Protection Motivation Theory: A Proposed Theoretical Extension and Moving beyond Rationality—The Case of Flooding

Abstract

:1. Introduction

- To explore theories of decision making which question the foundations of the rational expectations model and draw on insights from psychology and behavioral economics to explain behavior [31];

- To identify the main ways in which decisions about flood protection depart from the rational expectations model of consumer behavior and how these can be applied to the Augmented PMT; and

- To interpret findings from of these elements within the context of flood risk management and the uptake of property level flood protection measures.

2. Methodology

Data Collection and Framework Development

3. Results

3.1. Identifying Key Decision Drivers

3.1.1. Availability Bias

3.1.2. Optimism Bias

3.1.3. Myopia

3.1.4. Loss Aversion

3.1.5. Emotions

3.1.6. Complexity

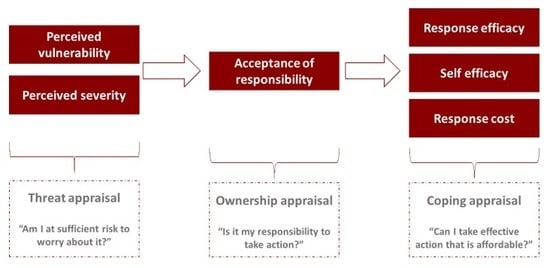

3.2. Augmented Protection Motivation Theory

4. Discussion

- A range of evidence has shown that households’ propensity to act rests on whether or not they believe that it should be their responsibility to do so.

- Availability bias and optimism bias can influence an individual’s threat appraisal by changing the way that they consider risk and evaluate their need for resistance or resilience products.

- A recent experience of flooding, or a prominence of flooding in the news, can create a perception of a relatively high risk of flooding in the future. The reverse is true of reduced salience of flooding.

- Optimism bias can also contribute to a perception of a relatively low risk of flooding. The influence of emotions may well stop people from engaging with the decision at all, while the complexity of thinking about risk may have a similar effect.

- Complexity is also important in the coping appraisal stage. If people feel that a choice is too difficult, they may opt to avoid taking a decision at all.

- Given that flood resistance and resilience measures require an up-front investment for an uncertain return (i.e., avoiding damage in a hypothetical future flood), loss aversion and myopia may lead to people deciding against investing in such measures.

- Whether targeted approaches can increase ownership of the need for households to take action, either in isolation or in combination with initiatives to increase understanding of a property-specific risk of flooding. For example, by simultaneously attempting to shift social norms to place the onus of action on the householder;

- What balance flood risk communications should take in attempting to increase threat perception through information, without having negative impacts on coping and/or threat appraisal; and

- Whether helping consumers to understand the options for resistance and resilience measures that are available ought to be a priority, or whether this only adds to complexity and reduces the likelihood of action.

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- House of Commons Environment, Food and Rural Affairs Committee. Future Flood Prevention; House of Commons: London, UK, 2016. [Google Scholar]

- HM Government. National Flood Resilience Review; HM Government: London, UK, 2016.

- Oakley, M. Incentivising Household Action on Flooding: Options for Using Incentives to Increase the Take up of Flood Resilience and Resistance Measures; Flood Re: London, UK, 2018. [Google Scholar]

- Bubeck, P.; Botzen, W.J.W.; Aerts, J.C.J.H. A Review of Risk Perceptions and Other Factors that Influence Flood Mitigation Behavior. Risk Anal. 2012, 32, 1481–1495. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Joseph, R.; Proverbs, D.; Lamond, J. Homeowners’ perceptions of property-level flood risk adaptation (PLFRA) measures: The case of the summer 2007 flood event in England. Int. J. Saf. Secur. Eng. 2015, 5, 251–265. [Google Scholar] [CrossRef]

- Kreibich, H.; Thieken, A.H.; Petrow, T.; Müller, M.; Merz, B. Flood loss reduction of private households due to building precautionary measures—lessons learned from the Elbe flood in August 2002. Nat. Hazards Earth Syst. Sci. 2005, 5, 117–126. [Google Scholar] [CrossRef] [Green Version]

- Bichard, E.; Kazmierczak, A. Are homeowners willing to adapt to and mitigate the effects of climate change? Clim. Chang. 2012, 112, 633–654. [Google Scholar] [CrossRef] [Green Version]

- Kellens, W.; Terpstra, T.; Maeyer, P.D. Perception and Communication of Flood Risks: A Systematic Review of Empirical Research. Risk Anal. 2013, 33, 24–49. [Google Scholar] [CrossRef] [Green Version]

- Terpstra, T.; Lindell, M.K. Citizens’ Perceptions of Flood Hazard Adjustments: An Application of the Protective Action Decision Model. Environ. Behav. 2013, 45, 993–1018. [Google Scholar] [CrossRef] [Green Version]

- Poussin, J.K.; Botzen, W.J.W.; Aerts, J.C.J.H. Factors of influence on flood damage mitigation behaviour by households. Environ. Sci. Policy 2014, 40, 69–77. [Google Scholar] [CrossRef]

- Department for Environment, Food and Rural Affairs. Public Dialogues on Flood Risk Communication: Final Report; Environment Agency: London, UK, 2015. [Google Scholar]

- Thurston, N.; Finlinson, B.; Breakspear, R.; Williams, N.; Shaw, J.; Chartterton, J. Developing the Evidence Base for Flood Resistance and Resilience: Summary Report; Department for Environment, Food and Rural Affairs: London, UK, 2008.

- Lamond, J.; McEwen, L.; Rose, C.; Wragg, A.; Joseph, R.; Twigger-Ross, C.; Papadopoulou, L.; White, O.; Dhonau, M.; Proverbs, D. Supporting the Uptake of Low Cost Resilience: Final Report (FD2682); Department for Environment, Food and Rural Affairs: London, UK, 2017.

- Joseph, R.; Lamond, J.; Proverbs, D.; Wassell, P. An analysis of the costs of resilient reinstatement of flood affected properties: A case study of the 2009 flood event in Cockermouth. Struct. Surv. 2011, 29, 279–293. [Google Scholar] [CrossRef]

- Rogers, R.W. A Protection Motivation Theory of Fear Appeals and Attitude Change. J. Psychol. 1975, 91, 93–114. [Google Scholar] [CrossRef]

- Rogers, R.W. Cognitive and physiological processes in fear appeals and attitude change: A revised theory of protection motivation. In Social Psychophysiology: A Sourcebook; Cacioppo, B.L., Petty, R.E., Eds.; Guildford Press: London, UK, 1983. [Google Scholar]

- Westcott, R.; Ronan, K.; Bambrick, H.; Taylor, M. Expanding protection motivation theory: Investigating an application to animal owners and emergency responders in bushfire emergencies. BMC Psychol. 2017, 5, 13. [Google Scholar] [CrossRef] [Green Version]

- Jansen, J. Studying Safe Online Banking Behaviour: A Protection Motivation Theory Approach. In Proceedings of the Ninth International Symposium on Human Aspects of Information Security & Assurance (HAISA 2015), Lesvos, Greece, 1 July 2015; pp. 120–130. [Google Scholar]

- Menard, P.; Warkentin, M.; Lowry, P.B. The impact of collectivism and psychological ownership on protection motivation: A cross-cultural examination. Comput. Secur. 2018, 75, 147–166. [Google Scholar] [CrossRef]

- Grothmann, T.; Reusswig, F. People at Risk of Flooding: Why Some Residents Take Precautionary Action While Others Do Not. Nat. Hazards 2006, 38, 101–120. [Google Scholar] [CrossRef]

- Thistlethwaite, J.; Henstra, D.; Brown, C.; Scott, D. How Flood Experience and Risk Perception Influences Protective Actions and Behaviours among Canadian Homeowners. Environ. Manag. 2018, 61, 197–208. [Google Scholar] [CrossRef] [PubMed]

- Knuth, D.; Kehl, D.; Hulse, L.; Schmidt, S. Risk Perception, Experience, and Objective Risk: A Cross-National Study with European Emergency Survivors: Risk Perception, Experience, and Objective Risk. Risk Anal. 2014, 34, 1286–1298. [Google Scholar] [CrossRef] [Green Version]

- Wachinger, G.; Renn, O.; Begg, C.; Kuhlicke, C. The Risk Perception Paradox—Implications for Governance and Communication of Natural Hazards. Risk Anal. 2013, 33, 1049–1065. [Google Scholar] [CrossRef]

- Jamie, W.; McCaughey, I.; Mundir, P.; Daly, S.; Mahdi, P. Trust and distrust of tsunami vertical evacuation buildings: Extending protection motivation theory to examine choices under social influence. Int. J. Dis. R. Red. 2017, 24, 462–473. [Google Scholar] [CrossRef]

- Bubeck, P.; Botzen, W.J.W.; Kreibich, H.; Aerts, J.C.J.H. Detailed insights into the influence of flood-coping appraisals on mitigation behaviour. Glob. Environ. Chang. 2013, 23, 1327–1338. [Google Scholar] [CrossRef]

- Bubeck, P.; Wouter Botzen, W.J.; Laudan, J.; Aerts, J.C.J.H.; Thieken, A.H. Insights into Flood-Coping Appraisals of Protection Motivation Theory: Empirical Evidence from Germany and France: Insights into Flood-Coping Appraisals of Protection Motivation Theory. Risk Anal. 2018, 38, 1239–1257. [Google Scholar] [CrossRef] [PubMed]

- Harries, T. Responding to Flood Risk in the UK. In Cities at Risk; Joffe, H., Rossetto, T., Adams, J., Eds.; Springer: Dordrecht, The Netherlands, 2013; Volume 33, pp. 45–72. ISBN 978-94-007-6183-4. [Google Scholar]

- Everett, G.; Lamond, J. Household behaviour in installing property-level flood adaptations: A literature review. In Proceedings of the 8th International Conference on Urban Regeneration and Sustainability The Sustainable City, Putrajaya, Malaysia, 3 December 2013. [Google Scholar]

- Harries, T. Why Most “At-Risk” Homeowners Do Not Protect Their Homes from Flooding. In Flood Hazards: Impacts and Responses for the Build Environment; Lamond, J., Booth, C., Hammond, F., Proverbs, D., Eds.; CRC Press: Boca Raton, FL, USA, 2011; pp. 327–341. ISBN 978-1-4398-2625-6. [Google Scholar]

- Burningham, K.; Fielding, J.; Thrush, D. Itll never happen to me: Understanding public awareness of local flood risk. Disasters 2008, 32, 216–238. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D. Thinking, Fast and Slow, 1st ed.; Farrar, Straus and Giroux: New York, NY, USA, 2013; ISBN 978-0-374-53355-7. [Google Scholar]

- Terpstra, T.; Gutteling, J.M. Households’ Perceived Responsibilities in Flood Risk Management in The Netherlands. Int. J. Water Resourc. Dev. 2008, 24, 555–565. [Google Scholar] [CrossRef]

- Harries, T. Feeling secure or being secure? Why it can seem better not to protect yourself against a natural hazard. Health Risk Soc. 2008, 10, 479–490. [Google Scholar] [CrossRef] [Green Version]

- Botzen, W.W.; Kunreuther, H.; Czajkowski, J.; de Moel, H. Adoption of Individual Flood Damage Mitigation Measures in New York City: An Extension of Protection Motivation Theory. Risk Anal. 2019, 39, 2143–2159. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Tversky, A.; Kahneman, D. Judgment under Uncerstainty: Heuristics and Biases. Science 1974, 185, 1124–1131. [Google Scholar] [CrossRef] [PubMed]

- Thaler, R.H.; Sunstein, C.R. Nudge: Improving Decisions about Health, Wealth and Happiness, Reprint ed.; Penguin: London, UK, 2009; ISBN 978-0-14-104001-1. [Google Scholar]

- Keller, C.; Siegrist, M.; Gutscher, H. The Role of the Affect and Availability Heuristics in Risk Communication. Risk Anal. 2006, 26, 631–639. [Google Scholar] [CrossRef]

- Wood, M.M.; Mileti, D.S.; Kano, M.; Kelley, M.M.; Regan, R.; Bourque, L.B. Communicating actionable risk for terrorism and other hazards. Risk Anal. Off. Publ. Soc. Risk Anal. 2012, 32, 601–615. [Google Scholar] [CrossRef]

- Burn, D.H. Perceptions of flood risk: A case study of the Red River Flood of 1997. Water Resourc. Res. 1999, 35, 3451–3458. [Google Scholar] [CrossRef]

- Kunreuther, H.; Miller, L.; Sagi, P.; Slovic, P.; Borkan, B.; Katz, N. Disaster Insurance Protection: Public Policy Lessons; Wiley: New York, NY, USA, 1978; ISBN 978-0-471-03259-5. [Google Scholar]

- Weinstein, N.D. Accuracy of smokers’ risk perceptions. Ann. Behav. Med. 1998, 20, 135–140. [Google Scholar] [CrossRef]

- Weinstein, N.D. Unrealistic optimism about future life events. J. Pers. Soc. Psychol. 1980, 1, 806–820. [Google Scholar] [CrossRef]

- Weinstein, N.D.; Lyon, J.E.; Rothman, A.J.; Cuite, C.L. Changes in perceived vulnerability following natural disaster. J. Soc. Clin. Psychol. 2000, 19, 372–395. [Google Scholar] [CrossRef]

- Benartzi, S.; Thaler, R.H. Risk Aversion or Myopia? Choices in Repeated Gambles and Retirement Investments. Manag. Sci. 1999, 45, 364–381. [Google Scholar] [CrossRef] [Green Version]

- Frederick, S.; Loewenstein, G.; O’donoghue, T. Time discounting and time preference: A critical review. J. Econ. Lit. 2002, 40, 351–401. [Google Scholar] [CrossRef]

- Laibson, D. Golden Eggs and Hyperbolic Discounting. Q. J. Econ. 1997, 112, 443–478. [Google Scholar] [CrossRef] [Green Version]

- Chaudhry, S.J.; Hand, M.; Kunreuther, H. An Experimental Investigation of the Effect of Presenting Cumulative Probabilities and Risk Zone Labels on the Purchase of Flood Insurance; Wharton Risk Management and Decision Processes Center: Philadelphia, PA, USA, 2017. [Google Scholar]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. J. Econ. Perspect. 1991, 5, 193–206. [Google Scholar] [CrossRef] [Green Version]

- Slovic, P.; Fischhoff, B.; Lichtenstein, S. Behavioral Decision Theory. Annu. Rev. Psychol. 1977, 28, 1–39. [Google Scholar] [CrossRef]

- Finucane, M.L.; Alhakami, A.; Slovic, P.; Johnson, S.M. The affect heuristic in judgments of risks and benefits. J. Behav. Decis. Mak. 2000, 13, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Slovic, P.; Finucane, M.L.; Peters, E.; MacGregor, D.G. Risk as Analysis and Risk as Feelings: Some Thoughts about Affect, Reason, Risk, and Rationality. Risk Anal. 2004, 24, 311–322. [Google Scholar] [CrossRef]

- Terpstra, T. Emotions, Trust, and Perceived Risk: Affective and Cognitive Routes to Flood Preparedness Behavior. Risk Anal. 2011, 31, 1658–1675. [Google Scholar] [CrossRef]

- Harries, T. The Anticipated Emotional Consequences of Adaptive Behaviour—Impacts on the Take-up of Household Flood-Protection Measures. Environ. Plan. Econ. Space 2012, 44, 649–668. [Google Scholar] [CrossRef] [Green Version]

- Feldman, G.; Dolores, A. Norm theory and the action-effect: The role of social norms in regret following action and inaction. J. Exp. Soc. Psychol. 2017, 69, 111–120. [Google Scholar] [CrossRef]

- Lo, A.Y. The role of social norms in climate adaptation: Mediating risk perception and flood insurance purchase. Glob. Environ. Chang. 2013, 23, 1249–1257. [Google Scholar] [CrossRef]

- Tversky, A.; Shafir, E. Choice under Conflict: The Dynamics of Deferred Decision. Psychol. Sci. 1992, 3, 358–361. [Google Scholar] [CrossRef]

- Iyengar, S.S.; Lepper, M.R. When choice is demotivating: Can one desire too much of a good thing? J. Pers. Soc. Psychol. 2000, 79, 995–1006. [Google Scholar] [CrossRef] [PubMed]

- Sethi-Iyengar, S.; Huberman, G.; Jiang, G. How Much Choice is Too Much? Contributions to 401(k) Retirement Plans. In Pension Design and Structure: New Lessons from Behavioral Finance; Mitchell, O.S., Utkus, S.P., Eds.; Oxford University Press: Oxford, UK, 2004; pp. 83–95. ISBN 978-0-19-160167-5. [Google Scholar]

- Bertrand, M.; Mullainathan, S.; Shafir, E. Behavioral Economics and Marketing in Aid of Decision Making among the Poor. J. Public Policy Mark. 2006, 25, 8–23. [Google Scholar] [CrossRef]

- Flood Re. Our Vision: Securing a Future of Affordable Flood Insurance; Flood Re: London, UK, 2018. [Google Scholar]

- Crossler, R.; Belanger, F. An Extended Perspective on Individual Security Behaviors. ACM SIGMIS Database Database Adv. Inf. Syst. 2014, 45, 51–71. [Google Scholar] [CrossRef]

| System 1 | System 2 |

|---|---|

| Fast | Slow |

| Automatic | Controlled |

| Effortless | Effortful |

| Associative | Rule-governed |

| Emotional | Neutral |

| Key Message |

|---|

|

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oakley, M.; Mohun Himmelweit, S.; Leinster, P.; Casado, M.R. Protection Motivation Theory: A Proposed Theoretical Extension and Moving beyond Rationality—The Case of Flooding. Water 2020, 12, 1848. https://0-doi-org.brum.beds.ac.uk/10.3390/w12071848

Oakley M, Mohun Himmelweit S, Leinster P, Casado MR. Protection Motivation Theory: A Proposed Theoretical Extension and Moving beyond Rationality—The Case of Flooding. Water. 2020; 12(7):1848. https://0-doi-org.brum.beds.ac.uk/10.3390/w12071848

Chicago/Turabian StyleOakley, Matthew, Sam Mohun Himmelweit, Paul Leinster, and Mónica Rivas Casado. 2020. "Protection Motivation Theory: A Proposed Theoretical Extension and Moving beyond Rationality—The Case of Flooding" Water 12, no. 7: 1848. https://0-doi-org.brum.beds.ac.uk/10.3390/w12071848