINT | −0.0041 (−0.93) | 0.0171 ** (2.23) | 0.0054 (0.63) | 0.0209 *** (3.17) | 0.0026 (0.31) | −0.0092 (−1.18) |

| RD | −0.9208 *** (−4.04) | −1.4060 *** (−3.67) | −1.0803 *** (−2.59) | −0.8039 *** (−2.59) | −1.0714 *** (−2.71) | −0.7785 ** (−2.07) |

| INVINT | −0.0441 *** (−3.76) | −0.0516 *** (−2.71) | −0.0591 *** (−2.72) | −0.0345 ** (−1.99) | −0.0383 * (−1.88) | −0.0388 ** (−1.95) |

| ROA | −0.0453 *** (−3.44) | 0.1975 *** (10.21) | 0.1814 *** (8.37) | 0.0782 *** (4.01) | 0.2926 *** (14.25) | 0.2296 *** (11.62) |

| FIRMAGE | −0.0045 *** (−2.78) | −0.0072 *** (−2.47) | −0.0059 * (−1.72) | 0.0112 *** (4.70) | 0.0069 ** (2.26) | 0.0089 *** (2.85) |

| FOREIGN | −0.0066 *** (−2.48) | −0.0081 * (−1.66) | −0.0080 (−1.48) | −0.0015 (−0.39) | −0.0052 (−1.02) | 0.0085 * (1.71) |

| SME | −0.0207 *** (−7.19) | −0.0302 *** (−5.98) | −0.0430 *** (−7.79) | −0.0381 *** (−8.97) | −0.0357 *** (−6.67) | −0.0359 *** (−7.12) |

| AUDIT | 0.0227 *** (5.65) | 0.0224 *** (3.13) | 0.0049 (0.56) | 0.0923 *** (15.86) | 0.0681 *** (9.02) | 0.0510 *** (6.44) |

| Sector | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Wald Test | 987.28 *** | 561.60 *** | 522.90 *** | 667.45 *** | 582.22 *** | 523.57 *** |

| Observations | 13,231 | 19,270 | 14,128 | 12,804 | 19,252 | 14,119 |

| Panel A. Results of Estimations | |||||||

| (I) | (II) | (III) | (IV) | (V) | (VI) | ||

| GAAPETR1 | GAAPETR2 | GAAPETR3 | CASHETR1 | CASHETR2 | CASHETR3 | ||

| GOVOWN | −0.1751 * (−1.92) | −0.0178 (−0.13) | −0.0398 (−0.25) | −0.1470 (−1.07) | −0.1474 (−0.99) | 0.1347 (0.93) | |

| SIZE | −0.0073 *** (−8.16) | −0.0121 *** (−7.68) | −0.0151 *** (−8.56) | −0.0056 *** (−4.25) | −0.0094 *** (−5.61) | −0.0079 *** (−4.93) | |

| GOVOWxSIZE | 0.0114 *** (2.64) | 0.0032 (0.49) | 0.0036 (0.52) | 0.0124 * (1.91) | 0.0092 (1.35) | −0.0061 (−0.94) | |

| LEV | 0.0520 *** (10.44) | 0.0407 *** (4.67) | 0.0499 *** (5.24) | −0.0369 *** (−5.02) | −0.0238 *** (−2.57) | −0.0426 *** (−4.91) | |

| GOVOWNxLEV | 0.0389 * (1.76) | 0.0241 (0.71) | −0.0085 (−0.22) | 0.1565 *** (4.68) | 0.0944 *** (2.60) | 0.0721 ** (2.04) | |

| CAPINT | −0.0010 (−0.22) | 0.0217 *** (2.73) | 0.0078 (0.88) | 0.0249 *** (3.71) | 0.0086 (1.02) | −0.0079 (−0.99) | |

| GOVOWNxCAPINT | −0.1092 *** (−4.85) | −0.0995 *** (−3.02) | −0.0732 ** (−2.01) | −0.0645 * (−1.86) | −0.0782 ** (−2.23) | −0.0043 (−0.13) | |

| RD | −1.0415 *** (−4.55) | −1.6073 *** (−4.12) | −1.1319 *** (−2.68) | −0.8789 *** (−2.80) | −1.0940 *** (−2.72) | −0.7618 ** (−2.01) | |

| GOVOWNxRD | 4.0810 *** (3.00) | 5.2810 *** (2.55) | 1.9834 (0.75) | 2.5752 (1.31) | 1.6380 (0.75) | 0.6001 (0.25) | |

| INVINT | −0.0209 * (−1.68) | −0.0299 (−1.46) | −0.0395 * (−1.69) | −0.0142 (−0.75) | −0.0330 (−1.51) | −0.0246 (−1.15) | |

| GOVOWNxINVINT | −0.1451 *** (−3.68) | −0.1189 * (−1.89) | −0.0601 (−0.84) | −0.0905 (−1.59) | 0.0546 (0.82) | 0.0015 (0.02) | |

| ROA | −0.0431 *** (−3.27) | 0.1950 *** (9.86) | 0.1800 *** (8.13) | 0.0716 *** (3.65) | 0.2930 *** (13.96) | 0.2309 *** (11.43) | |

| GOVOWNxROA | 0.2143 ** (2.00) | 0.1423 (1.44) | 0.1715 (1.57) | 0.3189 ** (2.01) | −0.0077 (−0.07) | −0.0021 (−0.02) | |

| FIRMAGE | −0.0046 *** (−2.79) | −0.0068 ** (−2.29) | −0.0056 (−1.58) | 0.0121 *** (5.02) | 0.0064 ** (2.03) | 0.0094 *** (2.92) | |

| GOVOWNxFIRMAGE | 0.0036 (0.41) | −0.0054 (−0.39) | −0.0080 (−0.48) | −0.0342 *** (−2.62) | 0.0056 (0.38) | −0.0125 (−0.81) | |

| FOREIGN | −0.0065 ** (−2.44) | −0.0086 * (−1.75) | −0.0084 (−1.54) | −0.0014 (−0.35) | −0.0045 (−0.86) | 0.0094 * (1.87) | |

| GOVOWNxFOREIGN | −0.0056 (−0.25) | 0.0371 (1.06) | 0.0206 (0.53) | 0.0337 (0.96) | −0.0421 (−1.13) | −0.0295 (−0.81) | |

| SME | −0.0168 *** (−5.69) | −0.0284 *** (−5.42) | −0.0405 *** (−7.06) | −0.0360 *** (−8.22) | −0.0356 *** (−6.39) | −0.0320 *** (−6.11) | |

| GOVOWNxSME | −0.0634 *** (−5.15) | −0.0381 * (−1.90) | −0.0467 ** (−2.09) | −0.0297 (−1.58) | 0.0067 (0.31) | −0.0522 *** (−2.52) | |

| AUDIT | 0.0259 *** (6.20) | 0.0223 *** (3.03) | 0.0044 (0.48) | 0.0947 *** (15.95) | 0.0724 *** (9.29) | 0.0532 *** (6.49) | |

| GOVOWNxAUDIT | −0.0372 * (−1.83) | −0.0009 (0.03) | 0.0068 (0.19) | −0.0458 (−1.56) | −0.0759 ** (−2.37) | −0.0231 (−0.72) | |

| Sector | Yes | Yes | Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | |

| Wald Test | 1241.37 *** | 624.31 *** | 570.54 *** | 750.68 *** | 623.23 *** | 556.58 *** | |

| Observations | 13,231 | 19,270 | 14,128 | 12,804 | 19,252 | 14,119 | |

| Panel B. Sum of Coefficients | |||||||

| Explanatory Variable | Coefficient | GAAPETR1 | GAAPETR2 | GAAPETR3 | CASHETR1 | CASHETR2 | CASHETR3 |

| SIZE | β2 + β3 | 0.0041 *** | −0.0089 | −0.0115 | 0.0068 * | −0.0002 | −0.014 |

| LEV | β4 + β5 | 0.0909 * | 0.0648 | 0.0414 | 0.1196 *** | 0.0706 *** | 0.1147 ** |

| CAPINT | β6 + β7 | −0.1102 *** | −0.0778 *** | −0.0654 ** | −0.0396 * | −0.0696 ** | −0.0122 |

| RD | β8 + β9 | 3.0395 *** | 3.6737 *** | 0.8515 | 1.6963 | 0.544 | −0.1617 |

| INVINT | β10 + β11 | −0.1660 *** | −0.1488 * | −0.0996 | −0.1047 | 0.0216 | −0.0231 |

| ROA | β12 + β13 | 0.1712 ** | 0.3373 | 0.3515 | 0.3905 ** | 0.2853 | 0.2288 |

| FIRMAGE | β14 + β15 | −0.001 | −0.0122 | −0.0136 | −0.0221 *** | 0.012 | −0.0031 |

| FOREIGN | β16 + β17 | −0.0121 | 0.0285 | 0.0122 | 0.0323 | −0.0466 | −0.0201 |

| SME | β18 + β19 | −0.0802 *** | −0.0665 * | −0.0872 ** | −0.0657 | −0.0289 | −0.0842 *** |

| AUDIT | β20 + β21 | −0.0116 * | 0.0232 | 0.0112 | 0.0489 | −0.0035 ** | 0.0301 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fernández-Rodríguez, E.; García-Fernández, R.; Martínez-Arias, A. Influence of Ownership Structure on the Determinants of Effective Tax Rates of Spanish Companies. Sustainability 2019, 11, 1441. https://0-doi-org.brum.beds.ac.uk/10.3390/su11051441

Fernández-Rodríguez E, García-Fernández R, Martínez-Arias A. Influence of Ownership Structure on the Determinants of Effective Tax Rates of Spanish Companies. Sustainability. 2019; 11(5):1441. https://0-doi-org.brum.beds.ac.uk/10.3390/su11051441

Chicago/Turabian StyleFernández-Rodríguez, Elena, Roberto García-Fernández, and Antonio Martínez-Arias. 2019. "Influence of Ownership Structure on the Determinants of Effective Tax Rates of Spanish Companies" Sustainability 11, no. 5: 1441. https://0-doi-org.brum.beds.ac.uk/10.3390/su11051441