1. Introduction

With a NECI (National Entrepreneurship Context Index) score of 5.21 (min = 1, max = 10) calculated by the Global Entrepreneurship Monitor (GEM), the most important study on entrepreneurship in the world, Mexico ranked 23 in 2018 (out of 54 economies) in the establishment of start-ups. The creation of new firms in Mexico has seen steady growth after the 2008 Global Economic Crisis and has been primarily impulsed by 3-helix entrepreneurial schemes formed by private firms impulsed by cultural and social norms (6.21, measured in a 9-point Likert scale, 1 = highly insufficient and 9 = highly sufficient), government entrepreneurship programs (5.63), and higher education institutions (HEIs)(6.45). As a result, Mexico has more than doubled its early-stage entrepreneurial (TEA) rate compared to 2010 (10%) and is higher than both the average of the Latin American countries (19.9%) and efficiency-driven economies (15%) [

1].

Entrepreneurs search for sustainable long-term business development by launching and leading high-growth firms in terms of job creation, wealth generation, and the development of effective entrepreneurial role models to maximize firm performance [

2,

3], especially when entrepreneurs increase their perceived behavioral control [

4] and imitate reputed and successful entrepreneurs [

5]. High-growth firms surge when they dispose of opportunity-based entrepreneurs, have large amounts of information, and are broad-market oriented [

6,

7,

8]. Business growth accelerates when both working performance and efficient management are satisfactory, and entrepreneurial competencies achieve a critical set of optimal input mix [

9]. International markets also speed up firms’ growth because they open new business opportunities [

10]. As a result, entrepreneurs seek global markets when they (a) have products or services suitable for exportation; (b) face small or immature domestic markets; (c) have intense local and regional competition; and (d) desire to leverage substantial investments in their firms. Consequently, organizations involved in exporting activities are more likely to grow [

11,

12], so there is a growing trend in the literature on entrepreneurship that unites international business and entrepreneurship [

13].

In this study, we find that it is easier to identify potentially high-growth firms, only if they combine innovative behavior, product newness, export orientation, entrepreneurial growth aspirations, new technology, and financial capital. Skills development and new competencies related to creative practice reduce perceived risks and challenges generated during organizational growth [

14]. When perceived threats reduce, and entrepreneurial leadership emerges, firms grow, enhancing the intangible resources of a territory [

15], especially when new business opportunities arise [

16,

17,

18]. This business effect is only moderated by the entrepreneurial culture of the firm [

19]. Also, growth-oriented entrepreneurs emphasize innovation, technological change, and organizational development as critical elements for business development [

20] and leadership, which has a positive influence on other entrepreneurs by enhancing two dimensions of psychological empowerment: meaning and impact [

21]. These findings suggest that the attitude for entrepreneurial growth is moderately attributable to the entrepreneurial and innovative behavior of the firm.

In this changing process, finance plays a vital role. The amount of financial capital available to support strategic endeavors impacts entrepreneurial decisions and affects ventures’ growth. Both innovation and the mode of entry into international markets require high levels of financial resources for business development [

22,

23]. However, little consideration has been given to the indirect relationship between financial capital and new ventures’ growth [

24]. Thus, we argue that financial capital reinforces both innovation and exports, which increases entrepreneurial growth aspirations.

This paper contributes to the literature through the analysis of the entrepreneurial growth aspirations of the firm in an efficiency-driven economy and the possibility to identify potential high-growth entrepreneurs through their innovative behavior and export orientation in the presence of financial capital. This study is relevant in a context where the number of entrepreneurs is increasing in Mexico, and there is a shortage of venture capital in the nation.

Section 2 outlines the theoretical framework and the hypotheses derived from it.

Section 3 describes the empirical analysis based on hierarchical regression.

Section 4 presents the results and discussion. The paper ends with conclusions related to financial capital, innovative behavior, and export orientation as predictors for sustainable development moderated by financial capital.

2. Theoretical Framework and Hypothesis

Since 2004, the World Economic Forum ranks countries based on its Global Competitiveness Report (GCI), which integrates the macroeconomic and the micro/business aspects of competitiveness into a single index. The report weighs the capacity of nations to deliver high levels of prosperity and economic wealth to their inhabitants. This fact, in turn, depends on how productively a country uses available economic resources. The GCI separates countries into three specific stages: innovation-driven, factor-driven, and efficiency-driven, each implying a growing degree of complexity in the firm.

An innovation-driven economy is described by idiosyncratic producers and an extraordinary segment of services in the marketplace. The ability to produce innovative products and services at the global technology frontier using the most advanced methods becomes the dominant source of competitive advantage.

Factor-driven economies are susceptible to exchange rate fluctuations, especially in third-world countries, economic cycles, and commodity prices. Underlying factor conditions, such as low-cost labor and unprocessed natural resources, are the dominant basis of competitive advantage and exports. In efficiency-driven economies, substantial investment in efficient infrastructure, business-friendly government administration, strong investment incentives, improving skills, and better access to investment capital allow significant improvements in productivity. A country’s advantage comes from producing more advanced products and services more efficiently.

For an efficiency-driven country such as Mexico, notwithstanding a higher concentration of challenges at the efficiency enhancers’ level, one can find important opportunities for boosting competitiveness in the areas of essential requirements and innovation and sophistication factors [

25]. As nations move into the innovation-driven phase, they can bear higher salaries and increasing standards of living if their organizations can compete by offering new or unique products and services in the market. At this phase, enterprises must compete by producing innovative goods with the help of very sophisticated and refined production processes rooted in knowledge and innovation.

Previous research suggests that entrepreneurial role models boost entrepreneurial attitudes [

26] and set four prerequisites for firm growth: abilities, knowledge, willingness, and business opportunities. As a result, we define sustainable business development as the set of business strategies based on knowledge, innovation, entrepreneurial capacity, and the skills of the company’s internal stakeholders to maximize value in the product and/or service offered in the market with the double goal of satisfying customers and preserving the environment. Sustainable business development is the result of entrepreneurial goal-directed behavior, intention being an essential predictor for firm growth [

27,

28]. Managerial skills are needed for pointing and obtaining other growth-related assets, such as organizational strategies, human resources, good relations with stakeholders, financial resources [

29,

30,

31], and administrative skills [

32,

33,

34]. Market changes offer business opportunities for growth based on strategies performed by firms or individuals [

35,

36]; thus, these opportunities derive from external business environments and are an exogenous factor for firm’s growth, where both innovative behavior and product newness have an essential role to play.

Sustainable business development directly depends on sustainable management, defined by the formulation, implementation, and evaluation of both environmental and socioeconomic sustainability-related decisions and actions [

37,

38].

2.1. Innovative Behavior, Product Newness, and Entrepreneurial Growth Aspirations

Innovative market changes offer new growth opportunities [

32,

39] supported by the combination of product newness, original market–product strategies, and business policies focused on satisfying market niches. These elements provide additional revenue and growth opportunities to the firm [

20,

40,

41,

42], especially in regions and nations endowed with a high-approval entrepreneurial environment [

43]. However, it may be impossible for the firm to exploit business opportunities if the organization suffers from financial restrictions. To take advantage of business opportunities or to adjust business actions, entrepreneurs need to focus their firms on constant renewal and rethinking of the firm [

20,

44,

45,

46,

47,

48] to increase their market niche through business innovation.

Firms may renovate their processes, join new markets, adjust the procedure of production resources, and host innovative products and services to the market [

48] when taking advantage of growth opportunities, or developing the abilities required for growth [

49,

50]. Creative behavior is a measure to adapt and adjust the firm to secure business continuity, where coworkers’ feedback is more critical than supervisors’ response to increasing innovative actions [

51,

52,

53,

54].

Literature shows that enhancement in the capability to implement new products in the market is positively associated with firm performance, human resources abilities, and business growth [

36,

48,

49,

50]. Similarly, innovative internal capabilities, such as process improvement, firm performance, organizational growth, and profitability [

55,

56,

57,

58], determine investment in the firm. Likewise, external technology acquisitions may even enhance this effect [

59,

60], especially when practitioners and employees carry out skills, motivation, and opportunity-enhancing jobs [

61] guided by business-focused personality traits [

62].

When firms grow through internal mechanisms, ventures use innovative product development and marketing practices to identify and develop products to capture prospective clients. Businesses innovate to offer a new (or improved) product or service in the market [

63]. Both innovations (new and incremental) are essential to the venture, but both elements have differing implications for growth performance. For new ventures, initial product entries have the most definite potential to increase the venture’s market share [

64,

65]. Once a firm is established, human resources are essential for organizational sustainability [

66], defined as the adoption of a business model to create value that is consistent with the long-term safeguarding and improvement of environmental, social, and financial capital [

67]. Even then, research suggests that firms endowed with novel products achieve a better position for higher success [

68]. Innovation practices, such as the development of new products and services, have a positive and direct effect on business growth [

69] that is influenced directly by behavior (affective, behavioral, cognitive), direction (change, adapt, disengage), and time [

70]. As a result, we hypothesize that

H1: Product newness has a positive impact on the entrepreneurial growth aspirations of the firm.

2.2. Business Competition and Entrepreneurial Growth Aspirations

Another measure of product uniqueness is the competition level. Well-positioned market niches with increasing customer demands are more worthy than highly saturated markets endowed with full competition [

70]. The goal of a firm is to be competing both in blue oceans [

71] and purple oceans [

72] to sustain organizational growth, as opposed to red oceans defined by high competition. We expect that a firm facing less competition will have more opportunities to grow, as opposed to a firm facing intense competition in red oceans.

The attitude toward entrepreneurial growth may be partially attributable to the innovative conduct of the firm. However, a reduction in the perceived uncertainty and the increase of expected positive outcomes related to creative practice enhance the organizational aspirations for growth. To date, there is no consensus about the role of innovation regarding high expectations for business growth. Goals for growth go together with wishes in terms of innovation, exports, foreign investment, and the amount of capital needed to grow [

16,

73], but high levels of innovation do not necessarily coincide with business growth aspirations [

74,

75]. As a result, we hypothesize that

H2: Low competition has a positive effect on the entrepreneurial growth aspirations of the firm.

2.3. Technology and Entrepreneurial Growth Aspirations

These ideas highlight the importance of how technology-based strategies maintain the internal innovation level for new ventures’ growth [

76]. Research suggests that the combination of new products and services, frequency of products and services upgrades, and the use of external technology sources, patents, copyrights [

77], advanced technologies [

78], and technologically advanced partners make significant contributions for new ventures’ growth.

These results show that the role of innovation to reach entrepreneurial success requires additional research, as it is still unclear whether innovation is a prerequisite for strengthening business aspirations and expectations for growth [

79]. As a result, we hypothesize that

H3: Recent technology has a positive effect on the entrepreneurial growth aspirations of the firm.

2.4. Export Orientation and Entrepreneurial Growth Aspirations

As trade is becoming increasingly important in the global economy, firms need a minimum internationalization degree to be active in many markets with the final goal of innovating for sustainable business growth [

80]. Especially in some high-tech industries, a firm producing innovative products with a limited domestic market is forced to be internationalized. This internationalization process is low, on average, in factor-driven economies, but increases with economic development [

81]. Export orientation represents an aspect of globalization that measures trade flows, foreign direct investment, trade barriers, portfolio investment, and capital restrictions. Sometimes, export orientation is an essential dimension of the entrepreneurial growth aspirations of the firm [

82].

However, not only multinationals are internationally-oriented, as new and smaller firms are, using the latest technologies for increasingly broadening the scope of their business. Exporting is the first and most common step for a firm’s international expansion [

83,

84,

85], including new foreign ventures [

80]. An increasing number of startups pursue global markets [

86,

87,

88], especially in Asia and Europe. The growing significance of early internationalizing firms (international new ventures) challenges traditional internationalization perspectives [

89,

90]. Global new enterprises benefit from reductions and subsidies to reduce international transportation costs and investment barriers, with the final goal of increasing foreign trade and R&D [

91,

92]. As a result, there is a positive relationship between exports with entrepreneurial growth aspirations and expected business growth [

93]. As a result, we hypothesize that

H4: Export orientation has a positive effect on the entrepreneurial growth aspirations of the firm.

2.5. The Interaction of Financial Capital, Innovative Behavior, and Export Orientation on Entrepreneurial Growth Aspirations

Financial capital influences the employment for growth performance of nascent firms. A high level of financial capitalization is outstanding because entrepreneurs buy time to execute strategic objectives successfully, and this enables entrepreneurs to either undertake more ambitious strategies or change their course of business action. As a result, financial capitalization empowers entrepreneurs to meet the financing demands required to sustain business growth [

94].

The demand for financial resource requirements varies by the type of strategic initiative a venture undertakes. Financial and knowledge-based resources are particularly necessary for supporting significant strategic initiatives carried out by entrepreneurs [

95]. Innovation activities, for example, can require high levels of financial resources. Similarly, international expansion can be a costlier endeavor than just expanding domestically because of substantially higher transportation and transaction costs and higher business expectations. In short, firms wishing for rapid growth need higher levels of financial resources.

Financial capital provides the flexibility needed to support the firm’s strategic endeavors and to investigate how entrepreneurs have to accumulate financial wealth to benefit their startups. Recent contributions on aspirations for business growth suggest that ambitious entrepreneurs raise finance to support their expectations [

96] and to obtain financial resources from savings, family, and friends, but soon require additional funds to finance their business growth, and entrepreneurs with less innovative technologies tend to use their savings for growth. For more innovative technologies, financial capital often comes from external sources of capital, such as banks or venture capitalists. Similarly, exportations involve the discovery and exploitation of business opportunities abroad and require substantial quantities of money and other resources, which are often limited in new ventures.

Literature leads us to ask if significantly higher growth aspirations of new entrepreneurs result from the interaction effect between external financial capital, innovative behavior, and export orientation. We argue that high financial capital reinforces innovation behavior, export orientation, and entrepreneurial growth aspirations. Consequently, the main hypothesis and four secondary hypotheses H5 are suggested:

H5: Financial capital moderates positively the effect of product newness, low competition, recent technology, and export orientation on entrepreneurial growth aspirations.

H5a: Financial capital moderates positively the effect of product newness on entrepreneurial growth aspirations.

H5b: Financial capital moderates positively the effect of low competition on entrepreneurial growth aspirations.

H5c: Financial capital moderates positively the effect of recent technology on entrepreneurial growth aspirations.

H5d: Financial capital moderates positively the effect of export orientation on entrepreneurial growth aspirations.

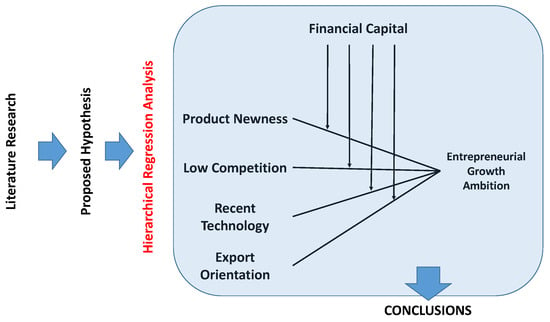

We propose and empirically test an innovative behavior and export-oriented model of growth aspirations to identify the determinants that might increase the growth aspirations of Mexican new entrepreneurs, as shown in

Figure 1.

3. Data and Methodology

To test these hypotheses, we use a sample of 512 Mexican new entrepreneurs drawn from the national adult population survey (APS) of the Global Entrepreneurship Monitor (GEM) surveys for the 2001–2014 period. We have chosen these years, according to GEM data availability in Mexico, because they coincide with the ruling of the National Action Party, which led to an entrepreneurial-oriented change for the first time in 70 years in Mexico, as it was partly focused on encouraging entrepreneurship and business creation. In the study, we use young firms as our proxy for entrepreneurial entry. This category serves the purpose of our study well because growth aspirations refer to firms established in the market. Also, young firms provide good coverage of the current level of employment used in our dependent variable.

3.1. Entrepreneurial Growth Aspirations

According to GEM, opportunity-driven entrepreneurs start their businesses, instead of searching for employment. An interesting but small subsegment of opportunity-driven entrepreneurs is made up of individuals who aspire to create growth-oriented firms. GEM data on growth expectations for new entrepreneurs is measured in terms of the number of jobs to be created within the next five years and is defined by similar firms in size, so there is no size effect of job creation. This is a continuous variable. As the distribution is biased, in our study we use a natural logarithm of expected jobs.

3.2. Innovative Behavior

Innovative behavior is evaluated from both perspectives of the market and industry in three ways: customer-, competitor-, and technology-orientated innovation. We use three indicators (dummy variables) for a new venture’s innovativeness. First, an indicator is used to reflect a venture’s new product/service offered to customers (Product Newness) (Yes, code 1; No, code 0). Second, we apply an indicator to analyze when entrepreneurs perceive that few competitors offer the same product or service in the market (Low Competition) (Yes, code 1; No, code 0). Third, we study if firms use available technologies aged less than one year (Recent Technology) (Yes, code 1; No, code 0).

3.3. Export Orientation

Export orientation assesses the extent to which entrepreneurs sell their products and services to foreign customers. This element is coded 1 for new ventures with at least 1% of foreign customers and coded 0 for new ventures with domestic customers only.

3.4. Financial Capital

In our study, financial capital is measured as the ratio of domestic credit granted to the private sector compared to GDP, as defined by the International Monetary Fund’s International Financial Statistics. This measure has been used by Klapper et al. [

97], as a proxy to measure financial capital. Regarding entrepreneurship, financial capital targeted at entrepreneurship is measured as the average of the scores (5-point Likert scale) on six questions (In my country: (a) there is sufficient equity funding available for new and growing firms; (b) there is sufficient debt funding available for new and growing firms; (c) there are sufficient government subsidies available for new and growing firms; (d) there is sufficient funding available from private individuals (other than founders) for new and growing firms; (e) there is sufficient venture capitalist funding available for new and growing firms; and (f) there is sufficient funding available through initial public offerings (IPOs) for new and growing firms) that capture whether financial capital is projected into a corporation aimed at entrepreneurship [

98]. This construct evidences good construct reliability [

99].

3.5. Controls

Previous elements have linked entrepreneurs and firms regarding entrepreneurial growth intentions. The following elements are potential explanatory variables for new entrepreneurs’ differing growth aspirations: Age (squared and mean-centered); Gender (Male = 1, Female = 0); Education (Tertiary = 1, Secondary and Primary = 0); Skills & Knowledge (Skills and Knowledge to start a business = 1, No Skills and Knowledge = 0); Business angels, defined as investments on startups during the past 3 years only (Yes = 1, No = 0); Current jobs (Yes = 1, No = 0); Industry structure (Yes = 1, No = 0); and Year dummies (Year 2001 = 0, Years 2002–2014 = 1). We have chosen these years, according to GEM data availability in Mexico, and because these years coincide with the ruling of the National Action Party, which led to an entrepreneurial-oriented change for the first time in 70 years in Mexico, as it was partly focused on encouraging entrepreneurship and business creation. Besides this, as a methodological control, we include in our analyses the GEM established business ownership (EBO) rate.

The hypotheses were tested using hierarchical regression analysis. The hierarchical regression approach is necessary since an interaction effect exists, but it is only relevant if the interaction term gives a significant contribution over and above the individual predictor effects model.

4. Results and Discussion

To calculate the sample size, we used the following formula

where:

- n

Size of the random sample

- z

Critical value of the standard normal for a confidence level. In this study, the confidence level is 95% (z = 1.96)

- e

Error (0.05)

- N

Population size (200,000)

- pq

Degree of heterogeneity. With absolute uncertainty (p = q = 0.5), this value maximizes.

Under the above expression, the minimum sample size required is 384 units (95% confidence level), and our sample reached 512 units, so the sample used is representative and valid as GEM data was used. Related to entrepreneurship, the GEM classifies firms in three groups: startup businesses (nascent entrepreneurs), new firms (up to 3.5 years old), and established firms (more than 3.5 years old). The combination of nascent and new firms is called TEA (Total Early-stage Entrepreneurial Activity). In this study, these 512 Mexican businesses are new firms only, so there is no size effect in the sample (

Table 1).

Table 2 shows descriptive statistics (mean and standard deviation, SD), and

Table 2 displays the correlation matrix. The control variables of age, gender, education, skills and knowledge, business angles, skills, current jobs, and GEM established business ownership (EBO) rate were first entered in a base model (Model 1) with no predictors and no interactions, as reported in column 1 (

Table 3). This model 1 explains a statistically significant share of the variance of the growth aspirations dependent variable (R

2 = 0.12,

p < 0.001).

The results shown in the correlation matrix display the entrepreneurial reality in Mexico. No value exceeds 0.8, which shows a weak degree of correlation between all the analyzed elements. Concerning age (column 1), the matrix displays meager correlation rates. Contrary to developing countries, such as Mexico, developing nations’ seniors are more driven by opportunity than necessity entrepreneurship and are primarily internally motivated [

100], as they have the skills, financial resources [

27], and time available to contribute to economic activity [

101]. With regards to gender (column 2), correlations are also low, and there are no substantial differences between the values, education being the highest correlation value (0.155), which shows that higher educational levels slightly increase entrepreneurial growth ambition.

Regarding education (column 3), the highest correlation value is shown between education and financial capital (0.382), which shows that investors and lenders rely on educated entrepreneurs when they grant loans. Skills and knowledge (column 4) are mainly correlated with export orientation (0.072), which shows that more knowledge and skills in international markets help, among other factors, to expand the company abroad. Managerial skills are less correlated with financial capital (0.048) and business angles (0.036). As expected, business angles (column 5) are more correlated with financial capital (0.067) and product newness (0.047) having the tendency to finance preferably new products and services in the market, primarily when firms export new products and services abroad (0.498, column 8) resulted from low competition (0.466, column 9). Regarding employment (column 6), the highest correlation value lies in the financial capital (0.086) followed by export orientation (0.085) since part of the capital obtained or generated in the company is destined to the creation of jobs as organizations grow. Business growth that accelerates when the firms open to new foreign markets.

As seen in

Table 4, the authors have used hierarchical regression to analyze three models formed by control variables only (model 1), control variables and predictors (model 2), and control variables, predictors, and interactions with financial capital (model 3). Regarding model 1, only three control variables have a statistically significant influence on entrepreneurial growth ambition: business angels (0.258,

p < 0.01), gender (0.200,

p < 0.05), and current jobs (0.116,

p < 0.01) which shows that the entrepreneurial growth ambition is mainly fed by the capital contributed by business angels and, to a lesser extent, by gender and work creation.

In model 2, recent technology is the only statistically significant variable as a predictor (1.163, p < 0.01) and has a positive sign, which shows a direct relationship between recent technology and the entrepreneurial growth ambition. This positive impact strengthens when the acquisition and adaptation of brand-new technology into the firm reinforces other elements related to the effective implementation of this technology, such as excellent managerial skills, efficient adaptation costs, and real-time technical collaboration with providers. This direct relationship continues in model 3, where the recent technology is a significant variable, as a predictor (1.352, p < 0.01) interacted with financial capital (0.093, p < 0.05). There is no evidence that product newness, low competition, export orientation, and financial capital have a predictor effect relationship with entrepreneurial growth aspirations.

Besides recent technology, the second statistically significant variable in model 3 is product newness only when interacting with financial capital (0.043,

p < 0.05). Product newness also has a positive sign, so this element increases the entrepreneurial growth ambition of the firm. According to these findings, both product newness and recent technology have a direct impact on entrepreneurial growth ambition, as financial capital interacts with innovative behavior, at least partly, by adapting current technology. Results are shown in

Figure 2.

The moderating effects of financial capital found in this study offer a new perception of the connection between innovative behavior and growth aspirations. As new firms face constant uncertainty and environmental change and struggle against the competition, both financial capital and recent technology seem to help firms in taking advantage of discovering opportunities for growth.

Examining the regression coefficients of the interaction terms, it is evident that financial capital moderates the relationship between product newness and growth aspirations and between recent technology and growth aspirations, but not in the case of the interaction of low competition and growth ambition, and export orientation and growth aspiration.

These results seem to claim causality, as there is a direct relationship between significative causes (product newness and recent technology) and the final effect (entrepreneurial growth aspirations), as the combination of product newness and recent technology (X) increases entrepreneurial growth aspirations (Y). Three commonly accepted conditions must hold to the claim that X causes Y: functional relationship between cause and effect, non-spuriousness (for a relationship between X and Y to be non-spurious, there must be a Z that causes both X and Y, so that the relationship X and Y vanishes once Z is controlled) [

102], and time precedence (for X to cause Y, X must precede Y in time, causing in such time precedence a causal asymmetric relationship. As a result, while X

t causes Y

t+k, it is not possible that Y

t+k causes X

t) [

103] By fulfilling these conditions, in our model the combination of product newness and recent technology (X) increases entrepreneurial growth aspirations (Y).

Contrary to what happens in our model, if causality either runs from Y to X or runs both ways (simultaneity) is only when the endogeneity problem emerges. The endogeneity problem arises when the explanatory variables and the error term are correlated in a regression model, leading to biased and inconsistent estimates [

104]. Endogeneity surges in the presence of simultaneity, measurement error, and omitted variables caused by excluded fixed effects and selection [

105].

To avoid the endogeneity problem, we have used GEM data in our study, because GEM surveys are randomized, which is a failsafe way to eliminate endogeneity, as important sources of endogeneity are the omitted variables bias, caused by omitting fixed effects, omitting selection, and the problem of simultaneity [

105]. All the prevailing econometric remedies to address the endogeneity problem, the Generalized Method of Moments (GMM) has the most significant correction effect on the bias, followed by instrumental variables (IV approach), fixed effects models, lagged dependent variables, and the addition of more meaningful control variables, firm fixed effects, and year fixed effects [

104], but to mitigate the endogeneity problem, more and more researchers consider firm fixed effects to control for time-invariant firm-specific information [

106].

Related to the endogeneity problem, firm size affects the independent and dependent variables simultaneously, and it is a more crucial firm characteristic than other control variables [

106]. It is, therefore, advisable to avoid a sharp disparity in the firm size of the companies analyzed. For that reason, of the three groups of companies used in GEM, startup businesses (nascent entrepreneurs), new firms (up to 3.5 years old), and established firms (more than 3.5 years old), we have analyzed new firms only. The reason for this choice is that, inside the TEA, they are the most numerous in the Mexican business reality.

The endogeneity problem can also be driven by unobservable CEO/entrepreneur characteristics. To diminish this problem, Coles and Li [

107] find that CEO/entrepreneur fixed effects capture managerial ability, human capital, and risk aversion, and combined with observable attributes, supply 80–90% of explained variation in managerial delta (the sensitivity of managerial wealth to stock price) and vega (the sensitivity of expected managerial wealth to stock volatility). Unobserved manager attributes deliver a high proportion of explained variation in the dependent variable for executive wealth-performance sensitivity, board independence, the board size, and sensitivity of expected executive compensation to firm risk [

108].

Robustness

Regarding structural change, we have used a Chow breakpoint (year 2008) test using GEM data (

Table 5), as there is no parameter instability, the error terms u

1t and u

2t are independently distributed, and in the subperiod regressions are normally distributed with the same (homoscedastic) variance σ

2, that is, u

1t ~ N(0,σ

2) and u

2t ~ N(0,σ

2) to obtain the restricted residual sum of squares (RSS

R) for the time period 2001–2014 with df (degrees of freedom) = n

1 + n

2 - k, where k is the number of parameters estimated, restricted to not different subperiod regressions (λ

1 = γ

1 and λ

2 = γ

2). Since the two sets of samples are deemed independent, we can add RSS

1 (2001–2008) and RSS

2 (2009–2014) to obtain the unrestricted residual sum of squares (RSS

UR) with df = n

1 + n

2 − 2k to study if the First Global Financial Crisis that began in 2008 after the Lehman Brothers bankruptcy and tightening of the conditions for granting financial capital to companies has caused a structural change in both TEA (Total Early-Stage Entrepreneurial Activity) and EBO (Established Business Ownership) in Mexico.

The Chow test affirms that with no structural change then, the RSS

R and RSS

UR should not be statistically different. Therefore, if we form the following ratio:

We apply the Chow Breakpoint Test (breaking point = 2008) to observe if there are no breaks at specified breakpoints (null hypothesis). The results obtained are shown in

Table 6.

As the Chow breakpoint (Year 2008) test of structural change for GEM TEA data is F(1,8) = 0.921393 < qF(0.95,1,8) = 5.3177 and F(1,8) p-value = 0.365218 > 0.05, we accept the null hypothesis. As a result, no structural change is observed, and the GEM TEA data is robust and structurally stable. Similarly, as the Chow breakpoint (Year 2008) test of structural change for GEM EBO data is F(1,8) = 0.407969 < qF(0.95,1,8) = 5.3177 and F(1,8) p-value = 0.540853 > 0.05, we also accept the null hypothesis. As a result, no structural change is observed, and the GEM EBO data is robust and structurally stable.

Finally, it is fruitful to analyze the stability of the parameters to show robustness. To do this, we use a CUSUMSQ (cumulative sum of squares of recursive residuals) contrast for parameter stability at a 95% confidence level (

Figure 3 and

Table 7). The aggregate sum of squares of recursive residues allows observing non-random deviations from their average value line. Mathematically,

As the plot of cumulative sum of squares of recursive residuals (red curve) is always inside the critical bounds (lower limit and upper limit) at 5% significance level, the parameters are stable.

5. Conclusions

This paper contributes to academic debate through the analysis of entrepreneurial growth aspirations and the possibility of identifying potential high growth entrepreneurs through its innovative behavior and export orientation in the presence of financial capital. We argue financial capital may reinforce the contribution of both innovative behavior and international orientation to growth aspirations. To identify the determinants that might increase the growth aspirations of new entrepreneurs, we propose and empirically test a model of growth aspirations based on innovation and internationalization theories.

From the viewpoint of entrepreneurship and SME development, the challenge for Mexico is, therefore, to move in the coming years from an efficiency-driven to an innovation-driven economy, which is characterized by a stronger presence of innovative small businesses and is associated with the transition towards an upper-income economy. This fact is particularly remarkable for the Mexican states, which need to nurture their local economies beyond the mere attraction of foreign direct investment through the efficient use of its resources, and the promotion of high impact entrepreneurship.

This study takes an essential step toward an increased understanding of entrepreneurial growth ambition. A substantial part of this study focuses on researching how innovative entrepreneurial behavior, export orientation, and financial capital are related to the entrepreneurial aspirations in new firms. Specifically, we have empirically investigated the moderating role of financial capital on the relationship between innovative behavior and growth aspirations, and between export orientation and growth aspirations in Mexican new firms. While there is no consensus on the variables affecting the entrepreneurial growth ambition, we have concluded that the entrepreneurial ambition for business growth depends on product newness only if it interacts with financial capital and recent technology.

The first insight we can provide based on our findings is that product newness moderated by financial capital slightly increases (0.043, p < 0.01) entrepreneurial growth aspirations of the firm. This process of entrepreneurial change is stronger when business angles invest in the firm, as they tend to finance preferably new products and services in the market, primarily when the firm exports new products abroad resulted from the low competition. As a result, investors and lenders only rely on educated entrepreneurs when they grant loans.

The second insight is that recent technologies moderated by financial capital also increases (0.093, p < 0.01) the entrepreneurial growth aspirations of the firm. Brand new technology increases competitiveness, helps to open new markets, tends to decrease operating costs, and optimizes productive and commercial processes carried out by firms. These positive effects are being reinforced when the human capital is more specialized, as higher educational levels slightly increase the entrepreneurial growth ambition, as educated human resources expect higher salaries and faster professional careers. This situation is more visible in large companies, and especially in business groups, where labor mobility is greater, and the implementation of technology is fast, in general. Therefore, there is a direct relationship between recent technologies and entrepreneurial growth ambition.

Although skills and knowledge are needed to strengthen entrepreneurship, especially early-stage entrepreneurship, and innovation, empirical results show that business strategies should not be targeted at entrepreneurship in general, but should be based on innovative entrepreneurs focused on product newness and recent technology.

In the interactive role of financial capital and innovative behavior on entrepreneurial growth aspirations, it has been assumed that new business objectives match with the owner’s goals, which cannot be accurate in entrepreneurial clusters. Besides this, market development and growth opportunities can vary considerably in different industries and nations, so the moderating role of financial capital may change.

However, there is growing evidence that certain types of entrepreneurs matter more than others when it comes to fostering long term economic growth. High impact entrepreneurs are the individuals that launch and lead companies with above-average growth in terms of job creation and wealth creation. As their firms grow and add new jobs, they develop innovations, generate millions in wealth, and act as role models for the next generation of young people in their countries. These entrepreneurs represented only a small minority of entrepreneurial activity. Established firms with high growth trajectories should be associated with new entrepreneurs endowed with higher growth aspirations.

Given these positive economic effects, it is advisable for the public administration to support the adoption of new technologies in the firms by applying tax reductions and subsidies, especially to startups, as happens in many countries worldwide. A complementary strategy should be to incentivize the creation of 4-helix entrepreneurial ecosystems, formed by the interaction of HEIs, the public administration, firms, and NGOs (non-governmental organizations) to incentive both product newness and recent technology with the help of innovation and entrepreneurship through the implementation of public–private initiatives.

Finally, these conclusions lead us to establish two proposals for future research. First, to extend this research based on entrepreneurship to selected efficiency-driven countries to compare them by applying a longitudinal study, and, second, to increase the scope of this study to include the aspirations of growth for nascent and established entrepreneurs.